219 Crippled Oak Trail Jasper, GA 30143

Estimated Value: $454,000 - $582,000

Studio

3

Baths

1,818

Sq Ft

$287/Sq Ft

Est. Value

About This Home

This home is located at 219 Crippled Oak Trail, Jasper, GA 30143 and is currently estimated at $521,756, approximately $286 per square foot. 219 Crippled Oak Trail is a home located in Pickens County with nearby schools including Tate Elementary School, Pickens County Middle School, and Pickens County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 4, 2021

Sold by

Foresman Eileen M

Bought by

Rich Roger W and Rich Lynda S

Current Estimated Value

Purchase Details

Closed on

Nov 15, 2002

Sold by

Palmer Russel

Bought by

Foresman Eileen M

Purchase Details

Closed on

Nov 23, 1999

Sold by

Junod Martha Joy

Bought by

Palmer Russel and Palmer Carolyn

Purchase Details

Closed on

Jun 15, 1998

Bought by

Junod Martha Joy

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rich Roger W | $430,000 | -- | |

| Foresman Eileen M | $72,000 | -- | |

| Palmer Russel | $40,000 | -- | |

| Junod Martha Joy | $20,000 | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,231 | $178,409 | $38,000 | $140,409 |

| 2024 | $3,531 | $178,409 | $38,000 | $140,409 |

| 2023 | $3,547 | $174,409 | $34,000 | $140,409 |

| 2022 | $3,498 | $174,409 | $34,000 | $140,409 |

| 2021 | $3,800 | $174,409 | $34,000 | $140,409 |

| 2020 | $2,943 | $136,111 | $34,000 | $102,111 |

| 2019 | $3,010 | $136,111 | $34,000 | $102,111 |

| 2018 | $3,039 | $136,111 | $34,000 | $102,111 |

| 2017 | $3,088 | $136,111 | $34,000 | $102,111 |

| 2016 | $3,137 | $136,111 | $34,000 | $102,111 |

| 2015 | $3,064 | $136,111 | $34,000 | $102,111 |

| 2014 | $3,071 | $136,111 | $34,000 | $102,111 |

| 2013 | -- | $136,111 | $34,000 | $102,111 |

Source: Public Records

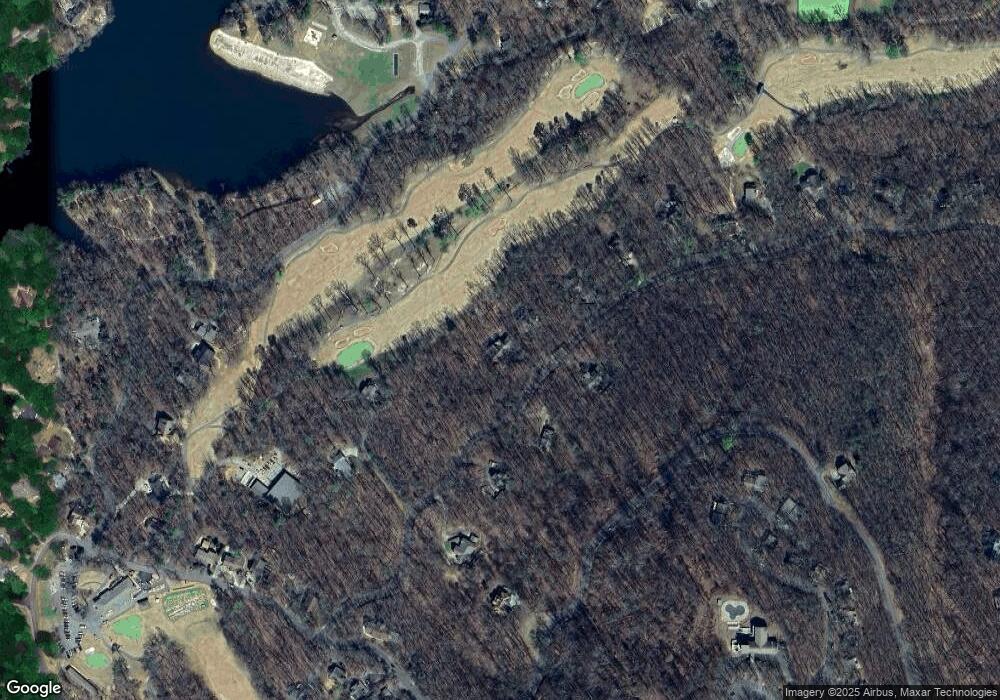

Map

Nearby Homes

- 0 Oak Ct Unit 7679013

- 0 Oak Ct Unit 10640652

- 0 Crippled Oak Trail Unit 7483547

- 0 Crippled Oak Trail Unit 10409950

- 70 Fox Den Cir

- 455 Tamarack Dr

- 200 Villa Rd Unit 126

- 353 Tamarack Dr

- 220 Fox Den Cir

- 3501 Crippled Oak Trail

- 3183 Crippled Oak Trail

- 3366 Crippled Oak Trail

- 264 Fox Den Cir

- 296 Fairview Ct

- 617 Crippled Oak Trail

- 192 Grassy Knob Ct

- 297 Fairview Ct

- 78 Blue Pine Ct

- 298 Lake View Trace

- 300 Fairview Ct

- 225 Crippled Oak Trail

- 231 Crippled Oak Trail

- 226 Crippled Oak Trail Unit A

- LT246 Crippled Oak Trail

- 262 Crippled Oak Trail

- 236 Crippled Oak Trail

- 212 Crippled Oak Trail

- 263 Crippled Oak Trail

- 46 Golf View Ct

- 154 Crippled Oak Trail

- 259 Golf View Ct

- 259 Gold View Ct

- 295 Crippled Oak Trail

- 260 Golf View Ct

- 331 Crippled Oak Trail Unit 20134

- 41 Golf View Ct

- 128 Crippled Oak Trail

- 272 Tamarack Dr

- 515 Tamarack Dr

- 359 Crippled Oak Trail Unit 240

Your Personal Tour Guide

Ask me questions while you tour the home.