2164 Swains Lock Ct Point of Rocks, MD 21777

Estimated Value: $383,000 - $422,000

3

Beds

3

Baths

1,360

Sq Ft

$294/Sq Ft

Est. Value

About This Home

This home is located at 2164 Swains Lock Ct, Point of Rocks, MD 21777 and is currently estimated at $399,503, approximately $293 per square foot. 2164 Swains Lock Ct is a home located in Frederick County with nearby schools including Valley Elementary School, Brunswick Middle School, and Brunswick High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 23, 2015

Sold by

Mcqueen Amber R and Taber Amber R

Bought by

Mcqueen Amber R and Mcqueen Steven A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$203,500

Outstanding Balance

$160,280

Interest Rate

3.83%

Mortgage Type

New Conventional

Estimated Equity

$239,223

Purchase Details

Closed on

Oct 21, 2011

Sold by

Ausherman Homes Inc

Bought by

Taber Amber R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,397

Interest Rate

2.75%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 3, 2010

Sold by

Pv I Llc

Bought by

Ausherman Homes Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mcqueen Amber R | -- | Attorney | |

| Taber Amber R | $221,000 | Oakwood Title Llc | |

| Ausherman Homes Inc | $420,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mcqueen Amber R | $203,500 | |

| Closed | Taber Amber R | $215,397 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,298 | $303,667 | -- | -- |

| 2024 | $3,298 | $265,100 | $75,000 | $190,100 |

| 2023 | $3,142 | $263,000 | $0 | $0 |

| 2022 | $3,118 | $260,900 | $0 | $0 |

| 2021 | $2,963 | $258,800 | $75,000 | $183,800 |

| 2020 | $2,963 | $247,533 | $0 | $0 |

| 2019 | $2,832 | $236,267 | $0 | $0 |

| 2018 | $2,725 | $225,000 | $60,000 | $165,000 |

| 2017 | $2,649 | $225,000 | $0 | $0 |

| 2016 | $2,985 | $215,933 | $0 | $0 |

| 2015 | $2,985 | $211,400 | $0 | $0 |

| 2014 | $2,985 | $211,400 | $0 | $0 |

Source: Public Records

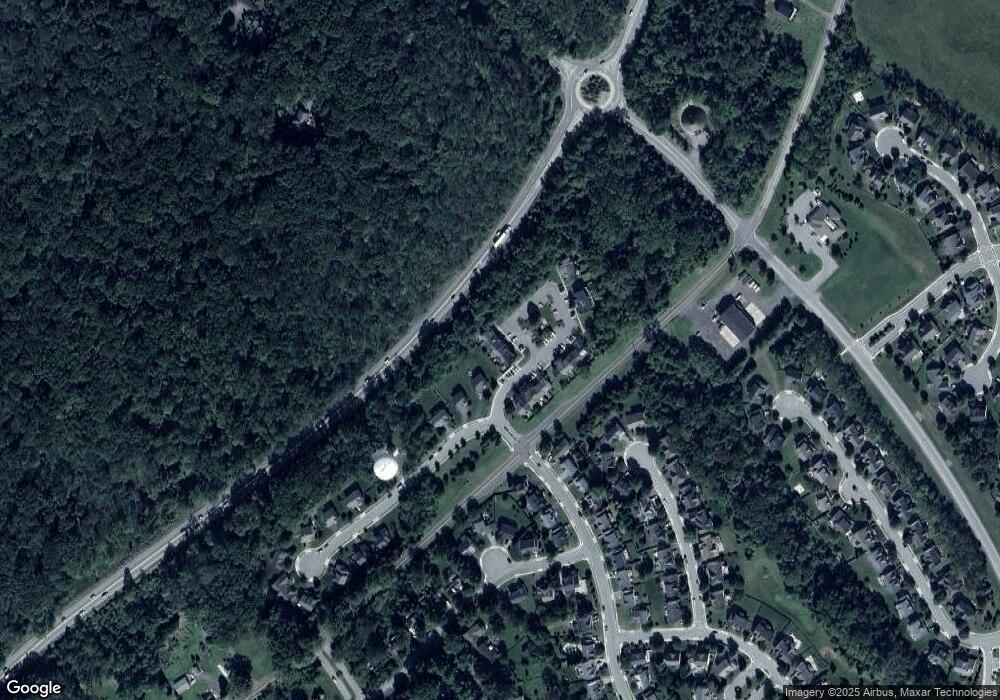

Map

Nearby Homes

- 1734 Fletchers Dr

- 2731 Tuscarora Rd

- 2734 Tuscarora Rd

- 2915 Fry Rd

- 41272 Yakey Ln

- 0 Mary Ln Unit VALO2078558

- 12235 Mary Ln

- 3230 Basford Rd

- 42024 Brightwood Ln

- 41073 Hickory Shade Ln

- 43084 Little Angel Ct

- 43080 Little Angel Ct

- 3450 Basford Rd

- 5510 Doubs Rd

- 2705 Bill Dorsey Blvd

- 2727 Bill Dorsey Blvd

- 00000 Mae Wade Ave

- 1261 New Design Rd

- 5504 Young Family Trail E

- 0000 Modly Ct

- 2162 Swains Lock Ct

- 2166 Swains Lock Ct

- 2168 Swains Lock Ct

- 2160 Swains Lock Ct

- 2170 Swains Lock Ct

- 2016 Cassidy Ct

- 2157 Swains Lock Ct

- 2159 Swains Lock Ct

- 2155 Swains Lock Ct

- 2161 Swains Lock Ct

- 2153 Swains Lock Ct

- 2151 Swains Lock Ct

- 2163 Swains Lock Ct

- 2014 Cassidy Ct

- 2165 Swains Lock Ct

- 0 Swains Lock Ct Unit 1006388248

- 0 Swains Lock Ct Unit FR6802547

- 2167 Swains Lock Ct

- 2171 Swains Lock Ct

- 2173 Swains Lock Ct