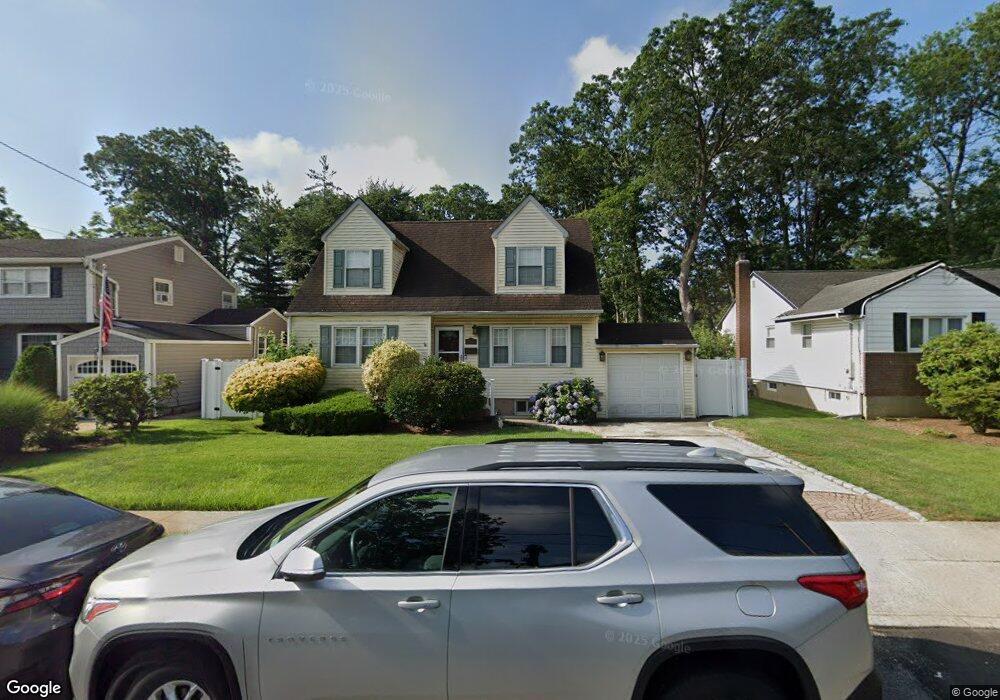

2182 Redmond Rd Merrick, NY 11566

Estimated Value: $914,185 - $948,000

Studio

2

Baths

2,442

Sq Ft

$381/Sq Ft

Est. Value

About This Home

This home is located at 2182 Redmond Rd, Merrick, NY 11566 and is currently estimated at $931,093, approximately $381 per square foot. 2182 Redmond Rd is a home located in Nassau County with nearby schools including Grand Avenue Middle School, Wellington C Mepham High School, and Sacred Heart School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 18, 2011

Sold by

Rettino Augustino M

Bought by

Prill Keith and Prill Marie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$376,000

Outstanding Balance

$257,084

Interest Rate

4.38%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$674,009

Purchase Details

Closed on

Nov 22, 2004

Sold by

Carter Joseph

Purchase Details

Closed on

Jan 24, 2002

Purchase Details

Closed on

Feb 25, 1997

Sold by

Karen Sheliney

Bought by

Carter Joseph G and Regine Anguelline M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Prill Keith | $470,000 | -- | |

| Prill Keith | $470,000 | -- | |

| Prill Keith | $470,000 | -- | |

| Prill Keith | $470,000 | -- | |

| -- | $140,000 | -- | |

| -- | $140,000 | -- | |

| -- | -- | -- | |

| -- | -- | -- | |

| Carter Joseph G | $156,500 | -- | |

| Carter Joseph G | $156,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Prill Keith | $376,000 | |

| Closed | Prill Keith | $376,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $14,821 | $562 | $243 | $319 |

| 2024 | $3,977 | $587 | $254 | $333 |

Source: Public Records

Map

Nearby Homes

- 526 Park Ave

- 1563 Stevens Ave

- 2360 Hamilton Rd

- 1448 Dewey Ave

- 1346 Bellmore Ave

- 37 Orchard St

- 1399 Bellmore Ave

- 1531 Merrick Ave

- 25 Old Mill Rd

- 1680 Lake Ave

- 2046 Hancock Ave

- 204 Maeder Ave

- 1974 Monroe Ave

- 1415 Rhode Ave

- TBD Camp Ave

- 2510 Haff Ave

- 2 Garfield St

- 45 Richard Ave

- 1617 Richard Ave

- 1817 Gardenia Ave

- 2184 Redmond Rd

- 2176 Redmond Rd

- 2192 Redmond Rd

- 79 Whittier Ave

- 58 Van Nostrand Ave

- 62 Van Nostrand Ave

- 54 Van Nostrand Ave

- 2162 Redmond Rd

- 1407 Whittier Ave

- 66 Van Nostrand Ave

- 2201 Van Nostrand Ave

- 2200 Redmond Rd

- 148 Taft Ave

- 83 Whittier Ave

- 2195 Redmond Rd

- 2163 Redmond Rd

- 85 Whittier Ave

- 2206 Redmond Rd

- 144 Taft Ave

- 1359 Taft Ave

Your Personal Tour Guide

Ask me questions while you tour the home.