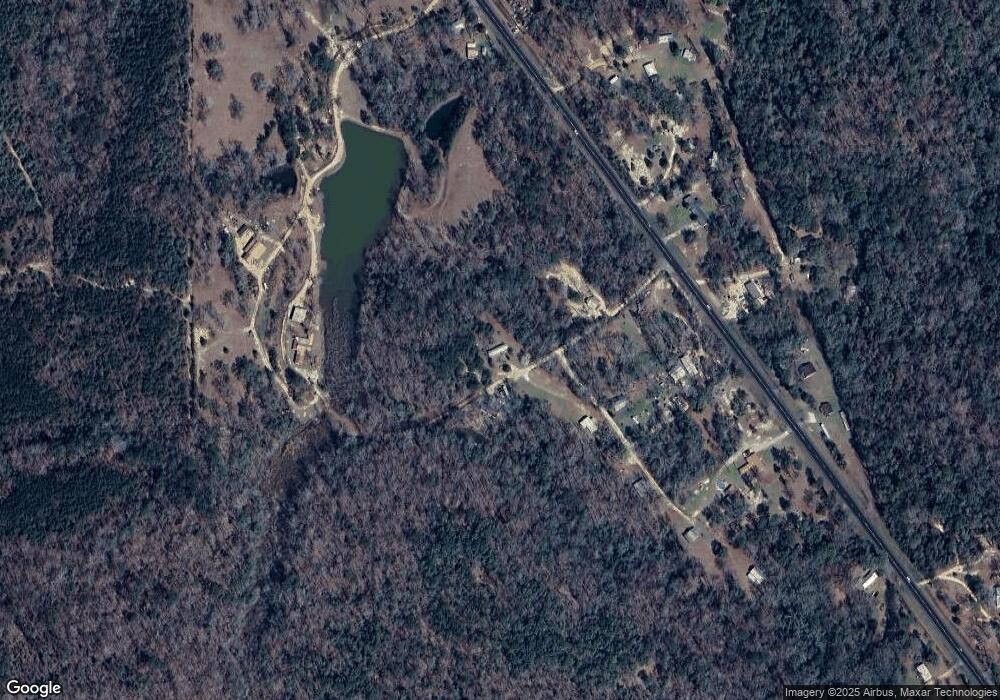

22 Roberts Rd Georgetown, GA 39854

Estimated Value: $72,525 - $134,000

--

Bed

--

Bath

672

Sq Ft

$153/Sq Ft

Est. Value

About This Home

This home is located at 22 Roberts Rd, Georgetown, GA 39854 and is currently estimated at $102,631, approximately $152 per square foot. 22 Roberts Rd is a home with nearby schools including Quitman County Elementary School and Quitman County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 6, 2005

Sold by

Roberts Ricky

Bought by

Geddings Dorothy Langlois

Current Estimated Value

Purchase Details

Closed on

Sep 3, 2003

Sold by

Langlois Joe and Langlois Bever

Bought by

Roberts Ricky

Purchase Details

Closed on

Jun 26, 1997

Sold by

Roberts Roberts D and Roberts Willen

Bought by

Langlois Joe and Langlois Bever

Purchase Details

Closed on

Sep 11, 1992

Sold by

Williams Herman G

Bought by

Roberts Roberts D and Roberts Willen

Purchase Details

Closed on

Jan 1, 1980

Sold by

Myers Magdaline E

Bought by

Williams Herman G

Purchase Details

Closed on

Jan 1, 1979

Sold by

Burton T Eanes

Bought by

Myers Magdaline E

Purchase Details

Closed on

Jan 1, 1901

Bought by

Burton T Eanes

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Geddings Dorothy Langlois | $10,000 | -- | |

| Roberts Ricky | -- | -- | |

| Langlois Joe | $11,000 | -- | |

| Roberts Roberts D | $9,000 | -- | |

| Williams Herman G | $700 | -- | |

| Myers Magdaline E | -- | -- | |

| Burton T Eanes | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $960 | $23,974 | $3,328 | $20,646 |

| 2024 | $960 | $23,974 | $3,328 | $20,646 |

| 2023 | $968 | $23,974 | $3,328 | $20,646 |

| 2022 | $968 | $23,974 | $3,328 | $20,646 |

| 2021 | $369 | $9,320 | $6,206 | $3,114 |

| 2020 | $369 | $9,320 | $6,206 | $3,114 |

| 2019 | $369 | $9,320 | $6,206 | $3,114 |

| 2018 | $298 | $9,320 | $6,206 | $3,114 |

| 2017 | $298 | $9,597 | $6,206 | $3,391 |

| 2016 | $307 | $9,597 | $6,206 | $3,391 |

| 2015 | -- | $9,597 | $6,206 | $3,391 |

| 2014 | -- | $9,597 | $6,206 | $3,391 |

| 2013 | -- | $9,597 | $6,206 | $3,390 |

Source: Public Records

Map

Nearby Homes

- 1794 Georgia 50

- 2036 Georgia 39

- 0 Old 39 Rd Unit 15.69

- 15.69 Old 39 Rd

- 0 Lower Lumpkin Rd

- 0 Lower Lumpkin Rd Unit 10511110

- 15 Bay Ln

- 10 Whip o Will Ln

- 111 Arrowhead Dr

- 102-103 Magnolia Dr

- 0 Jacqueline Dr

- 76 Jacqueline Dr

- 1194 U S Hwy 82-Parcel B

- 2+/- Ac Fawn Dr

- 253 Kaigler Rd

- 00 Georgia 39

- 0 Sandra Dr Unit 10544581

- 0 Sandra Dr Unit 27509

- 330 Georgia 27

- LOT 215 Winding Way Blvd

- 8 Roberts Rd

- 1766 Us Highway 82

- 1755 Us Highway 82

- 1720 Us Highway 82

- 25 Roberts Rd

- 13 Ridgetop Dr

- 1776 Us Highway 82

- 1788 Us Highway 82

- 1775 Us Highway 82

- 1775 Us Highway 82

- 1794 Us Highway 82

- 1692 Georgia 50

- 1692 Us Highway 82

- 273 Old 39 Rd

- 1824 Us Highway 82

- 1824 U S 82

- 1685 Us Highway 82

- 184 Old 39 Rd

- 24 Virginia Dr

- 0 Virginia Dr Unit 20812