Estimated Value: $678,000 - $898,272

4

Beds

2

Baths

2,238

Sq Ft

$357/Sq Ft

Est. Value

About This Home

This home is located at 2110 Forest Grove Estates Rd, Allen, TX 75002 and is currently estimated at $799,568, approximately $357 per square foot. 2110 Forest Grove Estates Rd is a home located in Collin County with nearby schools including Carrie L. Lovejoy Elementary School, Robert L Puster Elementary School, and Sloan Creek Intermediate School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 20, 2011

Sold by

Hedgcoxe Jack A and Hedgcoxe Annie M

Bought by

Ivivnova Cirbu Kassenavna

Current Estimated Value

Purchase Details

Closed on

Sep 25, 1998

Sold by

Dove William A and Dove Alice P

Bought by

Hedgcoxe Jack A and Hedgcoxe Annie M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,500

Interest Rate

6.69%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Dec 17, 1996

Sold by

Mcintyre Gordon K and Mcintyre Karen J

Bought by

Dove William A and Dove Alice P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

7.71%

Purchase Details

Closed on

Feb 22, 1994

Sold by

Snyder Charles E and Snyder Dawn L

Bought by

Mcintyre Gordon K and Mcintyre Karen J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,595

Interest Rate

6.94%

Mortgage Type

Assumption

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ivivnova Cirbu Kassenavna | -- | Ct | |

| Hedgcoxe Jack A | -- | -- | |

| Dove William A | -- | -- | |

| Mcintyre Gordon K | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hedgcoxe Jack A | $97,500 | |

| Previous Owner | Dove William A | $100,000 | |

| Previous Owner | Mcintyre Gordon K | $128,595 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,497 | $663,357 | $674,500 | $192,306 |

| 2024 | $7,497 | $603,052 | $674,500 | $201,271 |

| 2023 | $7,497 | $548,229 | $461,500 | $232,101 |

| 2022 | $8,514 | $498,390 | $497,000 | $234,059 |

| 2021 | $10,549 | $601,344 | $284,000 | $317,344 |

| 2020 | $10,599 | $580,937 | $284,000 | $296,937 |

| 2019 | $11,116 | $575,335 | $284,000 | $291,335 |

| 2018 | $11,799 | $607,536 | $284,000 | $369,098 |

| 2017 | $11,087 | $661,772 | $284,000 | $377,772 |

| 2016 | $10,502 | $559,917 | $177,500 | $382,417 |

| 2015 | $7,675 | $468,793 | $177,500 | $291,293 |

Source: Public Records

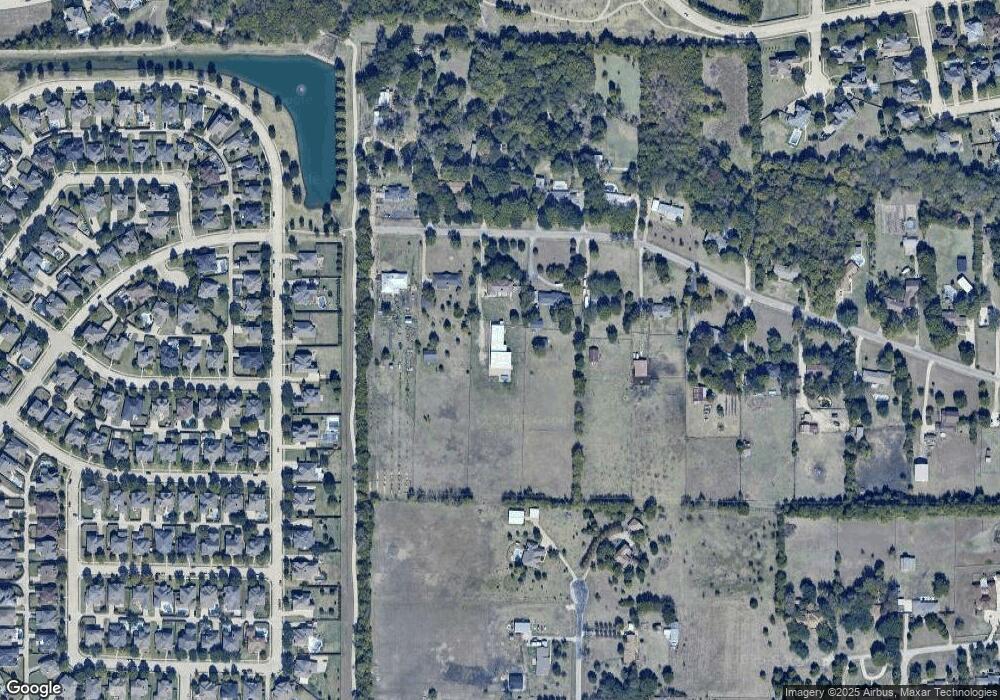

Map

Nearby Homes

- 1522 Farm Dale

- 2013 Country Brook Ln

- 2017 Country Brook Ln

- 1505 Winterbrook Ct

- 1804 Goodnight Ln

- 1717 Monaco Dr

- 1713 Whispering Glen Dr

- 1614 Wheatberry Ct

- 1908 Bordeaux Ct

- 1613 Country Brook Ln

- 1923 Armstrong Dr

- 211 Britton Ct

- 228 Britton Ct

- 2351 Rock Ridge Rd

- 258 Britton Ct

- 2701 Wolf Creek Dr

- 1011 Mesa Verde

- 1026 Grand Teton Dr

- 1029 Grand Teton Dr

- 1550 Charleston Dr

- 2106 Forest Grove Estates Rd

- 2114 Forest Grove Estates Rd

- 2107 Forest Grove Estates Rd

- 2118 Forest Grove Estates Rd

- 2102 Forest Grove Estates Rd

- 2111 Forest Grove Estates Rd

- 2103 Forest Grove Estates Rd

- 2101 Forest Grove Estates Rd

- 2203 Forest Grove Estates Rd

- 2202 Forest Grove Estates Rd

- 1514 Pleasant Run

- 1516 Pleasant Run

- 1512 Pleasant Run

- 2207 Forest Grove Estates Rd

- 1510 Pleasant Run

- 1506 Pleasant Run

- 2206 Forest Grove Estates Rd

- 2211 Forest Grove Estates Rd

- 1504 Pleasant Run

- 1881 Harvest Glen Dr