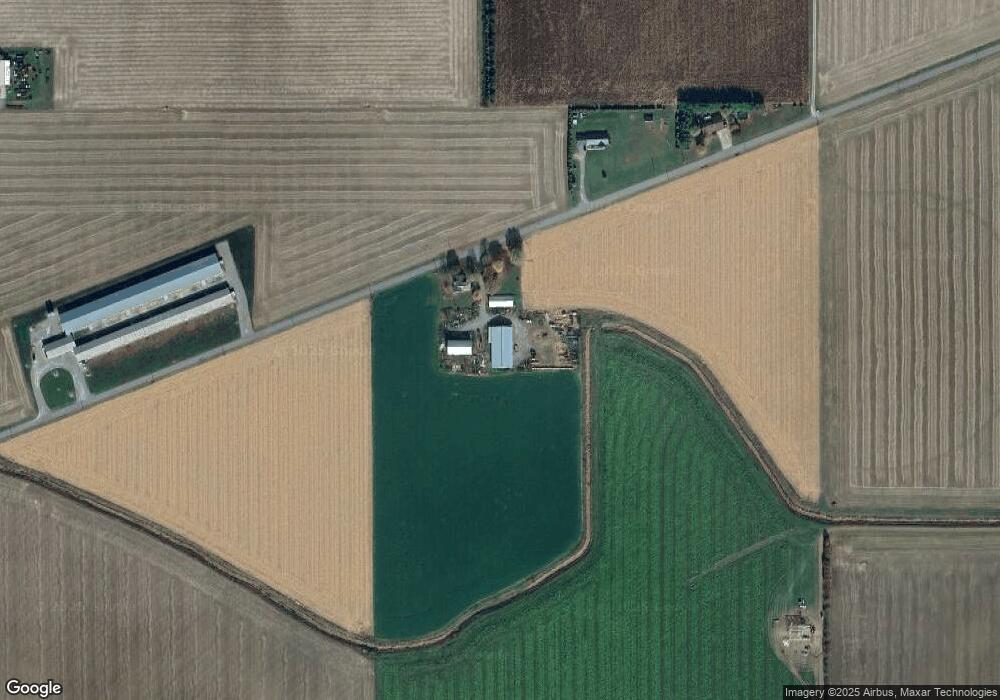

21310 Jennings Delphos Rd Delphos, OH 45833

Estimated Value: $211,000 - $416,000

3

Beds

2

Baths

1,236

Sq Ft

$281/Sq Ft

Est. Value

About This Home

This home is located at 21310 Jennings Delphos Rd, Delphos, OH 45833 and is currently estimated at $346,775, approximately $280 per square foot. 21310 Jennings Delphos Rd is a home located in Van Wert County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 6, 2016

Sold by

Gerdeman Shawn W and Gerdeman Elizabeth A

Bought by

Gerdeman Land & Cattle Llc

Current Estimated Value

Purchase Details

Closed on

Mar 8, 2011

Sold by

Gredemann Joel Andrew and Gerdemann Shannon Kathleen

Bought by

Gerdemann Shawn W and Gerdemann Elizabeth A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

4.85%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Jul 11, 2007

Sold by

Gerdemann Joel A and Gerdemann Nora R

Bought by

Gerdemann Joel Andrew

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,661

Interest Rate

6.42%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 9, 2003

Bought by

Gerdeman Shawn W

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gerdeman Land & Cattle Llc | -- | Attorney | |

| Gerdemann Shawn W | $185,000 | Attorney | |

| Gerdemann Joel Andrew | $91,000 | Attorney | |

| Gerdeman Shawn W | $185,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Gerdemann Shawn W | $100,000 | |

| Closed | Gerdemann Joel Andrew | $92,661 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,673 | $90,070 | $23,510 | $66,560 |

| 2023 | $2,673 | $90,070 | $23,510 | $66,560 |

| 2022 | $2,216 | $66,950 | $15,560 | $51,390 |

| 2021 | $2,172 | $66,950 | $15,560 | $51,390 |

| 2020 | $2,275 | $66,950 | $15,560 | $51,390 |

| 2019 | $1,854 | $61,650 | $19,260 | $42,390 |

| 2018 | $1,854 | $61,650 | $19,260 | $42,390 |

| 2017 | $1,883 | $61,650 | $19,260 | $42,390 |

| 2016 | $1,841 | $64,200 | $22,890 | $41,310 |

| 2015 | $1,841 | $64,200 | $22,890 | $41,310 |

| 2014 | $1,932 | $64,200 | $22,890 | $41,310 |

| 2013 | $1,787 | $54,670 | $13,360 | $41,310 |

Source: Public Records

Map

Nearby Homes

- 23056 Jennings Delphos Rd

- 11630 Clearview Dr

- 104 W Railroad St

- 104 W South St

- 19318 Middle Point Rd

- 201 W South St

- 19059 Wittington St

- TBD Dog Creek Rd

- 832 Erie St

- 18906 Bebb St

- 634 S Clay St

- 227 W Clime St Unit 10

- 231 N Bredeick St

- 409 N Bredeick St

- 616 W 5th St

- 415 W 5th St

- 604 W 6th St

- 424 S Canal St

- 827 S Washington St

- 221 S Main St

- 21371 Jennings Delphos Rd

- 21450 Jennings Delphos Rd

- 21497 Jennings Delphos Rd

- 21499 Jennings Delphos Rd

- 12481 Converse Roselm Rd

- 21656 Jennings Delphos Rd

- 21342 State Rd

- 21474 State Rd

- 21484 State Rd

- 21536 State Rd

- 12366 Converse Roselm Rd

- 20877 Jennings Delphos Rd

- 20999 State Rd

- 21902 Jennings Delphos Rd

- 20739 Jennings Delphos Rd

- 20936 State Rd

- 20701 Jennings Delphos Rd

- 0 Converse Roselm