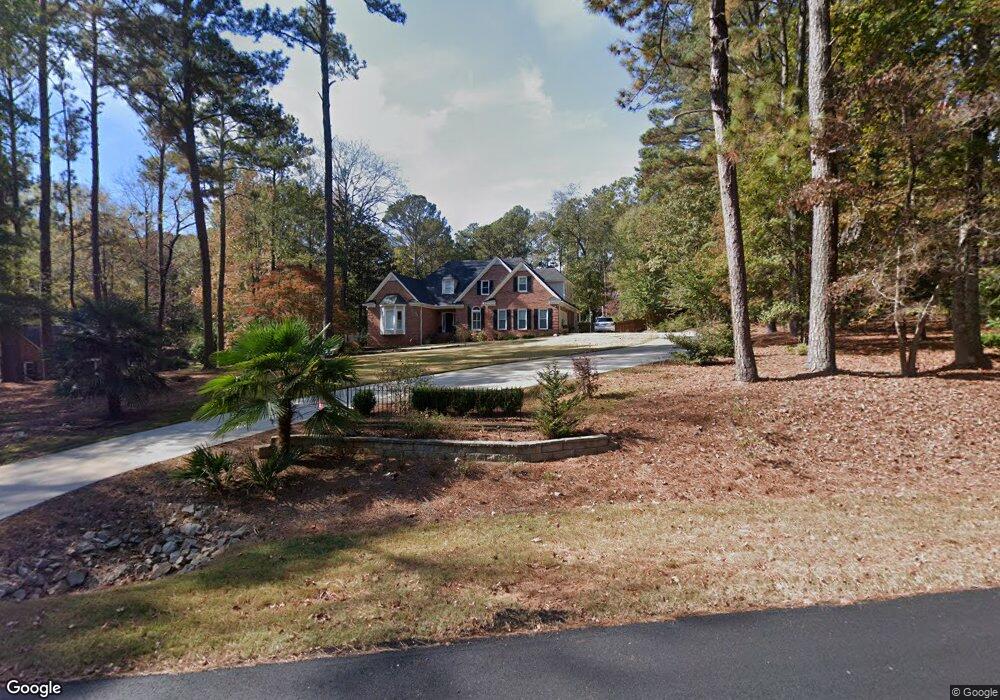

213 E Yorktown Dr Lagrange, GA 30240

Estimated Value: $479,000 - $643,000

4

Beds

3

Baths

3,858

Sq Ft

$143/Sq Ft

Est. Value

About This Home

This home is located at 213 E Yorktown Dr, Lagrange, GA 30240 and is currently estimated at $552,630, approximately $143 per square foot. 213 E Yorktown Dr is a home located in Troup County with nearby schools including Franklin Forest Elementary School, Hillcrest Elementary School, and Hollis Hand Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 1, 2017

Sold by

Brown Robert S

Bought by

Gong Jeffery Allan and Gong Steven Ray

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$158,500

Outstanding Balance

$131,966

Interest Rate

3.94%

Mortgage Type

New Conventional

Estimated Equity

$420,664

Purchase Details

Closed on

Jun 18, 2003

Sold by

Robert S Brown Jr Interest

Bought by

Brown Robert S and Brown Deborah H

Purchase Details

Closed on

Jun 14, 1994

Sold by

Hendrix Daniel T

Bought by

Robert S Brown Jr Interest

Purchase Details

Closed on

Jan 1, 1986

Sold by

Ruth Berford and Ruth Kirk

Bought by

Hendrix Daniel T

Purchase Details

Closed on

Dec 6, 1983

Sold by

Phillips S H

Bought by

Ruth Berford and Ruth Kirk

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gong Jeffery Allan | $308,500 | -- | |

| Brown Robert S | -- | -- | |

| Robert S Brown Jr Interest | $190,000 | -- | |

| Hendrix Daniel T | $16,500 | -- | |

| Ruth Berford | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gong Jeffery Allan | $158,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,825 | $176,920 | $18,000 | $158,920 |

| 2023 | $4,844 | $177,600 | $18,000 | $159,600 |

| 2022 | $4,619 | $165,480 | $18,000 | $147,480 |

| 2021 | $3,827 | $126,880 | $12,000 | $114,880 |

| 2020 | $3,827 | $126,880 | $12,000 | $114,880 |

| 2019 | $3,769 | $124,960 | $12,000 | $112,960 |

| 2018 | $3,156 | $106,640 | $13,200 | $93,440 |

| 2017 | $3,156 | $106,640 | $13,200 | $93,440 |

| 2016 | $3,056 | $103,312 | $13,200 | $90,112 |

| 2015 | $3,061 | $103,312 | $13,200 | $90,112 |

| 2014 | $2,923 | $98,570 | $13,200 | $85,370 |

| 2013 | -- | $95,424 | $13,200 | $82,224 |

Source: Public Records

Map

Nearby Homes

- 219 E Yorktown Dr

- 3011 Mooty Bridge Rd

- 206 Sturbridge Dr

- 0 Waterview Dr Unit LOT 34 10500921

- 0 Waterview Dr Unit LOT 37 & 27B

- 0 Waterview Dr Unit 10580887

- 0 Waterview Dr Unit LOT 31 10491353

- 0 Waterview Dr Unit LOT 30 10491028

- 0 Waterview Dr Unit 10554814

- 0 Waterview Dr Unit 10558462

- 1006 Wares Cross Rd

- 589 Waterview Dr

- 223 Village Dr

- 24 N Brooks Rd

- 42 Wooding Place

- 117 Woodchase

- 102 Woodchase

- 109 Windridge

- 107 Windridge

- 107 Cameron Pointe Dr

- 211 E Yorktown Dr

- 215 E Yorktown Dr

- E E Yorktown Dr

- 314 W Yorktown Dr

- 209 E Yorktown Dr

- 316 W Yorktown Dr

- 217 E Yorktown Dr

- 214 E Yorktown Dr

- 310 W Yorktown Dr

- 212 E Yorktown Dr

- W W Yorktown Dr Unit 49

- W W Yorktown Dr

- 318 W Yorktown Dr

- 207 E Yorktown Dr

- 216 E Yorktown Dr

- 210 E Yorktown Dr

- 308 W Yorktown Dr

- 315 W Yorktown Dr

- 208 E Yorktown Dr

- 313 W Yorktown Dr