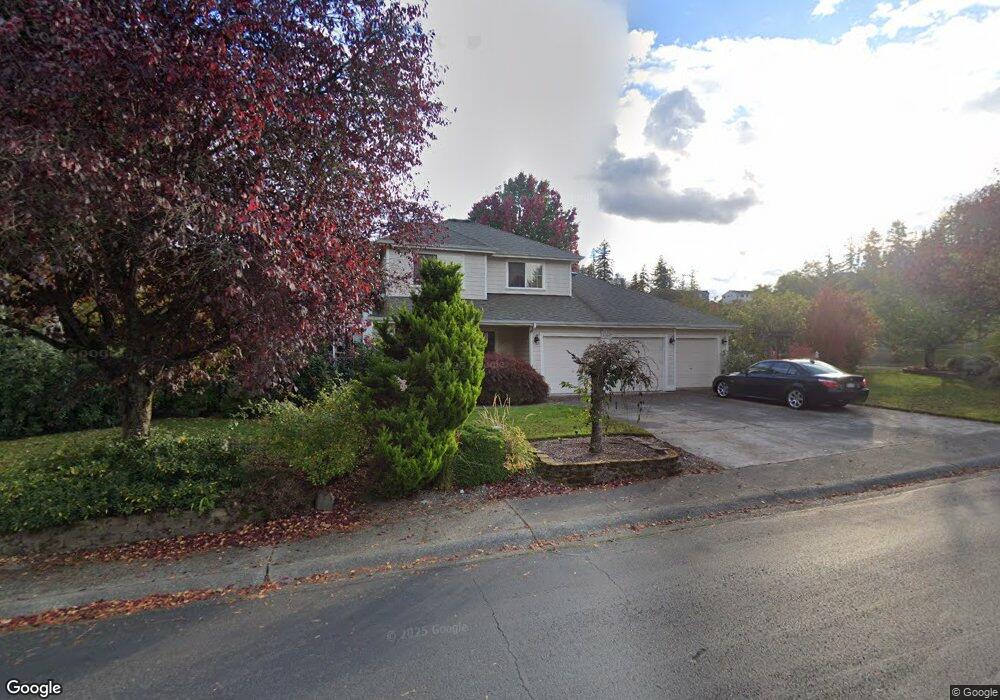

2125 NE Bjorn St Poulsbo, WA 98370

Estimated Value: $640,000 - $672,000

4

Beds

3

Baths

1,939

Sq Ft

$340/Sq Ft

Est. Value

About This Home

This home is located at 2125 NE Bjorn St, Poulsbo, WA 98370 and is currently estimated at $658,393, approximately $339 per square foot. 2125 NE Bjorn St is a home located in Kitsap County with nearby schools including Poulsbo Elementary School, Poulsbo Middle School, and North Kitsap High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 12, 2007

Sold by

Knight Annette A

Bought by

Mika Gale Jr Richard A and Mika Gale

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$288,000

Outstanding Balance

$173,653

Interest Rate

6.1%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$484,740

Purchase Details

Closed on

Oct 13, 2004

Sold by

Knight Brian P

Bought by

Knight Annette A

Purchase Details

Closed on

Jun 8, 1998

Sold by

Schneider Homes Inc

Bought by

Knight Brian P and Knight Annette

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$167,300

Interest Rate

7.17%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mika Gale Jr Richard A | $360,280 | Transnation Title | |

| Knight Annette A | -- | -- | |

| Knight Brian P | $172,500 | Transnation Title Insurance |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mika Gale Jr Richard A | $288,000 | |

| Previous Owner | Knight Brian P | $167,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $5,085 | $566,690 | $118,310 | $448,380 |

| 2025 | $5,085 | $566,690 | $118,310 | $448,380 |

| 2024 | $4,675 | $536,410 | $110,640 | $425,770 |

| 2023 | $4,755 | $536,410 | $110,640 | $425,770 |

| 2022 | $4,216 | $452,220 | $96,040 | $356,180 |

| 2021 | $4,077 | $405,380 | $86,050 | $319,330 |

| 2020 | $3,964 | $387,210 | $82,210 | $305,000 |

| 2019 | $3,721 | $363,410 | $76,830 | $286,580 |

| 2018 | $3,454 | $286,590 | $58,370 | $228,220 |

| 2017 | $3,294 | $286,590 | $58,370 | $228,220 |

| 2016 | $3,372 | $270,290 | $58,370 | $211,920 |

| 2015 | $3,254 | $262,140 | $58,370 | $203,770 |

| 2014 | -- | $250,730 | $58,370 | $192,360 |

| 2013 | -- | $250,730 | $58,370 | $192,360 |

Source: Public Records

Map

Nearby Homes

- 2405 NE Waterlily Way

- 18130 Sunrise Ridge Ave NE

- 1610 NE Mount Kamela Ct

- 2413 NE Sunnymede St

- 2040 NE Norseman Way

- 2046 NE Norseman Way

- 17505 NE Midnight Sun Loop

- 2052 NE Norseman Way

- 2058 NE Norseman Way

- 2064 NE Norseman Way

- 18552 15th Loop NE

- 2019 NE Norseman Way

- 2072 NE Norseman Way

- Luna Plan at Liberty Bay Vista

- Rainier Plan at Liberty Bay Vista

- Bennett Plan at Liberty Bay Vista

- Bennett (Basement) Plan at Liberty Bay Vista

- Noah (Basement) Plan at Liberty Bay Vista

- Warren Plan at Liberty Bay Vista

- Raymond Plan at Liberty Bay Vista

- 2121 NE Lind Ct

- 2150 Miss Ellis Loop NE

- 2170 Miss Ellis Loop NE

- 2140 Miss Ellis Loop NE

- 2130 NE Bjorn St

- 2105 NE Lind Ct

- 2108 NE Bjorn St

- 2075 NE Bjorn St

- 2130 Miss Ellis Loop NE

- 2172 NE Gustaf St

- 2074 NE Bjorn St

- 2058 NE Lind Ct

- 2085 NE Lind Ct

- 2167 NE Gustaf St

- 2120 Miss Ellis Loop NE

- 2170 NE Gustaf St

- 2185 Miss Ellis Loop NE

- 2195 Miss Ellis Loop NE

- 2056 NE Bjorn St

- 2225 Miss Ellis Loop NE