2111 E Belt Line Rd Unit 168A Richardson, TX 75081

Duck Creek NeighborhoodEstimated Value: $206,916 - $236,000

2

Beds

1

Bath

908

Sq Ft

$242/Sq Ft

Est. Value

About This Home

This home is located at 2111 E Belt Line Rd Unit 168A, Richardson, TX 75081 and is currently estimated at $219,979, approximately $242 per square foot. 2111 E Belt Line Rd Unit 168A is a home located in Dallas County with nearby schools including Dartmouth Elementary School, Apollo Junior High School, and Berkner High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 21, 2017

Sold by

Smith Lois P and Clegg Lois Patricia

Bought by

Taylor Nancy

Current Estimated Value

Purchase Details

Closed on

Mar 21, 2013

Sold by

Clegg Lois P and Smith Lois P

Bought by

Clegg Lois P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,341

Interest Rate

3.56%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 22, 2005

Sold by

Smith Lois P and Smith Danny

Bought by

Smith Lois P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,245

Interest Rate

5.61%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 28, 2005

Sold by

Osgood Lois E

Bought by

Smith Lois P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,245

Interest Rate

5.61%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Taylor Nancy | -- | None Available | |

| Clegg Lois P | -- | First American | |

| Smith Lois P | -- | Rtt | |

| Smith Lois P | -- | Rtt |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Clegg Lois P | $67,341 | |

| Previous Owner | Smith Lois P | $76,245 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $144 | $208,130 | $54,180 | $153,950 |

| 2024 | $144 | $208,130 | $54,180 | $153,950 |

| 2023 | $144 | $158,900 | $54,180 | $104,720 |

| 2022 | $3,552 | $145,280 | $54,180 | $91,100 |

| 2021 | $2,977 | $113,500 | $54,180 | $59,320 |

| 2020 | $3,030 | $113,500 | $54,180 | $59,320 |

| 2019 | $3,180 | $113,500 | $54,180 | $59,320 |

| 2018 | $3,033 | $113,500 | $18,060 | $95,440 |

| 2017 | $1,829 | $68,500 | $18,060 | $50,440 |

| 2016 | $1,829 | $68,500 | $18,060 | $50,440 |

| 2015 | $551 | $68,500 | $18,060 | $50,440 |

| 2014 | $551 | $68,500 | $18,060 | $50,440 |

Source: Public Records

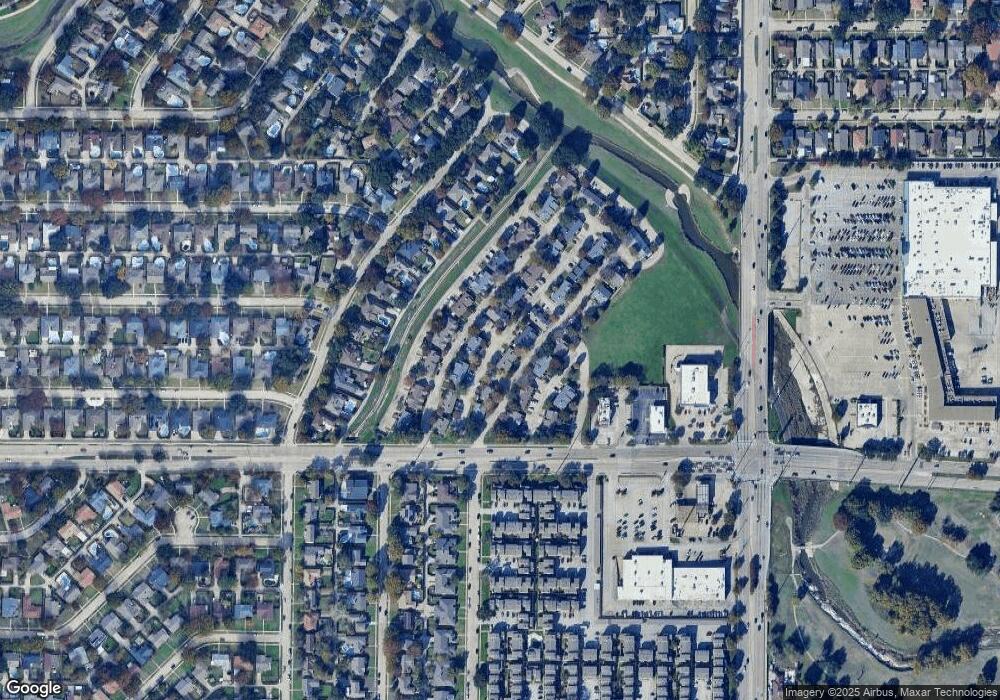

Map

Nearby Homes

- 100 Trellis Place Unit 102

- 145 Trellis Place Unit 145

- 1911 Marquette Dr

- 202 Mistletoe Dr

- 1912 Villanova Dr

- 2113 Trellis Place

- 2313 Trellis Place

- 2330 Village North Dr

- 2121 Poppy Ln

- 222 Mistletoe Dr

- 1804 University Dr

- 2123 Sunrise Trail

- 3220 Laurel Oaks Ct

- 3137 Pamela Place

- 1625 Villanova Dr

- 3806 Star Trek Ln

- 1618 University Dr

- 1619 Centenary Dr

- 1711 Windsong Trail

- 3105 Eastpark Dr

- 2111 E Belt Line Rd Unit 156A

- 2111 E Belt Line Rd Unit 106A

- 2111 E Belt Line Rd Unit 102B

- 2111 E Belt Line Rd Unit 168B

- 2111 E Belt Line Rd Unit 148B

- 2111 E Belt Line Rd Unit 138A

- 2111 E Belt Line Rd Unit 124C

- 2111 E Belt Line Rd Unit 4

- 2111 E Belt Line Rd Unit 148C

- 2111 E Belt Line Rd Unit 132C

- 2111 E Belt Line Rd

- 2111 E Belt Line Rd Unit 2

- 2111 E Belt Line Rd Unit 2

- 2111 E Belt Line Rd Unit 1

- 2111 E Belt Line Rd Unit 2

- 2111 E Belt Line Rd Unit 1

- 2111 E Belt Line Rd Unit 2

- 2111 E Belt Line Rd Unit 2

- 2111 E Belt Line Rd Unit 1

- 2111 E Belt Line Rd Unit 2