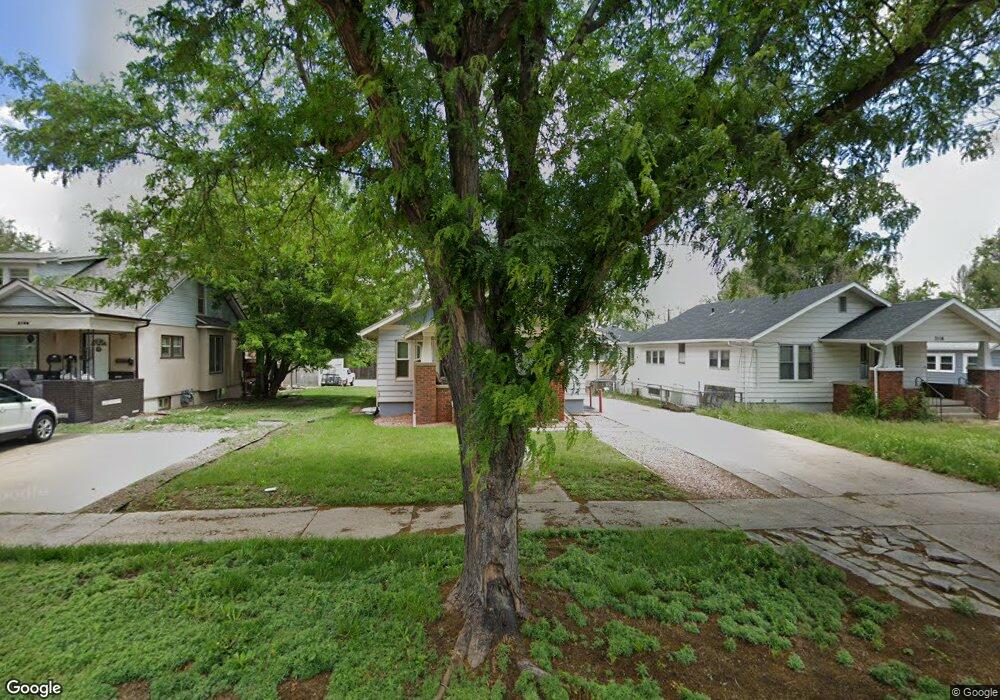

2110 8th Ave Greeley, CO 80631

Alta Vista NeighborhoodEstimated Value: $359,566 - $397,000

5

Beds

2

Baths

1,188

Sq Ft

$314/Sq Ft

Est. Value

About This Home

This home is located at 2110 8th Ave, Greeley, CO 80631 and is currently estimated at $373,142, approximately $314 per square foot. 2110 8th Ave is a home located in Weld County with nearby schools including Jackson Elementary School, Brentwood Middle School, and Greeley Central High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 24, 2006

Sold by

Enriquez Rosalio and Enriquez Mary

Bought by

Enriquez Mary

Current Estimated Value

Purchase Details

Closed on

Jan 31, 2002

Sold by

Whitman Margreet E

Bought by

Reed Norene S and Reed Robert W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,600

Outstanding Balance

$51,693

Interest Rate

7.15%

Estimated Equity

$321,449

Purchase Details

Closed on

Jun 30, 1997

Sold by

Fry Helen H

Bought by

Whitman Margreet E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,000

Interest Rate

7.93%

Purchase Details

Closed on

Sep 6, 1977

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Enriquez Mary | -- | None Available | |

| Reed Norene S | $162,000 | -- | |

| Whitman Margreet E | $123,000 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Reed Norene S | $129,600 | |

| Previous Owner | Whitman Margreet E | $73,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,805 | $22,630 | $3,560 | $19,070 |

| 2024 | $1,805 | $22,630 | $3,560 | $19,070 |

| 2023 | $861 | $25,210 | $3,860 | $21,350 |

| 2022 | $1,784 | $20,460 | $2,970 | $17,490 |

| 2021 | $1,841 | $21,050 | $3,060 | $17,990 |

| 2020 | $1,589 | $18,230 | $2,720 | $15,510 |

| 2019 | $1,593 | $18,230 | $2,720 | $15,510 |

| 2018 | $1,271 | $15,340 | $2,390 | $12,950 |

| 2017 | $1,277 | $15,340 | $2,390 | $12,950 |

| 2016 | $968 | $13,080 | $1,970 | $11,110 |

| 2015 | $964 | $13,080 | $1,970 | $11,110 |

| 2014 | $697 | $9,230 | $1,850 | $7,380 |

Source: Public Records

Map

Nearby Homes

- 2130 9th Ave

- 2107 9th Ave

- 922 21st St

- 2237 10th Ave

- 2220 6th Ave

- 2015 5th Ave Unit A and B

- 1838 8th Ave

- 1825 7th Ave

- 1856 11th Ave

- 2411 10th Avenue Ct

- 1840 12th Ave

- 1861 12th Ave

- 1213 Cranford Place

- 1718 11th Ave

- 1817 12th Ave

- 1729 11th Ave

- 1864 14th Ave

- 1708 12th Ave

- 2430 14th Avenue Ct

- 2706 7th Ave

Your Personal Tour Guide

Ask me questions while you tour the home.