21857 Yellow Finch Ln Frankfort, IL 60423

North Frankfort NeighborhoodEstimated Value: $683,970 - $831,000

4

Beds

4

Baths

3,054

Sq Ft

$246/Sq Ft

Est. Value

About This Home

This home is located at 21857 Yellow Finch Ln, Frankfort, IL 60423 and is currently estimated at $752,493, approximately $246 per square foot. 21857 Yellow Finch Ln is a home located in Will County with nearby schools including Grand Prairie Elementary School, Chelsea Intermediate School, and Hickory Creek Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 10, 2007

Sold by

Great Lakes Bank Na

Bought by

Seibert Scott A and Seibert Shawn L

Current Estimated Value

Purchase Details

Closed on

Mar 29, 2005

Sold by

Marquette Bank

Bought by

Seibert Scott A and Seibert Shawn L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$290,000

Interest Rate

5.71%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Mar 28, 2005

Sold by

Harris Bank Joliet Na

Bought by

Marquette Bank and Trust #15874

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$290,000

Interest Rate

5.71%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Seibert Scott A | -- | None Available | |

| Seibert Scott A | $398,000 | Chicago Title Insurance Co | |

| Marquette Bank | $72,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Seibert Scott A | $290,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $14,826 | $195,126 | $34,656 | $160,470 |

| 2023 | $14,826 | $174,266 | $30,951 | $143,315 |

| 2022 | $12,961 | $158,727 | $28,191 | $130,536 |

| 2021 | $12,229 | $148,496 | $26,374 | $122,122 |

| 2020 | $11,929 | $144,311 | $25,631 | $118,680 |

| 2019 | $11,548 | $140,449 | $24,945 | $115,504 |

| 2018 | $11,347 | $136,411 | $24,228 | $112,183 |

| 2017 | $11,341 | $133,226 | $23,662 | $109,564 |

| 2016 | $11,079 | $128,659 | $22,851 | $105,808 |

| 2015 | $9,580 | $124,128 | $22,046 | $102,082 |

| 2014 | $9,580 | $123,265 | $21,893 | $101,372 |

| 2013 | $9,580 | $124,863 | $22,177 | $102,686 |

Source: Public Records

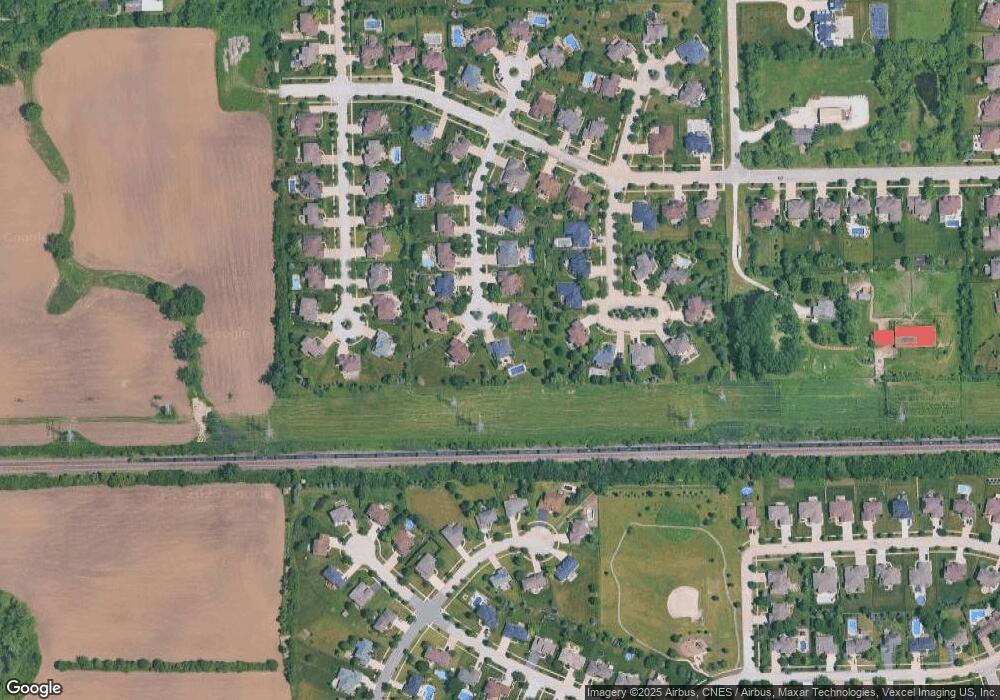

Map

Nearby Homes

- 10785 Ashford Ave

- 10850 W Laraway Rd

- 10993 Pioneer Trail

- 10652 Lexington Ct

- 22151 Clove Dr

- 22125 Jasmine Dr

- 11453 Falls View Way

- 21409 Foxtail Dr

- 21647 S Owens Rd

- 21696 Cappel Ln

- 21629 Kent Ct

- 11668 Misty Creek Ln

- The Aster Plan at Misty Creek

- The Soho Plan at Misty Creek

- 21334 Sage Brush Ln

- 119 Pleasant Hill Ct

- 22018 Mary Dr

- 21359 Saddle Ln

- 21244 Sage Brush Ln

- 481 Pleasant Hill Rd

- 21851 Yellow Finch Ln

- 21882 Blue Bird Ln

- 21856 Yellow Finch Ln

- 21845 Yellow Finch Ln

- 21850 Yellow Finch Ln

- 21866 Blue Bird Ln

- 21892 Blue Bird Ln

- 21844 Yellow Finch Ln

- 21839 Yellow Finch Ln

- 21840 Blue Bird Ln

- 21855 Morning Dove Ln

- 21838 Yellow Finch Ln

- 21849 Morning Dove Ln

- 21895 Blue Bird Ln

- 21831 Yellow Finch Ln

- 21948 Pembrook Dr

- 21936 Pembrook Dr

- 21960 Pembrook Dr

- 21843 Morning Dove Ln

- 21843 Morning Dove Ln