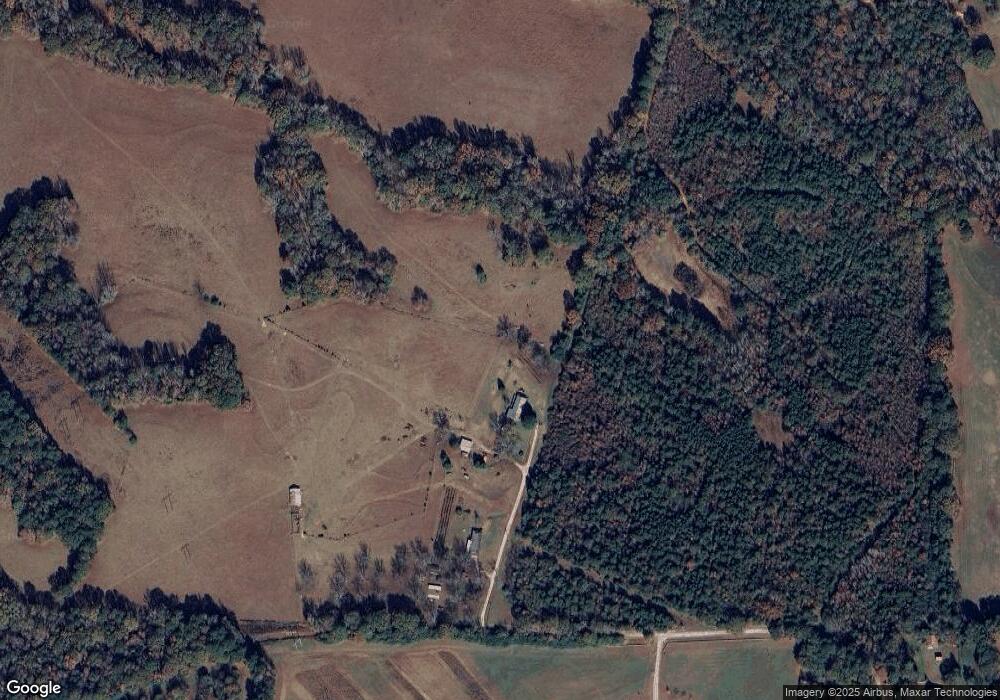

218 Scott Rd Molena, GA 30258

Estimated Value: $266,386 - $334,000

--

Bed

1

Bath

1,640

Sq Ft

$186/Sq Ft

Est. Value

About This Home

This home is located at 218 Scott Rd, Molena, GA 30258 and is currently estimated at $304,462, approximately $185 per square foot. 218 Scott Rd is a home located in Pike County with nearby schools including Pike County Primary School, Pike County Elementary School, and Pike County Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 30, 2008

Sold by

Not Provided

Bought by

Scott David Norton

Current Estimated Value

Purchase Details

Closed on

Jul 10, 2000

Sold by

Scott Martha W and Scott John N

Bought by

Scott David Norton

Purchase Details

Closed on

Mar 24, 1994

Sold by

Scott John N and Scott Martha W

Bought by

Scott David Norton

Purchase Details

Closed on

Dec 13, 1993

Sold by

Scott Wanda Gail Ross

Bought by

Scott David Norton

Purchase Details

Closed on

Sep 7, 1979

Sold by

Scott David N

Bought by

Scott David N and Wanda Gail

Purchase Details

Closed on

Jun 16, 1975

Sold by

Scott Kathleen L

Bought by

Scott David N

Purchase Details

Closed on

Oct 1, 1974

Sold by

Scott John N and Scott Martha W

Bought by

Scott David N and Scott Kathleen L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Scott David Norton | -- | -- | |

| Scott David Norton | -- | -- | |

| Scott David Norton | -- | -- | |

| Scott David Norton | -- | -- | |

| Scott David N | -- | -- | |

| Scott David N | -- | -- | |

| Scott David N | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,223 | $80,406 | $22,400 | $58,006 |

| 2023 | $1,433 | $80,406 | $22,400 | $58,006 |

| 2022 | $1,528 | $73,933 | $22,400 | $51,533 |

| 2021 | $1,531 | $65,101 | $13,568 | $51,533 |

| 2020 | $1,474 | $64,715 | $13,568 | $51,147 |

| 2019 | $1,287 | $53,692 | $13,568 | $40,124 |

| 2018 | $1,285 | $53,692 | $13,568 | $40,124 |

| 2017 | $826 | $40,629 | $13,568 | $27,061 |

| 2016 | $754 | $40,629 | $13,568 | $27,061 |

| 2015 | $706 | $40,629 | $13,568 | $27,061 |

| 2014 | $857 | $40,629 | $13,568 | $27,061 |

| 2013 | -- | $40,628 | $13,568 | $27,060 |

Source: Public Records

Map

Nearby Homes

- 8272 Old Zebulon Rd

- 1044 Union School Rd

- 102 +/- ACRES - Old Zebulon Rd

- 3940 Highway 18

- 3940 Georgia 18

- 50 Judy Ct

- 2386 Smyrna Church Rd

- 3115 Old Lifsey Springs Rd

- 3197 Old Lifsey Springs Rd

- 3243 Old Lifsey Springs Rd

- 4326 Ga Highway 109

- 667 Hamilton Rd

- 0 Collier Rd Unit 25031854

- 0 Collier Rd Unit 10493888

- 0 Bagwell Rd Unit 10511111

- 0 W Fossett Rd Unit 10629253

- 392 Georgia 74

- 1138 Smyrna Church Rd

- 948 Smyrna Church Rd

- 0 Ga Hwy 18 Unit 223299

- 33 Scott Rd

- S Madden Bridge Rd

- 81 Madden Bridge Rd

- 319 Madden Bridge Rd

- 150 Madden Bridge Rd

- 114 Madden Bridge Rd

- 8326 Old Zebulon Rd

- 6761 Old Zebulon Rd

- 0 Madden Bridge Rd Unit 2&3 8360415

- 8367 Old Zebulon Rd

- 8543 Old Zebulon Rd

- 8755 Old Zebulon Rd

- 63 New Rd

- 8919 Old Zebulon Rd

- 69 New Rd

- 1650 N Madden Bridge Rd

- 1600 N Madden Bridge Rd

- 285 New Rd

- 364 New Rd Unit 5

- 1373 N Madden Bridge Rd