2150 N Mccord Rd Unit 102F Toledo, OH 43615

Estimated Value: $43,000 - $127,000

2

Beds

1

Bath

836

Sq Ft

$96/Sq Ft

Est. Value

About This Home

This home is located at 2150 N Mccord Rd Unit 102F, Toledo, OH 43615 and is currently estimated at $79,891, approximately $95 per square foot. 2150 N Mccord Rd Unit 102F is a home located in Lucas County with nearby schools including Dorr Street Elementary School, Springfield Middle School, and Springfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 11, 2022

Sold by

Old Venetian Llc

Bought by

Venetian Woods Investors Llc

Current Estimated Value

Purchase Details

Closed on

Oct 2, 2017

Sold by

Kmar Llc

Bought by

Trinicap Properties 8 Llc

Purchase Details

Closed on

Nov 22, 2006

Sold by

Ewing John B and Ewing Elizabeth A

Bought by

Kmar Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$25,600

Interest Rate

6.41%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 10, 1999

Sold by

Jayanti Venkantesan Kalpathy and Venkatesan Kalpathy

Bought by

Ewing John B and Ewing Elizabeth A

Purchase Details

Closed on

Nov 6, 1992

Sold by

Bobak Susan J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Venetian Woods Investors Llc | -- | Frost Brown Todd Llc | |

| Trinicap Properties 8 Llc | $123,500 | None Available | |

| Kmar Llc | $32,000 | Attorney | |

| Ewing John B | $26,900 | Northwest Title Agency Of Oh | |

| -- | $25,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kmar Llc | $25,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $456 | $13,930 | $1,190 | $12,740 |

| 2023 | $709 | $9,275 | $910 | $8,365 |

| 2022 | $703 | $9,275 | $910 | $8,365 |

| 2021 | $613 | $9,275 | $910 | $8,365 |

| 2020 | $678 | $8,610 | $910 | $7,700 |

| 2019 | $664 | $8,610 | $910 | $7,700 |

| 2018 | $716 | $8,610 | $910 | $7,700 |

| 2017 | $772 | $9,485 | $875 | $8,610 |

| 2016 | $779 | $27,100 | $2,500 | $24,600 |

| 2015 | $777 | $27,100 | $2,500 | $24,600 |

| 2014 | $684 | $9,490 | $880 | $8,610 |

| 2013 | $684 | $9,490 | $880 | $8,610 |

Source: Public Records

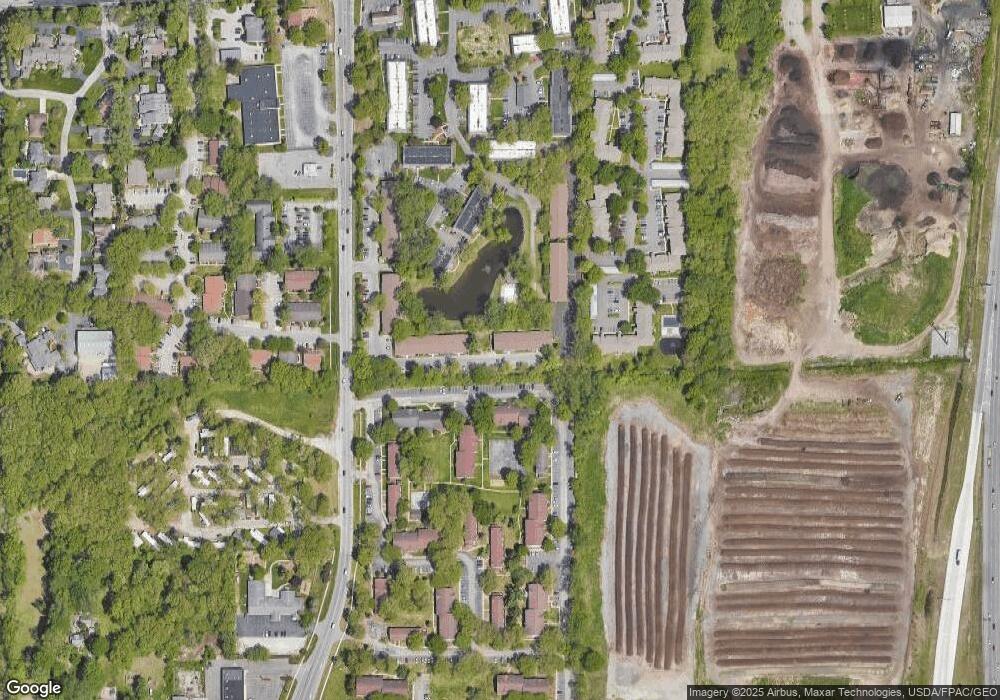

Map

Nearby Homes

- 6820 Cloister Ct Unit 6820

- 6952 Leicester Rd

- 1802 Deer Trail Dr

- 1032 Saturn Dr

- 1128 Plum Grove Ln

- 1714 Deer Trail Dr

- 1715 Brooklynn Park W

- 1053 Plum Grove Ln

- 6616 Elmer Dr

- 1985 Oakhaven Rd

- 6968 Shooters Hill Rd

- 6843 Kristi Lynne Ln

- 2015 Oakside Rd

- 2010 Oakside Rd

- 2004 Oakside Rd

- 2515 Orchard Hills Blvd

- 1709 Acorn Dr

- 6850 Kristi Lynne Ln

- 2150 Fieldbrook Dr

- 1911 N Holland Sylvania Rd

- 2150 N Mccord Rd Unit 46

- 2150 N Mccord Rd Unit 109F

- 2150 N Mccord Rd Unit 108

- 2150 N Mccord Rd

- 2150 N Mccord Rd Unit 105F

- 2150 N Mccord Rd

- 2150 N Mccord Rd Unit 101F

- 2150 N Mccord Rd Unit 100F

- 2150 N Mccord Rd Unit 99F

- 2150 N Mccord Rd

- 2150 N Mccord Rd Unit 97F

- 2150 N Mccord Rd Unit 96E

- 2150 N Mccord Rd Unit 95E

- 2150 N Mccord Rd Unit 94E

- 2150 N Mccord Rd Unit 93E

- 2150 N Mccord Rd Unit 91E

- 2150 N Mccord Rd Unit 90E

- 2150 N Mccord Rd Unit 89E

- 2150 N Mccord Rd Unit 87E

- 2150 N Mccord Rd Unit 81E