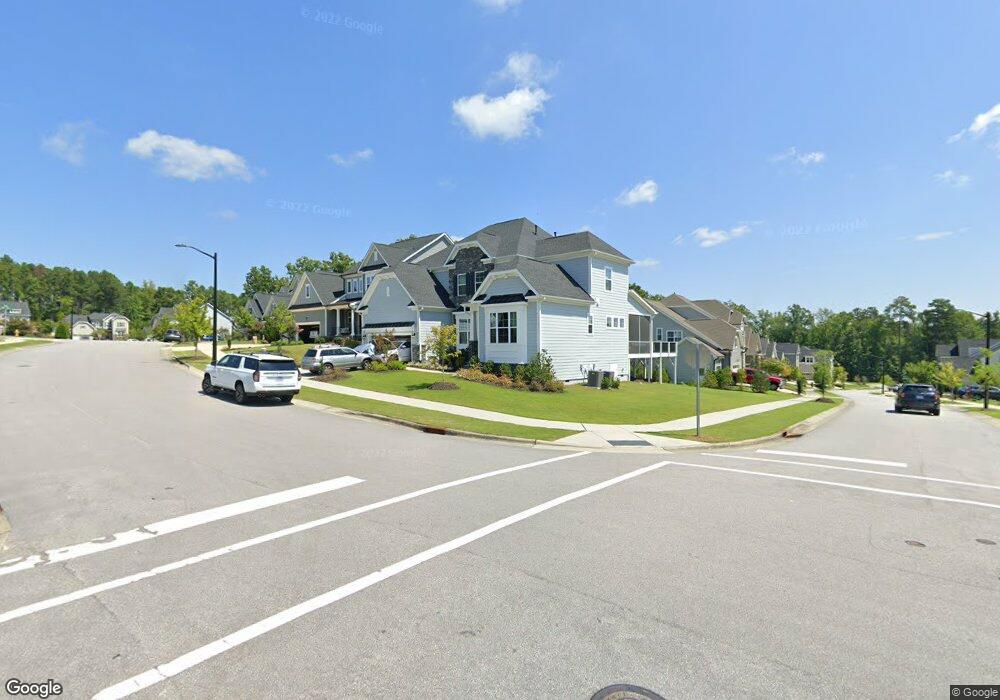

2105 White Rocks Rd Unit 26 Wake Forest, NC 27587

Estimated Value: $870,000 - $898,000

5

Beds

6

Baths

4,300

Sq Ft

$206/Sq Ft

Est. Value

About This Home

This home is located at 2105 White Rocks Rd Unit 26, Wake Forest, NC 27587 and is currently estimated at $886,897, approximately $206 per square foot. 2105 White Rocks Rd Unit 26 is a home located in Wake County with nearby schools including Heritage Elementary School, Heritage Middle School, and Heritage High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 2, 2025

Sold by

Daniel Garcia Adrian and Resendez Krystal

Bought by

Garza Christopher and Garza Evanthia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$693,562

Outstanding Balance

$688,774

Interest Rate

6.84%

Mortgage Type

VA

Estimated Equity

$198,123

Purchase Details

Closed on

Jul 18, 2019

Sold by

Standara Pacific Of The Carolinas Llc

Bought by

Resendez Garcia Adrian Daniel and Resendez Garcia Krystal

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$436,000

Interest Rate

3.5%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Garza Christopher | $880,000 | None Listed On Document | |

| Resendez Garcia Adrian Daniel | $545,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Garza Christopher | $693,562 | |

| Previous Owner | Resendez Garcia Adrian Daniel | $436,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,264 | $802,457 | $100,000 | $702,457 |

| 2024 | $7,237 | $760,154 | $100,000 | $660,154 |

| 2023 | $6,542 | $561,258 | $75,000 | $486,258 |

| 2022 | $6,275 | $561,258 | $75,000 | $486,258 |

| 2021 | $6,166 | $561,258 | $75,000 | $486,258 |

| 2020 | $6,166 | $561,258 | $75,000 | $486,258 |

| 2019 | $826 | $65,000 | $65,000 | $0 |

| 2018 | $763 | $65,000 | $65,000 | $0 |

| 2017 | $738 | $65,000 | $65,000 | $0 |

| 2016 | $728 | $65,000 | $65,000 | $0 |

| 2015 | $567 | $60,000 | $60,000 | $0 |

Source: Public Records

Map

Nearby Homes

- Tupelo Plan at Forestville Towns

- Hawthorne Plan at Forestville Towns

- Twinberry Plan at Forestville Towns

- 557 Forestville Rd

- 555 Forestville Rd

- 553 Forestville Rd

- 549 Forestville Rd

- 547 Forestville Rd

- 541 Forestville Rd

- 529 Forestville Rd

- 515 Forestville Rd

- 1724 Highpoint St

- 664 Old Dairy Dr

- 1713 Gwen Dr

- 1713 Thicketon Cir

- 1508 Pointon Way

- 3905 Song Sparrow Dr

- 1101 Trentini Ave

- 9528 White Carriage Dr

- 6633 Penfield St

- 2101 White Rocks Rd Unit 25

- 3305 Silver Ore Ct Unit 27

- 2205 White Rocks Rd Unit 46

- 2205 White Rocks Rd

- 2013 White Rocks Rd

- 2013 White Rocks Rd

- 3304 Silver Ore Ct

- 3304 Silver Ore Ct Unit 47

- 3229 Silver Ore Ct

- 3229 Silver Ore Ct Unit 83

- 3309 Silver Ore Ct Unit 28

- 3309 Silver Ore Ct

- 3228 Star Gazing Ct

- 2209 White Rocks Rd Unit 45

- 3228 Silver Ore Ct Unit 84

- 3228 Silver Ore Ct

- 3308 Silver Ore Ct Unit 48

- 2009 White Rocks Rd Unit 23

- 3313 Silver Ore Ct

- 3225 Silver Ore Ct