2137 Georgetown Verona Rd West Manchester, OH 45382

Estimated Value: $297,000 - $425,395

2

Beds

3

Baths

1,540

Sq Ft

$224/Sq Ft

Est. Value

About This Home

This home is located at 2137 Georgetown Verona Rd, West Manchester, OH 45382 and is currently estimated at $345,599, approximately $224 per square foot. 2137 Georgetown Verona Rd is a home located in Preble County with nearby schools including Tri-County North Elementary School, Tri-County North Middle School, and Tri-County North High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 20, 2018

Sold by

League Terry K and League Melissa J

Bought by

Ferguson John W and Ferguson Caitlyn M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,000

Outstanding Balance

$190,663

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$154,936

Purchase Details

Closed on

Sep 29, 1998

Sold by

Kimmel John D

Bought by

Terry K & Melissa J League

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,633

Interest Rate

6.99%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ferguson John W | $190,833 | Jb Title | |

| Terry K & Melissa J League | $150,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ferguson John W | $220,000 | |

| Previous Owner | Terry K & Melissa J League | $81,633 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,369 | $115,330 | $17,680 | $97,650 |

| 2023 | $4,369 | $115,330 | $17,680 | $97,650 |

| 2022 | $4,010 | $89,500 | $17,610 | $71,890 |

| 2021 | $4,202 | $89,500 | $17,610 | $71,890 |

| 2020 | $4,118 | $89,500 | $17,610 | $71,890 |

| 2019 | $3,379 | $72,210 | $14,700 | $57,510 |

| 2018 | $3,480 | $72,210 | $14,700 | $57,510 |

| 2017 | $5,777 | $208,570 | $151,060 | $57,510 |

| 2016 | $5,681 | $176,190 | $127,190 | $49,000 |

| 2014 | $5,641 | $176,190 | $127,190 | $49,000 |

| 2013 | $4,125 | $151,060 | $102,060 | $49,000 |

Source: Public Records

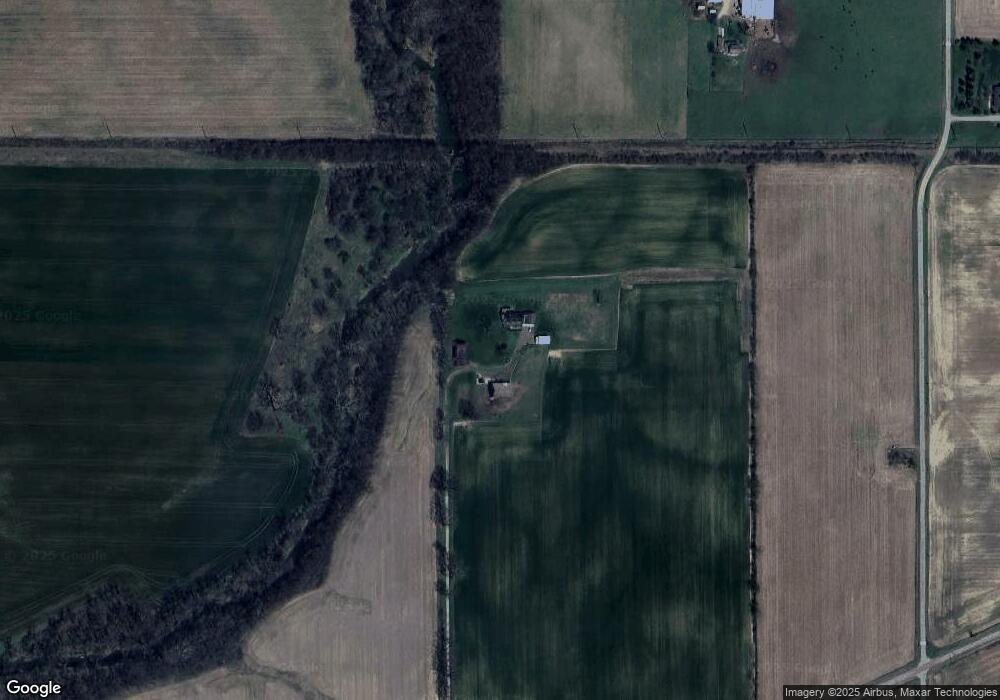

Map

Nearby Homes

- 0 E Scott Unit 942470

- 10995 Rockridge Rd

- 383 Georgetown Verona Rd

- 9923 Euphemia Castine Rd

- 0 Friday Rd

- 6806 Darke-Preble County Line Rd

- 140 State Route 503

- 230 Stephens Rd

- 6254 State Route 722

- 2892 Swishers Mill Rd

- 693 Friday Rd

- 792 W Holtzmuller Rd

- 246 N Main St

- 7337 E Lock Rd

- 610 Pearl St

- 620 Pearl St

- 8486 Us Route 127

- 0 Ohio 722 Unit 10051560

- 0 Ohio 722 Unit 10 Acres 1040185

- 0 Ohio 722 Unit 938536

- 10851 Davis Rd

- 10858 Davis Rd

- 10563 Davis Rd

- 2009 Georgetown Verona Rd

- 10926 Davis Rd

- 10276 Davis Rd

- 1842 E Holtzmuller Rd

- 1964 Georgetown Verona Rd

- 2681 Georgetown Verona Rd

- 12064 Euphemia Castine Rd

- 11669 Euphemia Castine Rd

- 11603 Euphemia Castine Rd

- 10105 Davis Rd

- 11811 Euphemia Castine Rd

- 12143 Euphemia Castine Rd

- 11500 Euphemia Castine Rd

- 11176 Davis Rd

- 12348 Euphemia Castine Rd

- 12388 Euphemia Castine Rd

- 11290 Euphemia Castine Rd