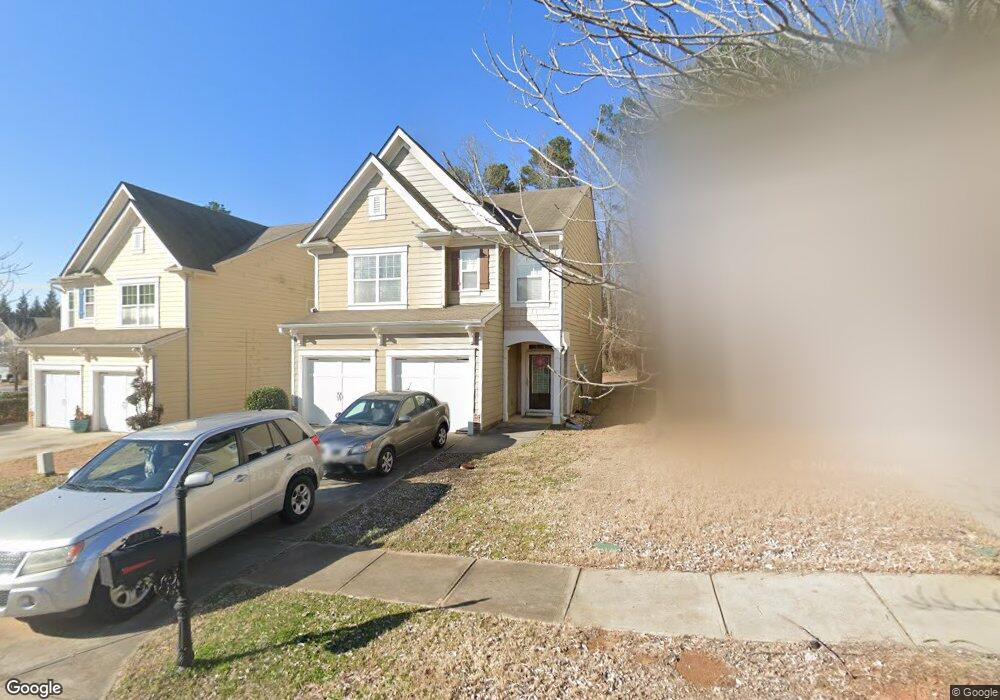

210 Highwind Way Unit 3 Fairburn, GA 30213

Estimated Value: $282,685 - $308,000

3

Beds

3

Baths

1,838

Sq Ft

$159/Sq Ft

Est. Value

About This Home

This home is located at 210 Highwind Way Unit 3, Fairburn, GA 30213 and is currently estimated at $292,921, approximately $159 per square foot. 210 Highwind Way Unit 3 is a home located in Fulton County with nearby schools including Renaissance Elementary School, Renaissance Middle School, and Langston Hughes High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 14, 2019

Sold by

Key Darlene A

Bought by

Tribble Keyota

Current Estimated Value

Purchase Details

Closed on

Jul 25, 2017

Sold by

Key Darlene A

Bought by

Key Darlene A and Key Ashley

Purchase Details

Closed on

May 16, 2017

Sold by

Barnes Kimberly J

Bought by

Key Darlene A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,337

Interest Rate

4.37%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 21, 2005

Sold by

Bowen Family Homes Inc

Bought by

Barnes Kimberly J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,148

Interest Rate

5.62%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tribble Keyota | $168,750 | -- | |

| Key Darlene A | -- | -- | |

| Key Darlene A | $147,000 | -- | |

| Barnes Kimberly J | $154,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Key Darlene A | $144,337 | |

| Previous Owner | Barnes Kimberly J | $152,148 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,095 | $114,360 | $23,600 | $90,760 |

| 2023 | $3,089 | $109,440 | $27,040 | $82,400 |

| 2022 | $1,966 | $89,040 | $16,800 | $72,240 |

| 2021 | $1,925 | $71,200 | $15,240 | $55,960 |

| 2020 | $2,669 | $65,600 | $14,000 | $51,600 |

| 2019 | $991 | $58,720 | $11,600 | $47,120 |

| 2018 | $1,240 | $53,400 | $11,280 | $42,120 |

| 2017 | $693 | $34,080 | $6,720 | $27,360 |

| 2016 | $691 | $34,080 | $6,720 | $27,360 |

| 2015 | $694 | $34,080 | $6,720 | $27,360 |

| 2014 | $705 | $34,080 | $6,720 | $27,360 |

Source: Public Records

Map

Nearby Homes

- 6066 Allpoint Way Unit 3

- 6127 Landers Loop

- 782 Jasperson Ct Unit 46

- 539 Greyhawk Way

- 6164 Chastain Way

- 7565 Jennadee Dr

- 515 Lakeside View

- 8004 Larksview Dr

- 7729 Waterlace Dr

- 8030 Snapwell Dr

- 7314 Parkland Bend

- 7980 Cedar Grove Rd

- 7946 Gossamer Dr

- 5745 Village Loop

- 6398 Foggy Oak Dr

- 7789 Village Pass

- 0 Short Rd Unit 7501417

- 8155 Equinox Ln

- 8150 Equinox Ln

- 6275 Short Rd

- 210 Highwind Way

- 220 Highwind Way Unit 3

- 200 Highwind Way Unit 3

- 230 Highwind Way

- 6054 Allpoint Way

- 240 Highwind Way

- 6050 Allpoint Way

- 250 Highwind Way

- 7728 Bellmist Dr

- 115 Emberwood Ln Unit 3

- 7748 Bellmist Dr

- 6063 Allpoint Way

- 260 Highwind Way

- 260 Highwind Way Unit 55

- 125 Emberwood Ln

- 7724 Bellmist Dr

- 225 Highwind Way Unit 225

- 225 Highwind Way

- 6070 Allpoint Way

- 135 Emberwood Ln