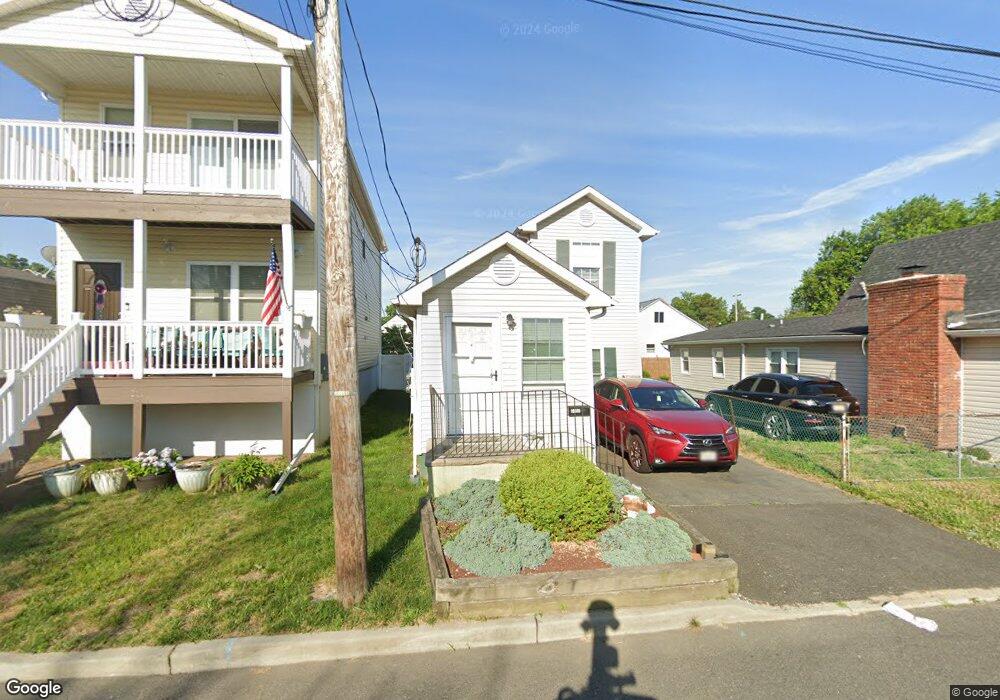

210 Cliff Ave Unit a South Amboy, NJ 08879

Estimated Value: $432,000 - $463,000

2

Beds

1

Bath

--

Sq Ft

2,178

Sq Ft Lot

About This Home

This home is located at 210 Cliff Ave Unit a, South Amboy, NJ 08879 and is currently estimated at $451,719. 210 Cliff Ave Unit a is a home located in Middlesex County with nearby schools including Sayreville War Memorial High School, St. Mary Elementary School, and Cardinal Mccarrick High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 21, 2022

Sold by

Alter Paula A

Bought by

Oyibo Katima

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$333,841

Outstanding Balance

$309,444

Interest Rate

3.56%

Mortgage Type

FHA

Estimated Equity

$142,275

Purchase Details

Closed on

May 19, 2014

Sold by

Kessler Dennis and Tripp Irving

Bought by

Alter Paula A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$202,759

Interest Rate

4.37%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 14, 1995

Sold by

Bankers Sav

Bought by

Kessler Dennis and Tripp Irving

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Oyibo Katima | $340,000 | Westcor Land Title | |

| Alter Paula A | $206,500 | Guardian Title Services Llc | |

| Kessler Dennis | $20,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Oyibo Katima | $333,841 | |

| Previous Owner | Alter Paula A | $202,759 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,380 | $104,500 | $42,600 | $61,900 |

| 2024 | $6,203 | $104,500 | $42,600 | $61,900 |

| 2023 | $6,203 | $104,500 | $42,600 | $61,900 |

| 2022 | $5,795 | $104,500 | $42,600 | $61,900 |

| 2021 | $5,731 | $104,500 | $42,600 | $61,900 |

| 2020 | $5,586 | $104,500 | $42,600 | $61,900 |

| 2019 | $5,468 | $104,500 | $42,600 | $61,900 |

| 2018 | $5,370 | $104,500 | $42,600 | $61,900 |

| 2017 | $5,246 | $104,500 | $42,600 | $61,900 |

| 2016 | $5,106 | $104,500 | $42,600 | $61,900 |

| 2015 | $4,990 | $104,500 | $42,600 | $61,900 |

| 2014 | $4,856 | $104,500 | $42,600 | $61,900 |

Source: Public Records

Map

Nearby Homes

- 99 Morgan Ave

- 333 Midland Ave

- 60 Wlodarczyk Place

- 36 Cliffwood Way

- 10 Dolan Ave

- 179 Gabriel Terrace

- 37 Hoffman Ave

- 4 Prusakowski Blvd

- 47 Prusakowski Blvd

- 21 Gordon Ave

- 21 Luke St

- 809 Summerfield Ave

- 158 Liberty St

- 3015 Lighthouse Ln

- 1200 Ernston Rd

- 158 Liberty St St

- 3014 Lighthouse Ln

- 67 Grabowski Dr

- 21 Lantana Way

- 1511 Pebble Place