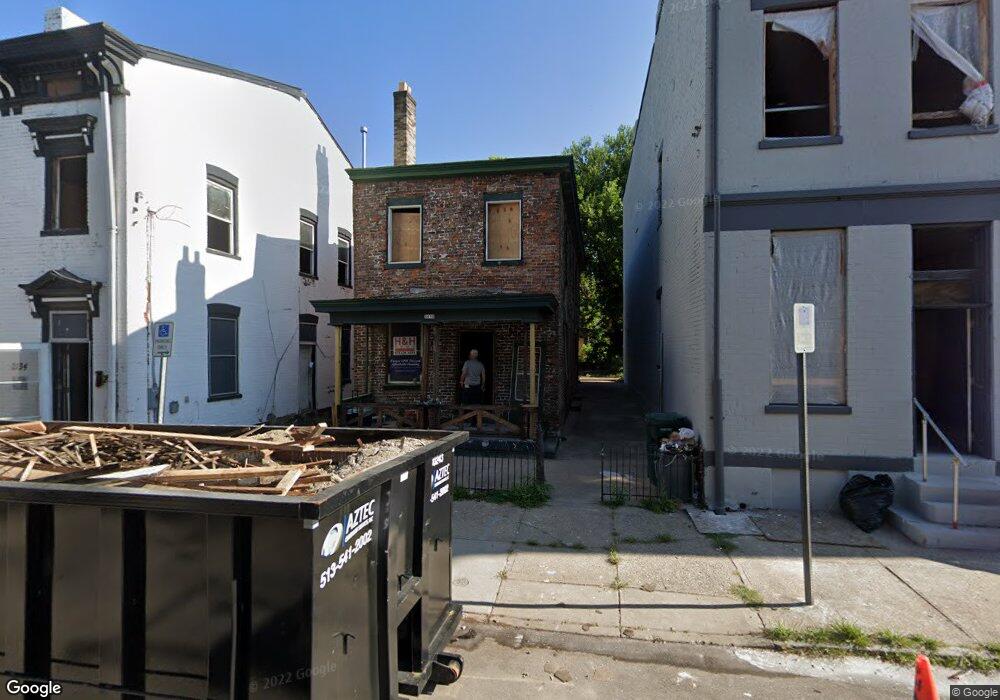

2132 Saint Michael St Cincinnati, OH 45204

East Price Hill NeighborhoodEstimated Value: $151,000 - $234,000

3

Beds

2

Baths

1,580

Sq Ft

$123/Sq Ft

Est. Value

About This Home

This home is located at 2132 Saint Michael St, Cincinnati, OH 45204 and is currently estimated at $194,744, approximately $123 per square foot. 2132 Saint Michael St is a home located in Hamilton County with nearby schools including Oyler School, Robert A. Taft Information Technology High School, and Gilbert A. Dater High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 19, 2023

Sold by

Habitat For Humanity Of Greater Cincinna

Bought by

Jones Charise L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$21,067

Outstanding Balance

$3,017

Interest Rate

6.71%

Mortgage Type

New Conventional

Estimated Equity

$191,727

Purchase Details

Closed on

Mar 26, 2018

Sold by

Community Matters Holdings Llc

Bought by

Habitat For Humanity Of Greater Cincinna

Purchase Details

Closed on

Dec 18, 2014

Sold by

Mann Flossie

Bought by

Community Matters Holdings Llc

Purchase Details

Closed on

Feb 25, 2000

Sold by

Great American Fsla

Bought by

Munn Flossie

Purchase Details

Closed on

Feb 14, 2000

Sold by

Sparks Tim W and Sparks Burnice G

Bought by

Great American Fsla

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jones Charise L | $250 | None Listed On Document | |

| Jones Charise L | $250 | None Listed On Document | |

| Habitat For Humanity Of Greater Cincinna | -- | None Available | |

| Community Matters Holdings Llc | $70,000 | Attorney | |

| Munn Flossie | $18,000 | -- | |

| Great American Fsla | $24,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jones Charise L | $21,067 | |

| Closed | Jones Charise L | $21,067 | |

| Open | Jones Charise L | $123,932 | |

| Closed | Jones Charise L | $123,932 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,006 | $51,885 | $1,103 | $50,782 |

| 2023 | $1,069 | $16,766 | $1,103 | $15,663 |

| 2022 | $539 | $7,546 | $959 | $6,587 |

| 2021 | $528 | $7,546 | $959 | $6,587 |

| 2020 | $529 | $7,546 | $959 | $6,587 |

| 2019 | $528 | $6,861 | $872 | $5,989 |

| 2018 | $529 | $6,861 | $872 | $5,989 |

| 2017 | $509 | $6,861 | $872 | $5,989 |

| 2016 | $467 | $6,132 | $896 | $5,236 |

| 2015 | $418 | $6,132 | $896 | $5,236 |

| 2014 | $420 | $6,132 | $896 | $5,236 |

| 2013 | $546 | $7,861 | $1,148 | $6,713 |

Source: Public Records

Map

Nearby Homes

- 2152 Staebler St

- 677 State Ave

- 2354 Warsaw Ave

- 2347 Maryland Ave

- 810 Matson Place

- 542 Davenport Ave

- 2358 Glenway Ave

- 2617 Eighth St W

- 2450 River Rd

- 490 Mt Hope Ave

- 2353 Wilder Ave

- 2425 Glenway Ave

- 2711 Price Ave

- 918 Mount Hope Ave

- 2810 Eighth St W

- 810 Summit Ave

- 720 Grand Ave

- 922 Summit Ave

- 2500 Warsaw Ave

- 2519 Warsaw Ave

- 2130 Saint Michael St

- 2134 Saint Michael St

- 2128 Saint Michael St

- 2124 Saint Michael St

- 646 Neave St

- 2137 Storrs St

- 2139 Storrs St

- 2135 Storrs St

- 2141 Storrs St

- 2133 Storrs St

- 642 Neave St

- 2131 Storrs St

- 654 Neave St

- 2129 Storrs St

- 2129 Saint Michael St

- 2127 Saint Michael St

- 2125 Saint Michael St

- 2127 Storrs St

- 656 Neave St

- 640 Neave St