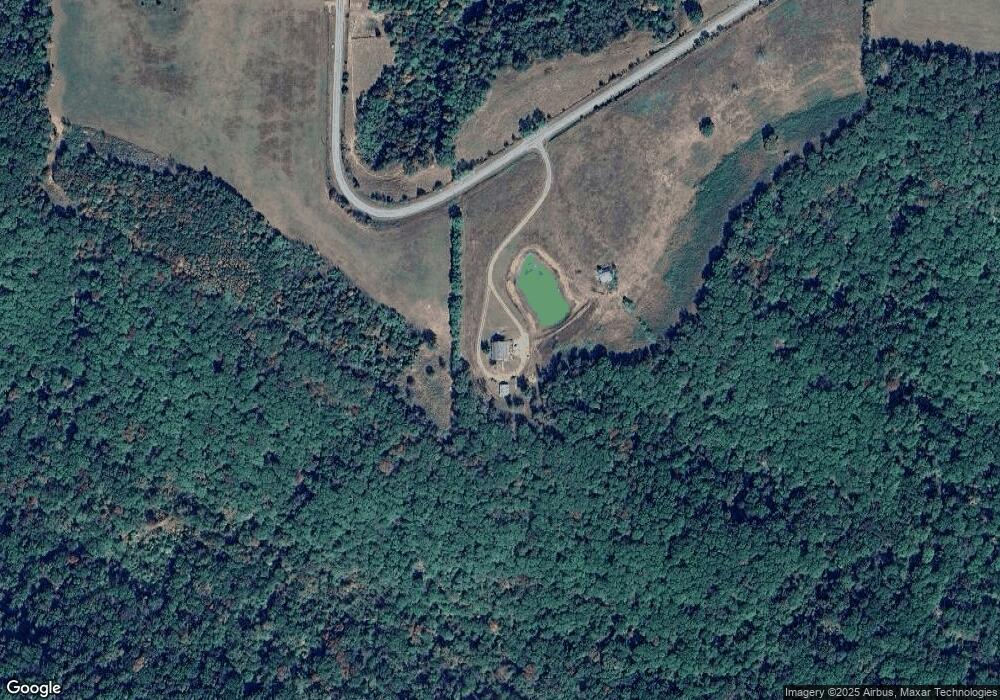

21033 Sunset Rd Winslow, AR 72959

Estimated Value: $304,000

--

Bed

2

Baths

3,800

Sq Ft

$80/Sq Ft

Est. Value

About This Home

This home is located at 21033 Sunset Rd, Winslow, AR 72959 and is currently estimated at $304,000, approximately $80 per square foot. 21033 Sunset Rd is a home located in Washington County with nearby schools including West Fork Elementary School, West Fork Middle School, and West Fork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 8, 2021

Sold by

Harvey Robert W and Harvey Raquel R

Bought by

Harvey Robert W and Harvey Raquel R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,150

Outstanding Balance

$149,336

Interest Rate

2.37%

Mortgage Type

New Conventional

Estimated Equity

$154,664

Purchase Details

Closed on

May 13, 1994

Bought by

Harvey Robert W and Harvey Alicia K

Purchase Details

Closed on

Jul 9, 1986

Bought by

First Nat'L Bank Of Crawford Co

Purchase Details

Closed on

Apr 3, 1986

Bought by

River Edge Construction Co

Purchase Details

Closed on

Jan 1, 1985

Bought by

Mooney Willie D and Mooney Beverly A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Harvey Robert W | -- | Mortgage Connect Lp | |

| Harvey Robert W | $102,000 | -- | |

| First Nat'L Bank Of Crawford Co | -- | -- | |

| River Edge Construction Co | -- | -- | |

| Mooney Willie D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Harvey Robert W | $192,150 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $33 | $680 | $680 | $0 |

| 2024 | $33 | $680 | $680 | $0 |

| 2023 | $33 | $680 | $680 | $0 |

| 2022 | $32 | $670 | $670 | $0 |

| 2021 | $1,463 | $45,380 | $3,170 | $42,210 |

| 2020 | $1,387 | $45,380 | $3,170 | $42,210 |

| 2019 | $1,308 | $34,920 | $2,710 | $32,210 |

| 2018 | $1,312 | $34,920 | $2,710 | $32,210 |

| 2017 | $1,276 | $34,920 | $2,710 | $32,210 |

| 2016 | $1,258 | $34,920 | $2,710 | $32,210 |

| 2015 | $1,182 | $34,920 | $2,710 | $32,210 |

| 2014 | $1,105 | $31,160 | $2,070 | $29,090 |

Source: Public Records

Map

Nearby Homes

- 16325 Sunset Wc 38

- 22908 Bidville Rd

- 17295 Olive Rd

- 0 Hwy 295 Hwy Unit 1292844

- 0 Madison 4099 Unit 1322233

- 17140 Skelton Rd (Wc 4146)

- 1732 Madison 4316

- 718-721 Madison 5548

- TBD Madison 4476 Rd

- TBD Madison 5116

- Tract C Madison Cr 5450

- 500 Madison 5550

- Tract D Madison Cr 5450

- Tract A Madison Cr 5450

- 16075 Chocolate Flats

- 924 Madison 5450

- 5224 Highway 295

- 0000 Madison 5114

- 846

- 2325 W Fly Gap Rd