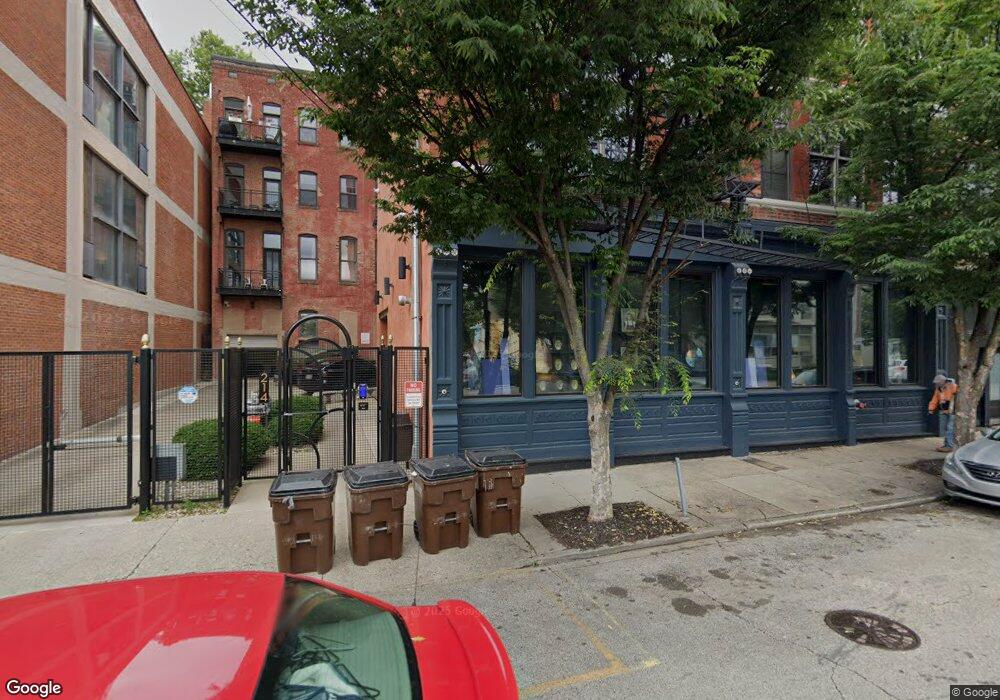

214 E 14th St Unit 2B Cincinnati, OH 45202

Over-The-Rhine NeighborhoodEstimated Value: $358,000 - $486,000

2

Beds

2

Baths

1,518

Sq Ft

$288/Sq Ft

Est. Value

About This Home

This home is located at 214 E 14th St Unit 2B, Cincinnati, OH 45202 and is currently estimated at $437,923, approximately $288 per square foot. 214 E 14th St Unit 2B is a home located in Hamilton County with nearby schools including Rothenberg Preparatory Academy, Robert A. Taft Information Technology High School, and Gilbert A. Dater High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 19, 2018

Sold by

Urban Jeremy and Urban Elizabeth

Bought by

Ross Shannon Bradley and Ross Shannon Tracey M

Current Estimated Value

Purchase Details

Closed on

Dec 30, 2015

Sold by

Mo Shea Holdings Llc

Bought by

Urban Jeremy and Salland Elizabeth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$301,500

Interest Rate

3.93%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 28, 2015

Sold by

Rito John D Fio

Bought by

Moshea Holdings Llc

Purchase Details

Closed on

Sep 16, 2004

Sold by

River City Developers Ltd

Bought by

Rito John D Fio

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$239,694

Interest Rate

5.12%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ross Shannon Bradley | $318,000 | None Available | |

| Urban Jeremy | $335,000 | Parkway Title | |

| Moshea Holdings Llc | $320,000 | Attorney | |

| Rito John D Fio | $299,700 | Chicago Title Insurance Comp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Urban Jeremy | $301,500 | |

| Previous Owner | Rito John D Fio | $239,694 | |

| Closed | Rito John D Fio | $59,924 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2023 | $9,217 | $139,650 | $23,100 | $116,550 |

| 2022 | $7,936 | $111,301 | $22,908 | $88,393 |

| 2021 | $7,631 | $111,301 | $22,908 | $88,393 |

| 2020 | $7,844 | $111,301 | $22,908 | $88,393 |

| 2019 | $8,648 | $117,250 | $19,250 | $98,000 |

| 2018 | $8,642 | $117,250 | $19,250 | $98,000 |

| 2017 | $8,211 | $117,250 | $19,250 | $98,000 |

| 2016 | $8,377 | $111,188 | $6,678 | $104,510 |

| 2015 | $7,500 | $111,188 | $6,678 | $104,510 |

| 2014 | $1,387 | $111,188 | $6,678 | $104,510 |

| 2013 | $1,331 | $104,895 | $6,300 | $98,595 |

Source: Public Records

Map

Nearby Homes

- 214 E 14th St Unit 3B

- 214 E 14th St

- 214 E 14th St Unit 4B

- 214 E 14th St Unit 4A

- 214 E 14th St Unit 5A

- 214 E 14th St Unit 3F

- 214 E 14th St Unit 2A

- 214 E 14th St Unit 5

- 214 E 14th St Unit 3A

- 221 Orchard St

- 219 Orchard St

- 223 Orchard St

- 217 Orchard St

- 215 Orchard St

- 213 Orchard St

- 211 Orchard St

- 1409 Sycamore St

- 209 Orchard St

- 1414 Main St

- 1420 Main St Unit 3E