214 Lloyd St Williamston, MI 48895

Estimated Value: $217,000 - $227,821

3

Beds

1

Bath

1,000

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 214 Lloyd St, Williamston, MI 48895 and is currently estimated at $221,955, approximately $221 per square foot. 214 Lloyd St is a home located in Ingham County with nearby schools including Williamston Discovery Elementary School, Williamston Explorer Elementary School, and Williamston Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 29, 2010

Sold by

Habitat For Humanity Of Greater Ingham C

Bought by

Pratt Christopher and Pratt Mary

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,550

Outstanding Balance

$48,997

Interest Rate

4.77%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$172,958

Purchase Details

Closed on

Aug 22, 2008

Sold by

Pratt Christopher P and Pratt Mary K

Bought by

Ingham East Habitat For Humanity Inc

Purchase Details

Closed on

Dec 23, 2005

Sold by

Hanes Patrick D and Hanes Susan E

Bought by

Pratt Christopher and Pratt Mary

Purchase Details

Closed on

Aug 19, 2003

Sold by

Pratt Christopher and Pratt Mary

Bought by

Hanes Patrick D

Purchase Details

Closed on

Apr 18, 2002

Sold by

Pratt Thomas R and Pratt Teresa

Bought by

National City Bank Of Michigan Illinois and First Of America Bank Michigan Na

Purchase Details

Closed on

Aug 15, 1994

Sold by

Pratt Tom and Pratt Teresa

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pratt Christopher | $87,200 | Stewart Title Agency | |

| Ingham East Habitat For Humanity Inc | -- | None Available | |

| Pratt Christopher | $4,400 | None Available | |

| Hanes Patrick D | -- | -- | |

| National City Bank Of Michigan Illinois | $41,876 | -- | |

| -- | $20,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Pratt Christopher | $73,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,997 | $0 | $0 | $0 |

| 2024 | $2,802 | $99,200 | $36,500 | $62,700 |

| 2023 | $2,802 | $85,700 | $28,800 | $56,900 |

| 2022 | $2,684 | $74,800 | $25,200 | $49,600 |

| 2021 | $2,892 | $73,300 | $21,000 | $52,300 |

| 2020 | $2,499 | $68,600 | $21,000 | $47,600 |

| 2019 | $2,417 | $62,900 | $16,600 | $46,300 |

| 2018 | $2,374 | $55,200 | $16,400 | $38,800 |

| 2017 | $2,304 | $54,200 | $14,700 | $39,500 |

| 2016 | -- | $53,400 | $14,700 | $38,700 |

| 2015 | -- | $45,500 | $20,478 | $25,022 |

| 2014 | -- | $41,300 | $22,054 | $19,246 |

Source: Public Records

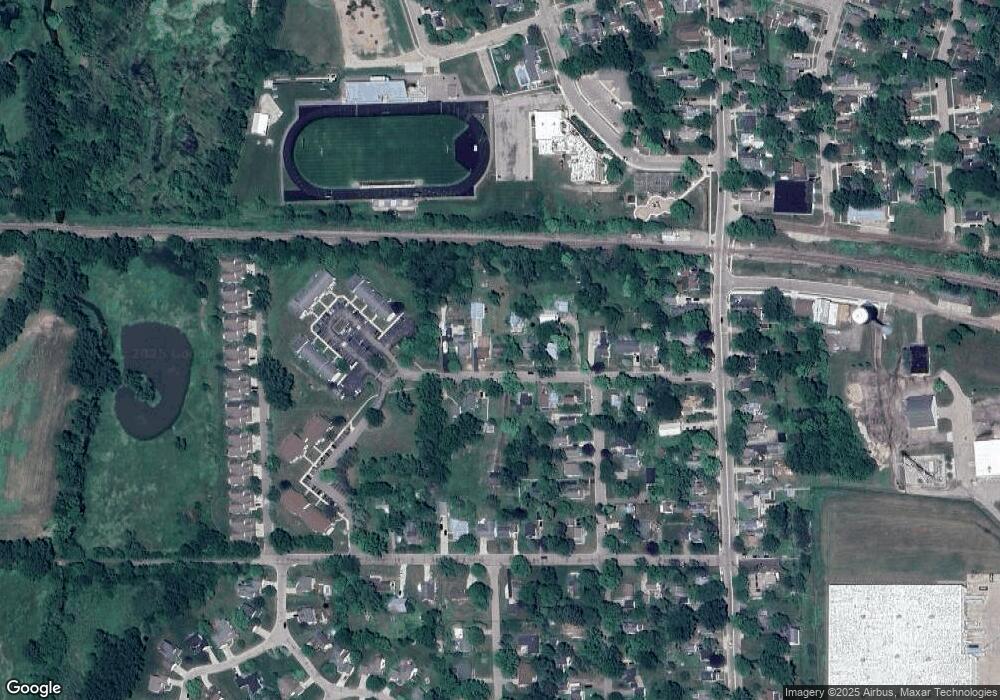

Map

Nearby Homes

- 131 W South St

- 402 Crossman St

- 1106 Cobblestone Ct

- 1544 Nottingham Forest Trail #63

- 1532 Lytell Johne's Path #77

- 540 W Grand River Ave

- 875 W Grand River Ave Unit 29

- 875 W Grand River Ave Unit 35

- 529 High St

- 133 E Riverside St

- 926 W Grand River Ave

- 610 E Church St

- 111 Block St

- 1108 W Maide Marian's Ct

- 1112 W Maide Marian's Ct

- 0 Linn Rd Unit 291462

- 482 Red Cedar Blvd

- 451 Red Cedar Blvd

- 508 Red Cedar Blvd

- 526 Red Cedar Blvd

- 208 Lloyd St

- 228 Lloyd St

- 220 Lloyd St

- 204 Lloyd St

- 221 Lloyd St

- 227 Lloyd St

- 205 Lloyd St

- 704 Georgia St

- 231 Lloyd St

- 710 Georgia St

- 136 Lloyd St

- 1163 W Maide Marian's Ct Unit 25

- 1163 W Maide Marian's Court #25

- 714 Georgia St

- 716 Georgia St

- 0 Harris Sherwood (Parcel) A Rd Unit 269414

- S Putnam St

- 130 Lloyd St

- 215 Lloyd St

- 131 Lloyd St