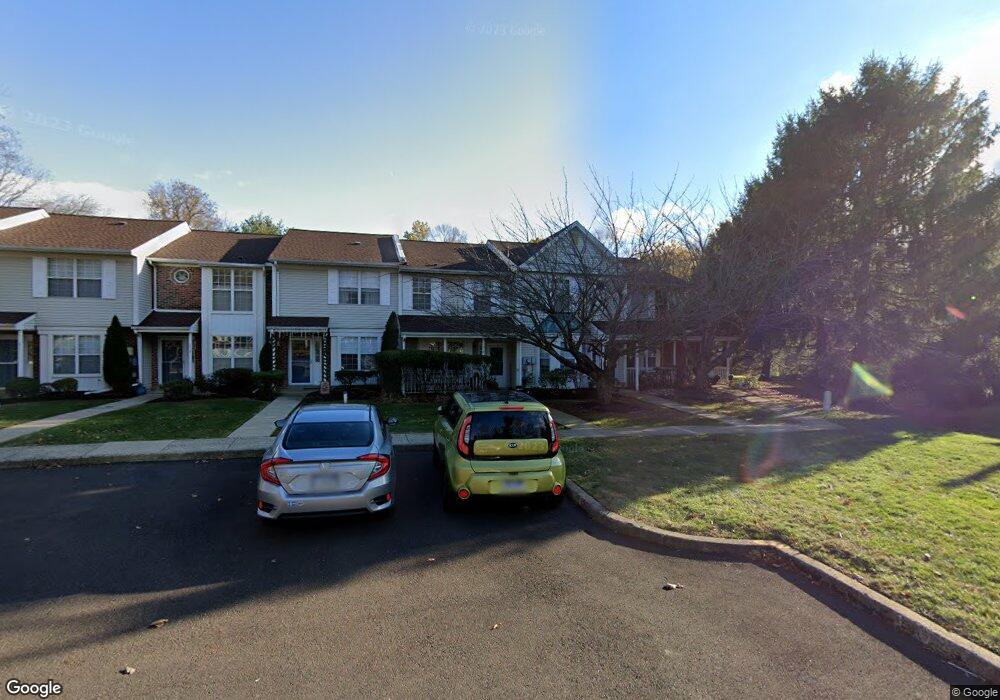

214 Leedom Way Unit 125 Newtown, PA 18940

Estimated Value: $377,972 - $400,000

2

Beds

2

Baths

1,122

Sq Ft

$343/Sq Ft

Est. Value

About This Home

This home is located at 214 Leedom Way Unit 125, Newtown, PA 18940 and is currently estimated at $385,243, approximately $343 per square foot. 214 Leedom Way Unit 125 is a home located in Bucks County with nearby schools including Goodnoe Elementary School, Newtown Middle School, and Council Rock High School North.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 28, 2000

Sold by

Skold Jane K

Bought by

Smith Maj Britt

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,300

Outstanding Balance

$36,445

Interest Rate

7.91%

Mortgage Type

FHA

Estimated Equity

$348,798

Purchase Details

Closed on

Sep 22, 1998

Sold by

Skold Jane K and Skold Britt

Bought by

Skold Jane K

Purchase Details

Closed on

Apr 30, 1998

Sold by

Hickey Susan and Polinsky Susan

Bought by

Skold Jane K and Skold Britt

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,772

Interest Rate

7.03%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 28, 1994

Sold by

Rhoads Richard B and Rhoads Kryston L

Bought by

Hickey Susan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,200

Interest Rate

7.12%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smith Maj Britt | $114,900 | -- | |

| Skold Jane K | -- | -- | |

| Skold Jane K | $99,000 | Lawyers Title Insurance Corp | |

| Hickey Susan | $90,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Smith Maj Britt | $112,300 | |

| Previous Owner | Skold Jane K | $96,772 | |

| Previous Owner | Hickey Susan | $88,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,633 | $20,440 | -- | $20,440 |

| 2024 | $3,633 | $20,440 | $0 | $20,440 |

| 2023 | $3,475 | $20,440 | $0 | $20,440 |

| 2022 | $3,408 | $20,440 | $0 | $20,440 |

| 2021 | $3,355 | $20,440 | $0 | $20,440 |

| 2020 | $3,194 | $20,440 | $0 | $20,440 |

| 2019 | $3,118 | $20,440 | $0 | $20,440 |

| 2018 | $3,059 | $20,440 | $0 | $20,440 |

| 2017 | $2,953 | $20,440 | $0 | $20,440 |

| 2016 | $2,933 | $20,440 | $0 | $20,440 |

| 2015 | -- | $20,440 | $0 | $20,440 |

| 2014 | -- | $20,440 | $0 | $20,440 |

Source: Public Records

Map

Nearby Homes

- 163 Leedom Way Unit 25

- 210 E Hanover St

- 4 Westwood Ct

- 48 Old Mill Ln

- 21 Tree Bark Ln

- 104 Cornell Rd

- 29 Tree Bark Ln

- 23 Brianna Rd

- 1016 Diamond Dr Unit 1016

- 66 Nathaniel Rd

- 102 Keenan Ln

- 180 Independence Dr

- 8 Dunham Ln

- 10014 Beacon Hill Dr Unit 7

- 3231 Durham Place

- 226 Court St

- 281 E Village Rd

- 327 Hale Dr Unit 801A

- 113 Thorton Ln

- 22 Penn St

- 215 Leedom Way Unit 124

- 213 Leedom Way Unit 126

- 216 Leedom Way Unit 123

- 212 Leedom Way Unit 127

- 211 Leedom Way Unit 128

- 210 Leedom Way

- 224 Leedom Way Unit 104

- 226 Leedom Way Unit 102

- 236 Leedom Way Unit 109

- 223 Leedom Way Unit 105

- 225 Leedom Way Unit 103

- 235 Leedom Way Unit 110

- 222 Leedom Way Unit 106

- 242 Leedom Way Unit 120

- 221 Leedom Way Unit 107

- 206 Leedom Way Unit 130

- 243 Leedom Way Unit 119

- 234 Leedom Way Unit 111

- 220 Leedom Way Unit 108

- 233 Leedom Way Unit 112