22 Azalea Ct Unit 2 Monmouth Junction, NJ 08852

Estimated Value: $525,491 - $557,000

2

Beds

3

Baths

1,684

Sq Ft

$321/Sq Ft

Est. Value

About This Home

This home is located at 22 Azalea Ct Unit 2, Monmouth Junction, NJ 08852 and is currently estimated at $540,873, approximately $321 per square foot. 22 Azalea Ct Unit 2 is a home located in Middlesex County with nearby schools including Monmouth Junction Elementary School, Crossroads North Middle School, and South Brunswick High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 29, 2019

Sold by

Malyska Denise

Bought by

Bhardwaj Ajay and Bhardwaj Anisha

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$268,800

Outstanding Balance

$174,502

Interest Rate

4%

Mortgage Type

New Conventional

Estimated Equity

$366,371

Purchase Details

Closed on

Sep 30, 1999

Sold by

Mccullough Rose

Bought by

Malyska Denise

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$89,900

Interest Rate

7.8%

Purchase Details

Closed on

Jan 9, 1995

Sold by

Hills Southridge

Bought by

Mccullough Ronald and Mccullough Rose

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bhardwaj Ajay | $336,000 | Unitas Title Agency Llc | |

| Malyska Denise | $164,900 | -- | |

| Mccullough Ronald | $124,990 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bhardwaj Ajay | $268,800 | |

| Previous Owner | Malyska Denise | $89,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,633 | $141,300 | $40,000 | $101,300 |

| 2024 | $7,359 | $141,300 | $40,000 | $101,300 |

| 2023 | $7,359 | $141,300 | $40,000 | $101,300 |

| 2022 | $7,140 | $141,300 | $40,000 | $101,300 |

| 2021 | $5,289 | $136,000 | $40,000 | $96,000 |

| 2020 | $6,914 | $136,000 | $40,000 | $96,000 |

| 2019 | $6,977 | $136,000 | $40,000 | $96,000 |

| 2018 | $6,748 | $136,000 | $40,000 | $96,000 |

| 2017 | $6,739 | $136,000 | $40,000 | $96,000 |

| 2016 | $6,668 | $136,000 | $40,000 | $96,000 |

| 2015 | $6,464 | $136,000 | $40,000 | $96,000 |

| 2014 | $6,359 | $136,000 | $40,000 | $96,000 |

Source: Public Records

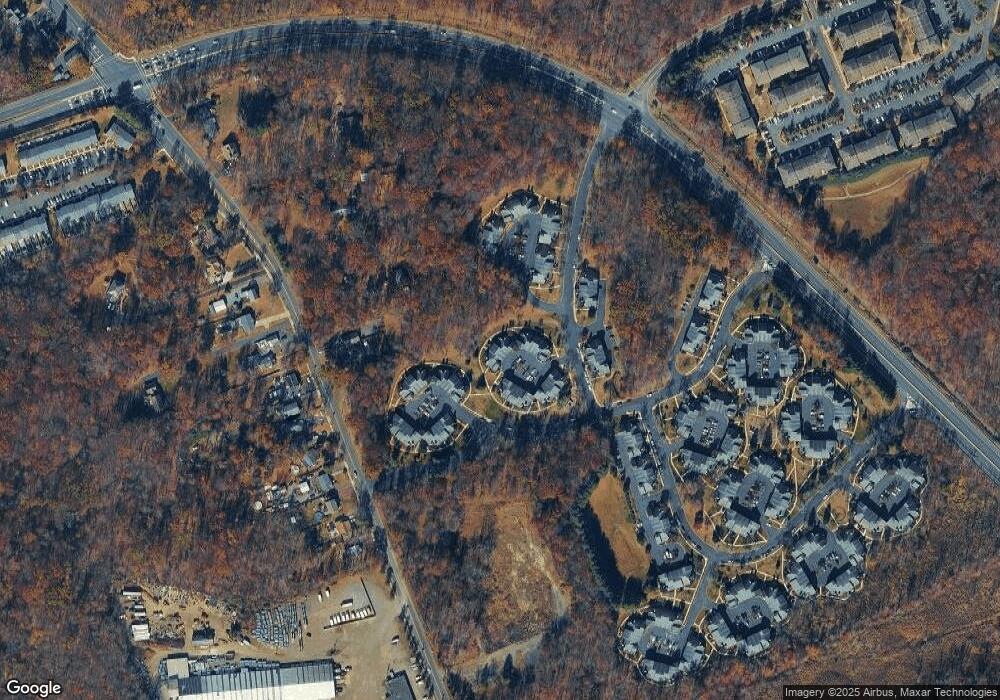

Map

Nearby Homes

- 22 Witch Hazel Ct Unit 2

- 32 Magnolia Ct

- 30 Magnolia Ct

- 209 Gambocz Ct

- 586 Ridge Rd

- 5192 Beech Ct

- 6143 Cedar Ct

- 7041 Elm Ct

- 9 Kearns Place Unit 3805

- 1106 Hickory Ct

- 1111 Hickory Ct

- 4031 Bayberry Ct

- 147 Major Rd

- 2002 Sandlewood Ct

- 1312 Juniper Ct

- 3242 Cypress Ct Unit 3242

- 3011 Cypress Ct

- 45 Old New Rd

- 206 Ash Ct

- 4 Donner Ct