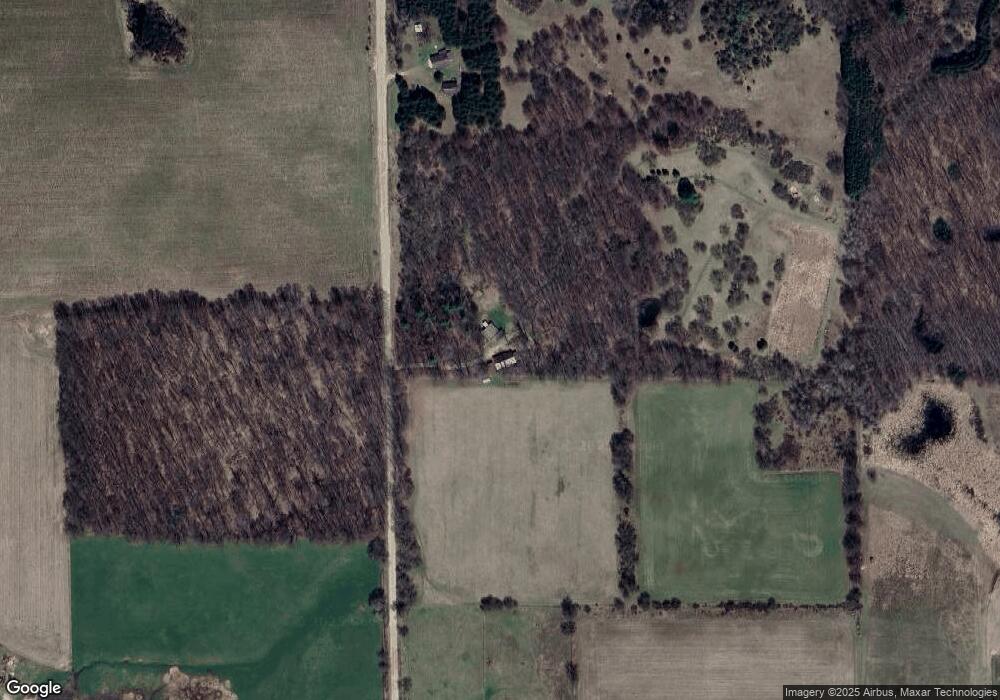

21760 50th Ave Barryton, MI 49305

Estimated Value: $232,000 - $295,000

Studio

--

Bath

--

Sq Ft

1,742,400

Sq Ft Lot

About This Home

This home is located at 21760 50th Ave, Barryton, MI 49305 and is currently estimated at $264,984. 21760 50th Ave is a home located in Mecosta County with nearby schools including Chippewa Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 20, 2022

Sold by

Moore James W and Moore Y

Bought by

Moore James W and Moore Y

Current Estimated Value

Purchase Details

Closed on

Aug 26, 2021

Sold by

Moore James W

Bought by

Moore James W and Mcfadden Jamie Renee

Purchase Details

Closed on

Sep 21, 2015

Sold by

Moore Jamie and Moore Denise

Bought by

Moore James W

Purchase Details

Closed on

Aug 17, 2015

Sold by

Moore Lorraine Kay

Bought by

Moore James W

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Moore James W | -- | -- | |

| Moore James W | -- | None Available | |

| Moore James W | -- | Attorney | |

| Moore James W | -- | Attorney |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $113,000 | $0 | $0 |

| 2024 | -- | $111,000 | $0 | $0 |

| 2023 | -- | $0 | $0 | $0 |

| 2022 | $0 | $87,000 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 22390 Ridge Rd

- 20213 30th Ave

- 3231 Miller Dr

- 3085 Merrill Lake Dr

- 19 Mile Rd

- 156 Stearns St

- 145 S Hudnut St

- 175 S Hudnut St

- 3250 17 Mile Rd

- 275 Negaunee Lake Dr

- 22132 15th Ave

- 506 McLachlan Point

- 17333 Summit Ct

- 17692 Lake Dr

- 17429 Summit Ct

- 17317 Summit St

- 4790 4th St

- 0 West Ave Unit 24046388

- Lot 895 Lake Miramichi Dr

- 00 Pueblo Trail

Your Personal Tour Guide

Ask me questions while you tour the home.