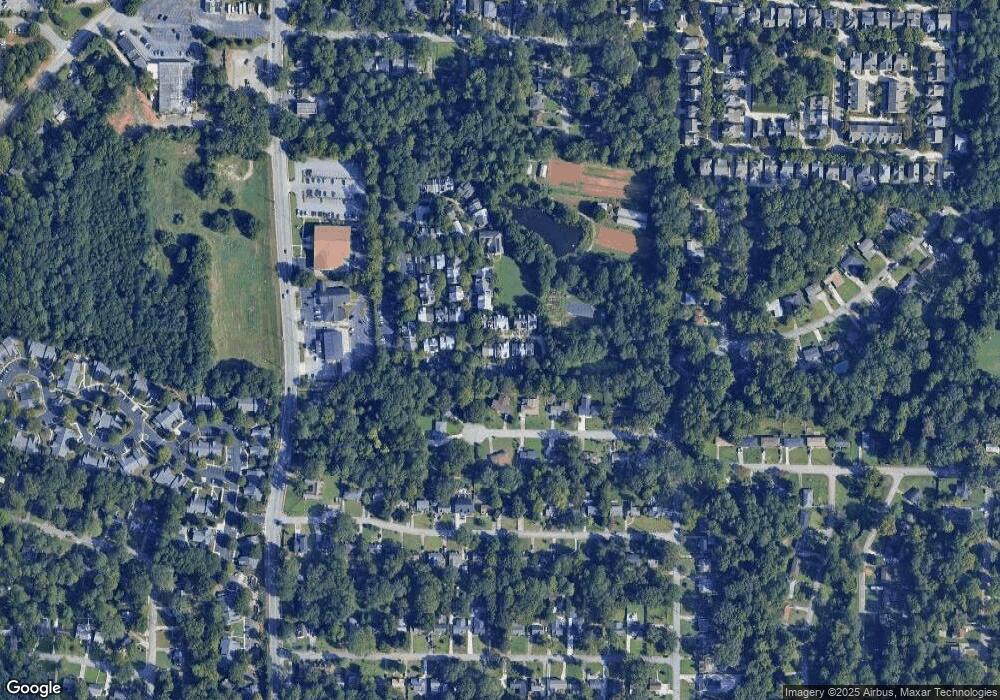

2103 Dancing Fox Rd Decatur, GA 30032

East Lake NeighborhoodEstimated Value: $329,354 - $381,000

3

Beds

3

Baths

1,592

Sq Ft

$228/Sq Ft

Est. Value

About This Home

This home is located at 2103 Dancing Fox Rd, Decatur, GA 30032 and is currently estimated at $362,589, approximately $227 per square foot. 2103 Dancing Fox Rd is a home located in DeKalb County with nearby schools including McNair Middle School, McNair High School, and Charles Drew Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 25, 2021

Sold by

Gimnig Karen

Bought by

Gimnig John E

Current Estimated Value

Purchase Details

Closed on

Feb 19, 2014

Sold by

Wei Stanley C

Bought by

Gimnig Karen and Gimnig John

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,000

Interest Rate

4.43%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 14, 2011

Sold by

Wei Stanley C

Bought by

Wei Stanley C and Hankin-Wei Abigail

Purchase Details

Closed on

Jun 23, 2008

Sold by

Hooper Stuart M

Bought by

Wei Stanley C and Hankin Abigail

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$197,600

Interest Rate

5.97%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 11, 2000

Sold by

East Lake Commons Inc

Bought by

Hooper Stuart M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$193,300

Interest Rate

8.38%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gimnig John E | -- | -- | |

| Gimnig Karen | $250,750 | -- | |

| Wei Stanley C | -- | -- | |

| Wei Stanley C | $247,000 | -- | |

| Hooper Stuart M | $203,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gimnig Karen | $192,000 | |

| Previous Owner | Wei Stanley C | $197,600 | |

| Previous Owner | Hooper Stuart M | $193,300 | |

| Closed | Wei Stanley C | $0 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,939 | $139,680 | $30,000 | $109,680 |

| 2024 | $4,307 | $148,440 | $30,000 | $118,440 |

| 2023 | $4,307 | $131,640 | $30,000 | $101,640 |

Source: Public Records

Map

Nearby Homes

- 101 Dancing Fox Rd Unit 101

- 1893 Burning Tree Dr

- 1926 Second Ave

- 1967 Cogar Dr

- 1944 Delphine Dr

- 410 Carter Ave SE

- 2049 Mcafee Rd

- 721 Fayetteville Rd SE Unit 612

- 2006 Mcafee Place

- 2032 Juanita St

- 599 Daniel Ave

- 2006 Juanita St

- 2164 Rockhaven Cir

- 2021 Connie Ln

- 701 Daniel Ave

- 673 Quillian Ave

- 1783 Terry Mill Rd SE

- 1933 Camellia Dr

- 672 Quillian Ave

- 678 Quillian Ave

- 2102 Dancing Fox Rd

- 2104 Dancing Fox Rd Unit 2104

- 2101 Dancing Fox Rd

- 2301 Dancing Fox Rd

- 2302 Dancing Fox Rd

- 1803 Dancing Fox Rd

- 1803 Dancing Fox Rd Unit 1803

- 1802 Dancing Fox Rd Unit 1802

- 1804 Dancing Fox Rd

- 1801 Dancing Fox Rd Unit 1801

- 2303 Dancing Fox Rd

- 2201 Dancing Fox Rd

- 2202 Dancing Fox Rd

- 2202 Dancing Fox Rd Unit 2202

- 1106 Dancing Fox Rd

- 2203 Dancing Fox Rd Unit 2203

- 1902 Dancing Fox Rd

- 1604 Dancing Fox Rd Unit 1604

- 1105 Dancing Fox Rd

- 1901 Dancing Fox Rd