2103 Foxknoll Dr Dayton, OH 45458

Estimated Value: $170,000 - $186,000

2

Beds

2

Baths

1,044

Sq Ft

$172/Sq Ft

Est. Value

About This Home

This home is located at 2103 Foxknoll Dr, Dayton, OH 45458 and is currently estimated at $179,333, approximately $171 per square foot. 2103 Foxknoll Dr is a home located in Montgomery County with nearby schools including Primary Village South, Normandy Elementary School, and Hadley E Watts Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 31, 2019

Sold by

Baxter Deborah K

Bought by

Romie Robert and Romie Eileen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,915

Outstanding Balance

$51,231

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$128,102

Purchase Details

Closed on

Sep 15, 2016

Sold by

Birecki Adam

Bought by

Baxter Deborah K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,200

Interest Rate

2.62%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Mar 17, 2003

Sold by

Hud

Bought by

Birecki Adam

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,000

Interest Rate

5.95%

Purchase Details

Closed on

Nov 7, 2002

Sold by

Coe Linda M

Bought by

Hud

Purchase Details

Closed on

Oct 16, 2002

Sold by

Coe Linda M

Bought by

Hud

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Romie Robert | $99,900 | Landmark Ttl Agcy South Inc | |

| Baxter Deborah K | $76,000 | Hallmark Title | |

| Birecki Adam | $65,000 | Lakeside Title & Escrow Agen | |

| Hud | $70,000 | -- | |

| Hud | $70,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Romie Robert | $74,915 | |

| Previous Owner | Baxter Deborah K | $72,200 | |

| Previous Owner | Birecki Adam | $52,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,374 | $54,580 | $8,350 | $46,230 |

| 2023 | $3,374 | $54,580 | $8,350 | $46,230 |

| 2022 | $2,785 | $35,600 | $5,460 | $30,140 |

| 2021 | $2,792 | $35,600 | $5,460 | $30,140 |

| 2020 | $2,791 | $35,600 | $5,460 | $30,140 |

| 2019 | $2,270 | $25,840 | $4,200 | $21,640 |

| 2018 | $2,029 | $25,840 | $4,200 | $21,640 |

| 2017 | $2,007 | $25,840 | $4,200 | $21,640 |

| 2016 | $2,129 | $25,220 | $4,200 | $21,020 |

| 2015 | $2,097 | $25,220 | $4,200 | $21,020 |

| 2014 | $2,097 | $25,220 | $4,200 | $21,020 |

| 2012 | -- | $29,210 | $4,200 | $25,010 |

Source: Public Records

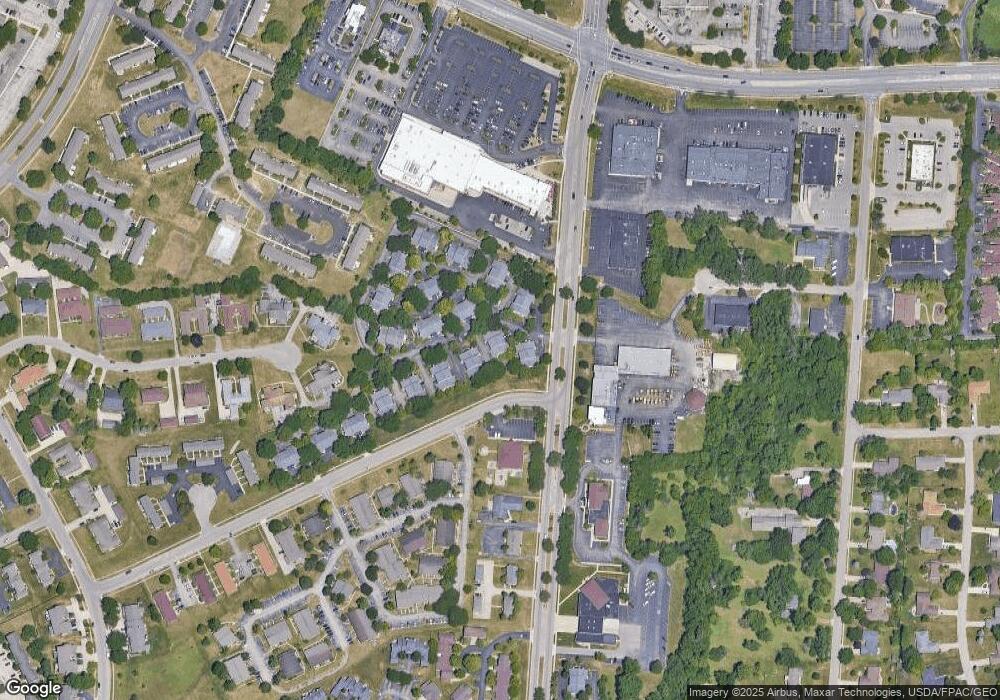

Map

Nearby Homes

- 1070 Foxshire Place

- 8436 Mcewen Rd

- 8454 Mcewen Rd

- 8472 Mcewen Rd

- 8477 Woodgrove Ct Unit 8

- 1241 Autumn Wind Ct

- 1157 Timbertrail Ct Unit 12

- 8517 Garnet Dr

- 8030 Paragon Rd

- 1124 Evergreen Park Ct Unit 221124

- 7853 Betsy Ross Cir Unit 11

- 1444 Yankee Vineyards

- 9211 Bottega - South Dr Unit 67

- 8370 Paragon Rd

- 8713 Washington Colony Dr Unit 311

- 1051 Millstone Rd

- 1200 Captains Bridge

- 8738 Washington Colony Dr Unit 832

- 8540 Cherrycreek Dr

- 8768 Washington Colony Dr Unit 12

- 1007 Foxshire Place

- 2101 Foxknoll Dr

- 1009 Foxshire Place

- 2097 Foxknoll Dr

- 2107 Foxknoll Dr

- 2081 Foxknoll Dr

- 2081 Foxknoll Dr

- 2083 Foxknoll Dr

- 2109 Foxknoll Dr

- 1003 Foxshire Place

- 2094 Foxknoll Dr

- 1008 Foxshire Place

- 1000 Foxshire Place

- 1094 Foxshire Place

- 2073 Foxknoll Dr

- 2075 Foxknoll Dr

- 1090 Foxshire Place

- 1012 Foxshire Place

- 1004 Foxshire Place

- 2074 Foxknoll Dr