21326 W Redwood Dr Plainfield, IL 60544

Carillon NeighborhoodEstimated Value: $402,000 - $431,000

3

Beds

3

Baths

2,480

Sq Ft

$169/Sq Ft

Est. Value

About This Home

This home is located at 21326 W Redwood Dr, Plainfield, IL 60544 and is currently estimated at $418,285, approximately $168 per square foot. 21326 W Redwood Dr is a home located in Will County with nearby schools including Elizabeth Eichelberger Elementary School, John F Kennedy Middle School, and Plainfield East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 5, 2024

Sold by

Clarke Michael

Bought by

Michael And Michele Clarke Trust and Clarke

Current Estimated Value

Purchase Details

Closed on

Apr 12, 2022

Sold by

Wendy A Brown Trust

Bought by

Clarice Michael

Purchase Details

Closed on

Mar 22, 2012

Sold by

Mcmahon Brian and Daniel J Mcmahon Trust

Bought by

Brown Wendy A and Wendy A Brown Trust

Purchase Details

Closed on

Apr 15, 2005

Sold by

Mcmahon Mary B and Mary B Mcmahon Trust

Bought by

Mcmahon Daniel J and Daniel J Mcmahon Trust

Purchase Details

Closed on

Oct 28, 1998

Sold by

Mcmahon Daniel J and Mcmahon Mary B

Bought by

Mcmahon Mary B and Mary B Mcmahon Trust

Purchase Details

Closed on

Mar 3, 1998

Sold by

The Northern Trust Company

Bought by

Mcmahon Daniel J and Mcmahon Mary B

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Michael And Michele Clarke Trust | -- | None Listed On Document | |

| Michael And Michele Clarke Trust | -- | None Listed On Document | |

| Clarice Michael | -- | Zapolis & Associates | |

| Brown Wendy A | $255,000 | First American Title Ins Co | |

| Mcmahon Daniel J | -- | -- | |

| Mcmahon Mary B | -- | -- | |

| Mcmahon Daniel J | $235,500 | Chicago Title Insurance Co |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $12,110 | $130,607 | $23,113 | $107,494 |

| 2023 | $12,110 | $117,252 | $20,750 | $96,502 |

| 2022 | $9,881 | $110,457 | $19,548 | $90,909 |

| 2021 | $9,402 | $103,803 | $18,370 | $85,433 |

| 2020 | $9,141 | $100,390 | $17,766 | $82,624 |

| 2019 | $8,643 | $95,157 | $16,840 | $78,317 |

| 2018 | $8,108 | $88,857 | $15,725 | $73,132 |

| 2017 | $7,609 | $83,883 | $14,845 | $69,038 |

| 2016 | $7,167 | $78,616 | $13,913 | $64,703 |

| 2015 | $6,396 | $72,622 | $12,852 | $59,770 |

| 2014 | $6,396 | $68,512 | $12,125 | $56,387 |

| 2013 | $6,396 | $72,593 | $12,125 | $60,468 |

Source: Public Records

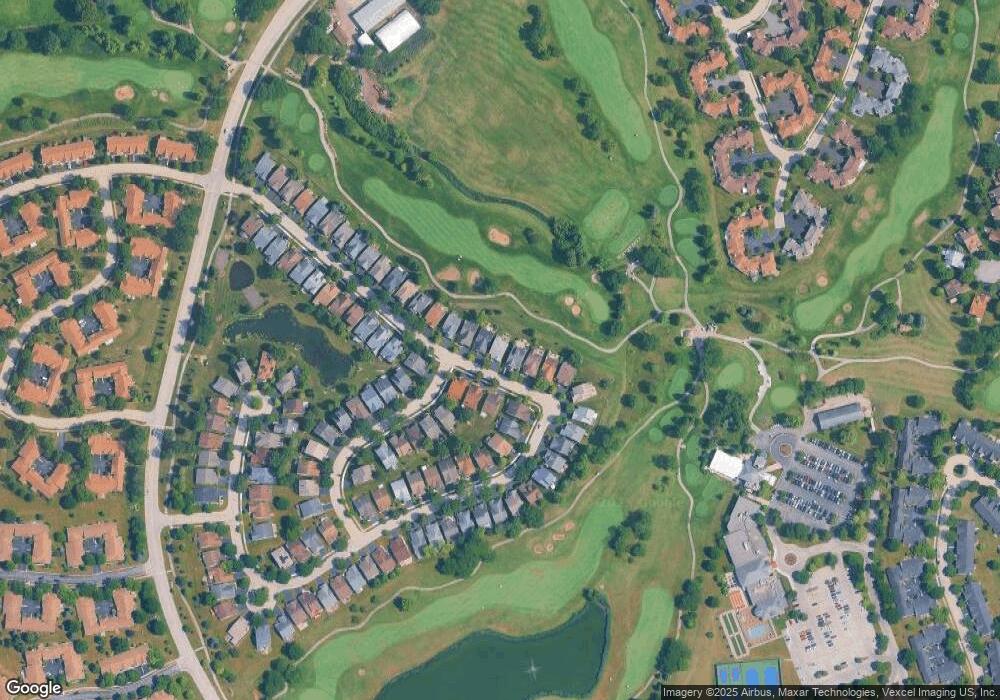

Map

Nearby Homes

- 21316 W Redwood Dr

- 21331 W Juniper Ln

- 21436 W Larch Ct

- 21365 W Juniper Ln

- 21535 W Empress Ln

- 13737 S Tamarack Dr

- 13832 S Balsam Ln Unit D

- 21600 W Larch Dr

- 13848 S Balsam Ln Unit A

- 13865 S Balsam Ln Unit D

- 13804 S Ironwood Dr

- 21230 W Walnut Dr Unit D

- 21521 W Douglas Ln

- 24041 W Walnut Dr

- 21519 W Basswood Ln

- 13494 Redberry Cir

- 13954 S Tamarack Dr

- 14037 S Tamarack Dr

- 21024 W Walnut Dr

- 21019 W Torrey Pines Ct

- 21328 W Redwood Dr

- 21324 W Redwood Dr

- 21322 W Redwood Dr

- 21330 W Redwood Dr

- 21332 W Redwood Dr

- 21320 W Redwood Dr

- 21325 W Redwood Dr

- 21327 W Redwood Dr

- 21323 W Redwood Dr

- 21335 W Sycamore Dr

- 21334 W Sycamore Dr

- 21341 W Redwood Dr

- 21341 W Sycamore Dr

- 21256 W Monterrey Dr

- 21257 W Monterrey Dr

- 21336 W Sycamore Dr

- 21347 W Sycamore Dr

- 21258 W Monterrey Dr

- 21259 W Monterrey Dr

- 21338 W Sycamore Dr