2125 Cabaniss Ln Weatherford, TX 76088

Estimated Value: $399,000 - $930,000

--

Bed

--

Bath

1,840

Sq Ft

$346/Sq Ft

Est. Value

About This Home

This home is located at 2125 Cabaniss Ln, Weatherford, TX 76088 and is currently estimated at $635,845, approximately $345 per square foot. 2125 Cabaniss Ln is a home located in Parker County with nearby schools including Garner Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 23, 2020

Sold by

Horwedel Jeffery A and Horwedel Kimberly A

Bought by

Slack Samuel Franklin and Slack Heather Dionne

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$169,497

Outstanding Balance

$134,897

Interest Rate

3.2%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$500,948

Purchase Details

Closed on

Mar 28, 2019

Sold by

King Marjorie E

Bought by

Horwedel Jeffery A and Horwedel Kimberly A

Purchase Details

Closed on

Jan 30, 2013

Sold by

King Forrest W

Bought by

King Forrest W Jr Life Estate

Purchase Details

Closed on

May 20, 1985

Bought by

King Forrest W Jr Life Estate

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Slack Samuel Franklin | -- | Providence Title Company | |

| Horwedel Jeffery A | -- | Providence Title Company | |

| King Forrest W Jr Life Estate | -- | -- | |

| King Marjorie E | -- | None Available | |

| King Forrest W Jr Life Estate | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Slack Samuel Franklin | $169,497 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,155 | $572,632 | -- | -- |

| 2024 | $6,155 | $520,575 | -- | -- |

| 2023 | $6,155 | $473,250 | $0 | $0 |

| 2022 | $6,699 | $430,230 | $221,380 | $208,850 |

| 2021 | $4,592 | $263,230 | $221,380 | $41,850 |

| 2020 | $2,722 | $156,380 | $156,380 | $0 |

| 2019 | $2,397 | $162,410 | $156,380 | $6,030 |

| 2018 | $2,194 | $117,350 | $113,510 | $3,840 |

| 2017 | $2,023 | $117,350 | $113,510 | $3,840 |

| 2016 | $1,839 | $96,850 | $93,010 | $3,840 |

| 2015 | $259 | $96,850 | $93,010 | $3,840 |

| 2014 | $263 | $96,350 | $92,510 | $3,840 |

Source: Public Records

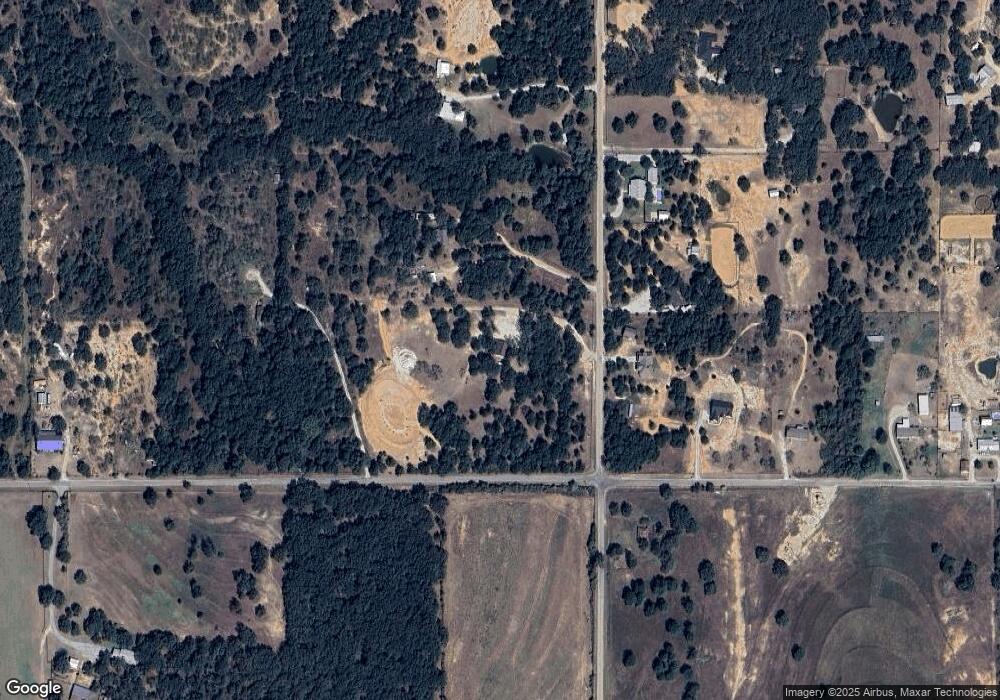

Map

Nearby Homes

- TBD Old Authon Rd

- TBD Mineral Wells Hwy

- 217 Jefferson Way

- Lot 3 Suade Way

- Lot 8 Suade Way

- Lot 5 Suade Way

- 233 Jefferson Way

- 121 Norene Ln

- TBD Willow Unit 3B

- TBD Willow Unit 3A

- Lot 6 Suade Way

- Lot 7 Suade Way

- 117 Norene Ln

- Lot 2 Suade Way

- 125 Norene Ln

- Lot 1 Way

- Lot 4 Suade Way

- TBD Willow Unit 1

- 1511 Cabaniss Ln

- 0 Tbd Old Authon Rd

- 2133 Cabaniss Ln

- 3990 Franko Switch Rd

- 2149 Cabaniss Ln

- 2121 Cabaniss Ln

- 2120 Cabaniss Ln

- 2128 Cabaniss Ln

- 3880 Franko Switch Rd

- 3874 Franko Switch Rd

- 2170 Cabaniss Ln

- 4044 Franko Switch Rd

- 2144 Cabaniss Ln

- 4045 Franko Switch Rd

- 3840 Franko Switch Rd

- 3762 Franko Switch Rd

- 3800 Franko Switch Rd

- 1301 Old Authon Rd

- 987 Old Authon Rd

- 3750 Franko Switch Rd

- 1901 Cabaniss Ln

- 3700 Franko Switch Rd