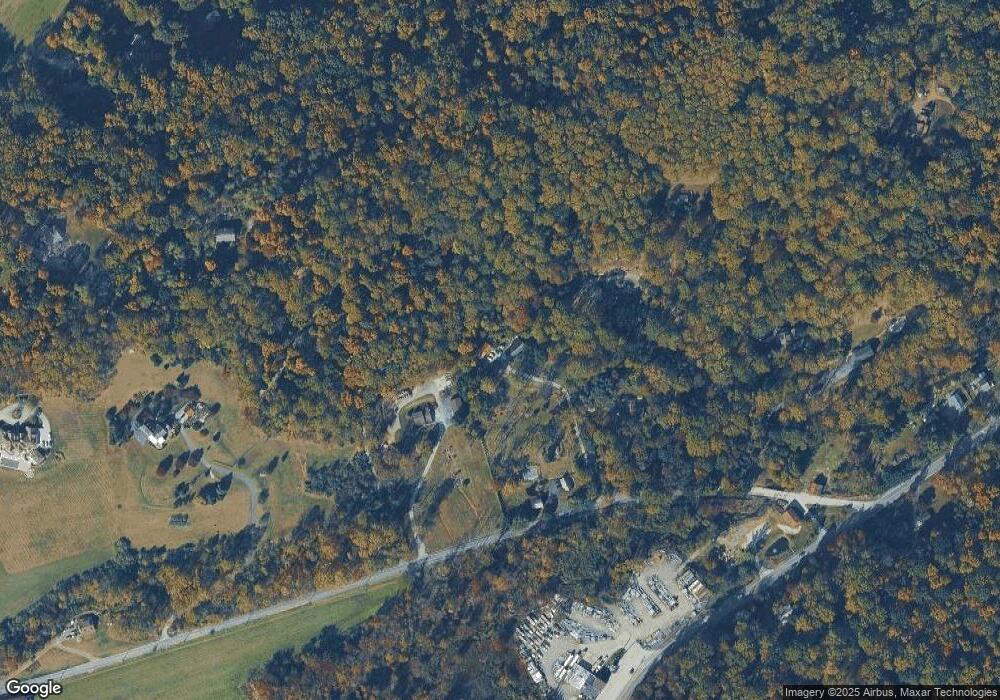

2107 Fairview Rd Glenmoore, PA 19343

Estimated Value: $628,000 - $826,000

4

Beds

4

Baths

2,418

Sq Ft

$290/Sq Ft

Est. Value

About This Home

This home is located at 2107 Fairview Rd, Glenmoore, PA 19343 and is currently estimated at $700,769, approximately $289 per square foot. 2107 Fairview Rd is a home located in Chester County with nearby schools including West Vincent Elementary School, Owen J Roberts Middle School, and Owen J Roberts High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 26, 2023

Sold by

Brownley Edwin A and Brownley Janine L

Bought by

Brownley Edwin A and Brownley Janine L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$486,000

Outstanding Balance

$474,233

Interest Rate

6.71%

Mortgage Type

New Conventional

Estimated Equity

$226,536

Purchase Details

Closed on

Nov 14, 2011

Sold by

Gilham Michael and Cumming Gilham Faye

Bought by

Brownley Edwin A and Brownley Janine L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$380,000

Interest Rate

4.12%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 21, 2008

Sold by

Clay Scott H and Clay Deborah L

Bought by

Gilham Michael and Cumming Gilham Faye

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$370,000

Interest Rate

5.25%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brownley Edwin A | -- | None Listed On Document | |

| Brownley Edwin A | $400,000 | None Available | |

| Gilham Michael | $490,000 | Manito Title Insurance Compa |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brownley Edwin A | $486,000 | |

| Previous Owner | Brownley Edwin A | $380,000 | |

| Previous Owner | Gilham Michael | $370,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,249 | $208,440 | $66,600 | $141,840 |

| 2024 | $8,249 | $208,440 | $66,600 | $141,840 |

| 2023 | $8,125 | $208,440 | $66,600 | $141,840 |

| 2022 | $7,988 | $208,440 | $66,600 | $141,840 |

| 2021 | $7,887 | $208,440 | $66,600 | $141,840 |

| 2020 | $7,676 | $208,440 | $66,600 | $141,840 |

| 2019 | $7,526 | $208,440 | $66,600 | $141,840 |

| 2018 | $7,373 | $208,440 | $66,600 | $141,840 |

| 2017 | $7,191 | $208,440 | $66,600 | $141,840 |

| 2016 | $6,259 | $208,440 | $66,600 | $141,840 |

| 2015 | $6,259 | $208,440 | $66,600 | $141,840 |

| 2014 | $6,259 | $208,440 | $66,600 | $141,840 |

Source: Public Records

Map

Nearby Homes

- 3896 Coventryville Rd

- 3381 Coventryville Rd

- 618 Kent Ct

- 1623 Hilltop Rd

- 475 Fairmont Dr Unit 237

- 3251 Coventryville Rd

- 957 Mount Pleasant Rd

- 108 Hartman Rd

- 955 Pinehurst Dr

- 214 Windgate Dr

- 176 Bucktown Crossing Unit 42C

- 3221 Coventryville Rd

- 1255 Hollow Rd

- 1940 Ridge Rd

- 1630 Sheeder Mill Rd

- 1420 Hollow Rd

- 1381 School House Ln

- 1672 Hollow Rd

- 121 Warwick Chase

- 1816 Pottstown Pike

- 2117 Fairview Rd

- 2103 Fairview Rd

- 2121 Fairview Rd

- 2111 Fairview Rd

- 2123 Fairview Rd

- 2127 Fairview Rd

- 2091 Fairview Rd

- 2128 Fairview Rd

- 2129 Fairview Rd

- 2047 Fairview Rd

- 1747 Pottstown Pike

- 1260 Prizer Rd

- 1817 Pottstown Pike

- 2063 Fairview Rd

- 3 Timber Dr

- 1742 Pottstown Pike

- 1833 Pottstown Pike

- 4 Timber Dr

- 1825 Pottstown Pike

- 1739 Pottstown Pike