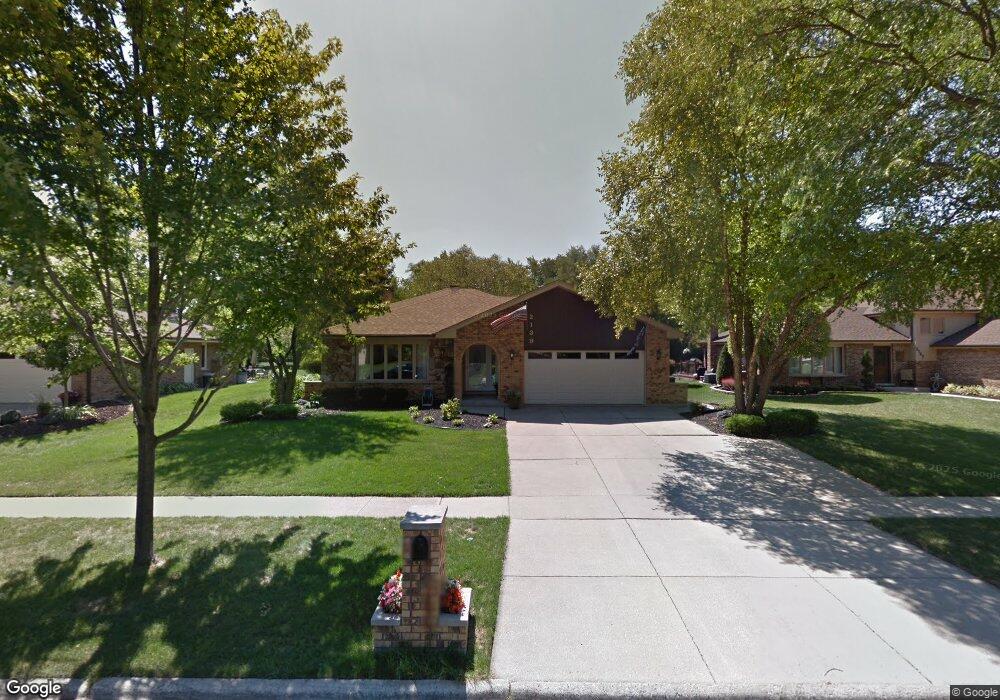

2139 Green Valley Rd Unit 1 Darien, IL 60561

Estimated Value: $525,938 - $559,000

3

Beds

4

Baths

1,642

Sq Ft

$330/Sq Ft

Est. Value

About This Home

This home is located at 2139 Green Valley Rd Unit 1, Darien, IL 60561 and is currently estimated at $541,485, approximately $329 per square foot. 2139 Green Valley Rd Unit 1 is a home located in DuPage County with nearby schools including Prairieview Elementary School, Elizabeth Ide Elementary School, and Lakeview Jr High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 2, 2023

Sold by

Simonetti Joseph S and Simonetti Amy

Bought by

Simonetti Joseph S

Current Estimated Value

Purchase Details

Closed on

Apr 27, 2011

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Simonetti Joseph S and Simonetti Amy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$223,500

Interest Rate

4.81%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 5, 2010

Sold by

Viane Michael

Bought by

Federal Home Loan Mortgage Corp

Purchase Details

Closed on

Jun 16, 2005

Sold by

Viane Michael J and Michael J Viane Declaration Of

Bought by

Viane Michael J and Viane Lisa Ann

Purchase Details

Closed on

May 23, 1997

Sold by

Kuta Julian and Kuta Teresa

Bought by

Viane Michael J and The Michael J Viane Declaratio

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,400

Interest Rate

7.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Simonetti Joseph S | -- | None Listed On Document | |

| Simonetti Joseph S | $224,000 | First American Title | |

| Federal Home Loan Mortgage Corp | -- | None Available | |

| Viane Michael J | -- | -- | |

| Viane Michael J | $248,000 | Intercounty Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Simonetti Joseph S | $223,500 | |

| Previous Owner | Viane Michael J | $198,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,206 | $153,130 | $48,625 | $104,505 |

| 2023 | $8,840 | $140,770 | $44,700 | $96,070 |

| 2022 | $8,580 | $136,330 | $43,570 | $92,760 |

| 2021 | $7,883 | $134,770 | $43,070 | $91,700 |

| 2020 | $7,752 | $132,100 | $42,220 | $89,880 |

| 2019 | $7,498 | $126,750 | $40,510 | $86,240 |

| 2018 | $7,153 | $119,040 | $40,300 | $78,740 |

| 2017 | $6,907 | $114,550 | $38,780 | $75,770 |

| 2016 | $6,582 | $109,320 | $37,010 | $72,310 |

| 2015 | $6,511 | $103,340 | $34,820 | $68,520 |

| 2014 | $6,785 | $106,260 | $33,850 | $72,410 |

| 2013 | $6,854 | $105,760 | $33,690 | $72,070 |

Source: Public Records

Map

Nearby Homes

- 512 Redondo Dr Unit 512

- 512 Redondo Dr Unit 112

- 7769 Danbury Dr

- 7930 Woodglen Ln Unit 204

- 505 Redondo Dr Unit 308

- 505 Redondo Dr Unit 305

- 8000 Woodglen Ln Unit 101

- 7925 Fairmount Ave

- 502 Redondo Dr Unit 503

- 500 Redondo Dr Unit 409

- 500 Redondo Dr Unit 308

- 8100 Woodglen Ln Unit 204

- 2013 Judd St

- 2417 Green Valley Rd

- 7704 Queens Ct

- 2611 Woodmere Dr Unit 24

- 7501 Cambridge Rd

- 2714 Whitlock Dr

- 7517 Main St

- 400 74th St Unit 106

- 2131 Green Valley Rd

- 2123 Green Valley Rd

- 2155 Green Valley Rd

- 2132 Green Valley Rd

- 2140 Green Valley Rd

- 2126 Green Valley Rd

- 2119 Green Valley Rd

- 2163 Green Valley Rd

- 526 Mark Ln

- 522 Mark Ln

- 518 Mark Ln

- 7810 Brompton Dr

- 514 Mark Ln

- 2115 Green Valley Rd

- 7811 Carlton Rd

- 530 Mark Ln

- 2118 Green Valley Rd

- 2201 Green Valley Rd

- 2200 Green Valley Rd

- 510 Mark Ln