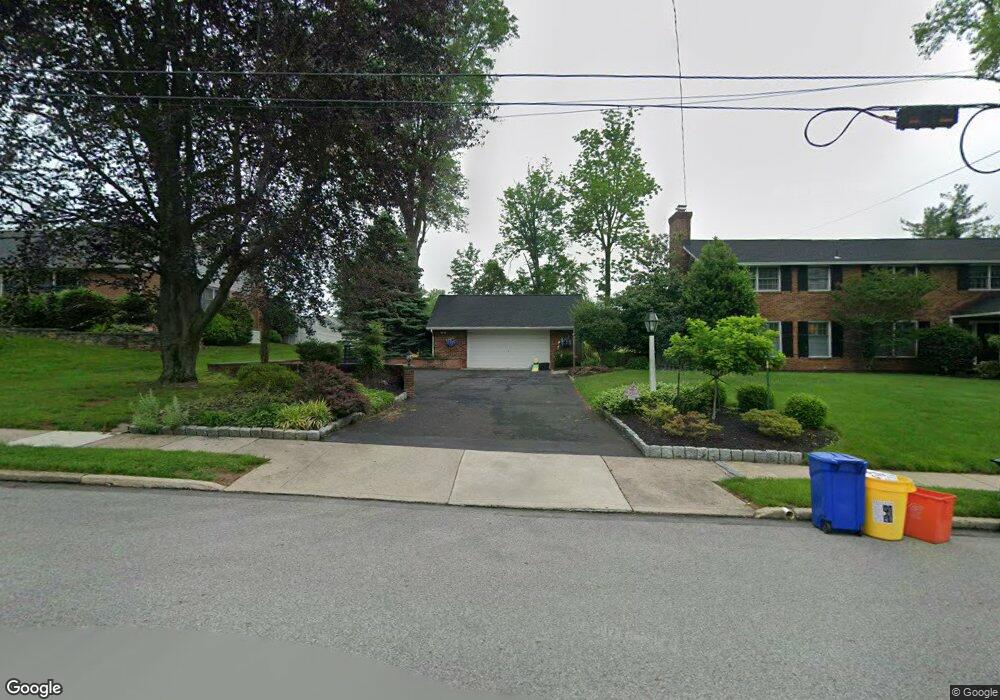

2105 Bridle Ln Oreland, PA 19075

Estimated Value: $795,435 - $1,005,000

5

Beds

4

Baths

3,558

Sq Ft

$256/Sq Ft

Est. Value

About This Home

This home is located at 2105 Bridle Ln, Oreland, PA 19075 and is currently estimated at $911,859, approximately $256 per square foot. 2105 Bridle Ln is a home located in Montgomery County with nearby schools including Erdenheim Elementary School, Enfield Elementary School, and Springfield Township Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 19, 2024

Sold by

Agnew Sean and Agnew Annemarie

Bought by

Finnegan Patrick James and Finnegan Christi

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$506,000

Outstanding Balance

$499,804

Interest Rate

6.86%

Mortgage Type

New Conventional

Estimated Equity

$412,055

Purchase Details

Closed on

Apr 20, 2020

Sold by

Kent Brian and Kent Erin

Bought by

Agnew Sean and Agnew Annemarie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$646,000

Interest Rate

3.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 26, 2012

Sold by

Graham Patricia L

Bought by

Kent Brian D and Kent Erin W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$417,000

Interest Rate

3.62%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 23, 2009

Sold by

Graham Gerald and Graham Patricia L

Bought by

Graham Patricia L and Graham Gerard A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$306,000

Interest Rate

5.2%

Purchase Details

Closed on

Jun 1, 2001

Sold by

Kent John F and Kent Marie F

Bought by

Graham Gerald A and Graham Patricia L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Finnegan Patrick James | $1,010,000 | None Listed On Document | |

| Agnew Sean | $680,000 | None Available | |

| Kent Brian D | $530,000 | None Available | |

| Graham Patricia L | -- | None Available | |

| Graham Gerald A | $389,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Finnegan Patrick James | $506,000 | |

| Previous Owner | Agnew Sean | $646,000 | |

| Previous Owner | Kent Brian D | $417,000 | |

| Previous Owner | Graham Patricia L | $306,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,890 | $231,210 | $62,230 | $168,980 |

| 2024 | $10,890 | $231,210 | $62,230 | $168,980 |

| 2023 | $10,511 | $231,210 | $62,230 | $168,980 |

| 2022 | $10,210 | $231,210 | $62,230 | $168,980 |

| 2021 | $9,944 | $231,210 | $62,230 | $168,980 |

| 2020 | $9,711 | $231,210 | $62,230 | $168,980 |

| 2019 | $9,562 | $231,210 | $62,230 | $168,980 |

| 2018 | $9,562 | $231,210 | $62,230 | $168,980 |

| 2017 | $9,128 | $231,210 | $62,230 | $168,980 |

| 2016 | $9,038 | $231,210 | $62,230 | $168,980 |

| 2015 | $8,591 | $231,210 | $62,230 | $168,980 |

| 2014 | $8,591 | $231,210 | $62,230 | $168,980 |

Source: Public Records

Map

Nearby Homes

- 6326 Farmar Ln

- 1709 Church Rd

- 223 Orlemann Ave

- 312 E Mill Rd

- 2106 Carolton Way

- 300 Lorraine Ave

- 160 Camp Hill Rd

- 238 Plymouth Ave

- 6274 W Valley Green Rd

- 10 Ronald Cir

- 1901 Pennsylvania Ave

- 231 Montgomery Ave

- 442 Oreland Mill Rd

- 500 E Mill Rd

- 1203 Wedgewood Rd

- 522 Pennsylvania Ave

- 200 Redford Rd

- Redford Plan at The Towns at Pennybrook

- 611 Creek Ln

- 407 Pennybrook Ct Unit 4 REDFORD END