Estimated Value: $576,000 - $668,107

4

Beds

3

Baths

3,256

Sq Ft

$192/Sq Ft

Est. Value

About This Home

This home is located at 210 Traymore Way, Greer, SC 29650 and is currently estimated at $624,027, approximately $191 per square foot. 210 Traymore Way is a home located in Greenville County with nearby schools including Woodland Elementary School, Riverside Middle School, and Riverside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 8, 2025

Sold by

Johnstone Sherrill T

Bought by

Johnstone Sherrill T and Johnstone William S

Current Estimated Value

Purchase Details

Closed on

Jan 29, 2010

Sold by

Beeson Henthorn Development Llc

Bought by

Johnstone Sherrill T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,040

Interest Rate

4.94%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 21, 2009

Sold by

Poinsett Homes Llc

Bought by

Beeson Henthorn Development Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,040

Interest Rate

4.94%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnstone Sherrill T | -- | None Listed On Document | |

| Johnstone Sherrill T | -- | None Listed On Document | |

| Johnstone Sherrill T | $239,000 | -- | |

| Beeson Henthorn Development Llc | $269,001 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Johnstone Sherrill T | $294,040 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,899 | $17,950 | $2,190 | $15,760 |

| 2023 | $3,899 | $17,950 | $2,190 | $15,760 |

| 2022 | $3,602 | $17,950 | $2,190 | $15,760 |

| 2021 | $3,573 | $17,950 | $2,190 | $15,760 |

| 2020 | $3,134 | $15,610 | $2,440 | $13,170 |

| 2019 | $3,130 | $15,610 | $2,440 | $13,170 |

| 2018 | $3,118 | $15,610 | $2,440 | $13,170 |

| 2017 | $3,109 | $15,610 | $2,440 | $13,170 |

| 2016 | $3,031 | $390,190 | $61,000 | $329,190 |

| 2015 | $2,991 | $390,190 | $61,000 | $329,190 |

| 2014 | $3,472 | $398,770 | $60,000 | $338,770 |

Source: Public Records

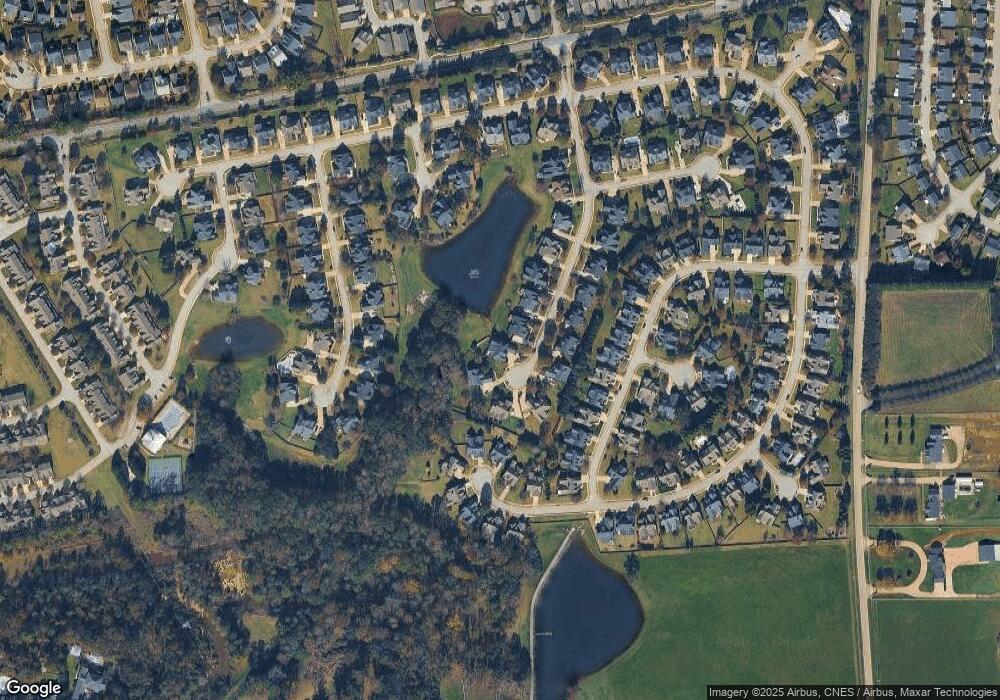

Map

Nearby Homes

- 211 Aldgate Way

- 8 Middleberry Ct

- 309 Hillsdale Dr

- 102 Durand Ct

- 235 Ashler Dr

- 927 Medora Dr

- 113 Saint James Place Dr

- 541 Ashler Dr

- 255 Highgate Cir

- 406 Chartwell Dr

- 306 Londonderry Ct

- 5 Mariner Ct

- 621 Chartwell Dr

- 632 Chartwell Dr

- 334 Ascot Ridge Ln

- 229 Marshland Ln

- 322 Ascot Ridge Ln

- 407 Sugar Mill Rd

- 221 Saratoga Dr

- 18 Abington Hall Ct

- 208 Traymore Way

- 212 Traymore Way

- 206 Traymore Way

- 213 Traymore Way

- 214 Traymore Way

- 211 Traymore Way

- 215 Traymore Way

- 209 Traymore Way

- 204 Traymore Way

- 208 Aldgate Way

- 206 Aldgate Way

- 304 Medford Dr

- 302 Medford Dr

- 207 Traymore Way

- 306 Medford Dr

- 300 Medford Dr

- 202 Traymore Way

- 308 Medford Dr

- 204 Aldgate Way

- 15 Barnstable Ct