22 The Byway Rd Owings Mills, MD 21117

Estimated Value: $299,633 - $329,000

--

Bed

2

Baths

938

Sq Ft

$335/Sq Ft

Est. Value

About This Home

This home is located at 22 The Byway Rd, Owings Mills, MD 21117 and is currently estimated at $313,908, approximately $334 per square foot. 22 The Byway Rd is a home located in Baltimore County with nearby schools including Owings Mills Elementary School, Deer Park Middle Magnet School, and Owings Mills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 1, 2019

Sold by

Julien Janelle D and Sargen Shaun A

Bought by

Julien Janelle D and Sargen Shaun A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$375,715

Outstanding Balance

$334,676

Interest Rate

4.25%

Mortgage Type

FHA

Estimated Equity

-$20,768

Purchase Details

Closed on

Jun 26, 2008

Sold by

Shcherbina Tetyana

Bought by

Flamingo Properties I Llc

Purchase Details

Closed on

Jan 15, 2003

Sold by

Warren Willie

Bought by

Shcherbina Tetyana

Purchase Details

Closed on

Mar 14, 2001

Sold by

Warren Phyllis

Bought by

Warren Willie and Warren Lois M

Purchase Details

Closed on

Dec 29, 2000

Sold by

Warren Willie

Bought by

Warren Phyllis

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Julien Janelle D | -- | White Rose Setmnt Svcs Inc | |

| Flamingo Properties I Llc | -- | -- | |

| Flamingo Properties I Llc | -- | -- | |

| Shcherbina Tetyana | $116,000 | -- | |

| Warren Willie | -- | -- | |

| Warren Phyllis | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Julien Janelle D | $375,715 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,352 | $183,567 | -- | -- |

| 2024 | $2,352 | $167,700 | $63,500 | $104,200 |

| 2023 | $1,165 | $166,133 | $0 | $0 |

| 2022 | $2,281 | $164,567 | $0 | $0 |

| 2021 | $2,093 | $163,000 | $63,500 | $99,500 |

| 2020 | $2,909 | $161,833 | $0 | $0 |

| 2019 | $1,947 | $160,667 | $0 | $0 |

| 2018 | $2,113 | $159,500 | $63,500 | $96,000 |

| 2017 | $1,936 | $151,867 | $0 | $0 |

| 2016 | $2,201 | $144,233 | $0 | $0 |

| 2015 | $2,201 | $136,600 | $0 | $0 |

| 2014 | $2,201 | $136,600 | $0 | $0 |

Source: Public Records

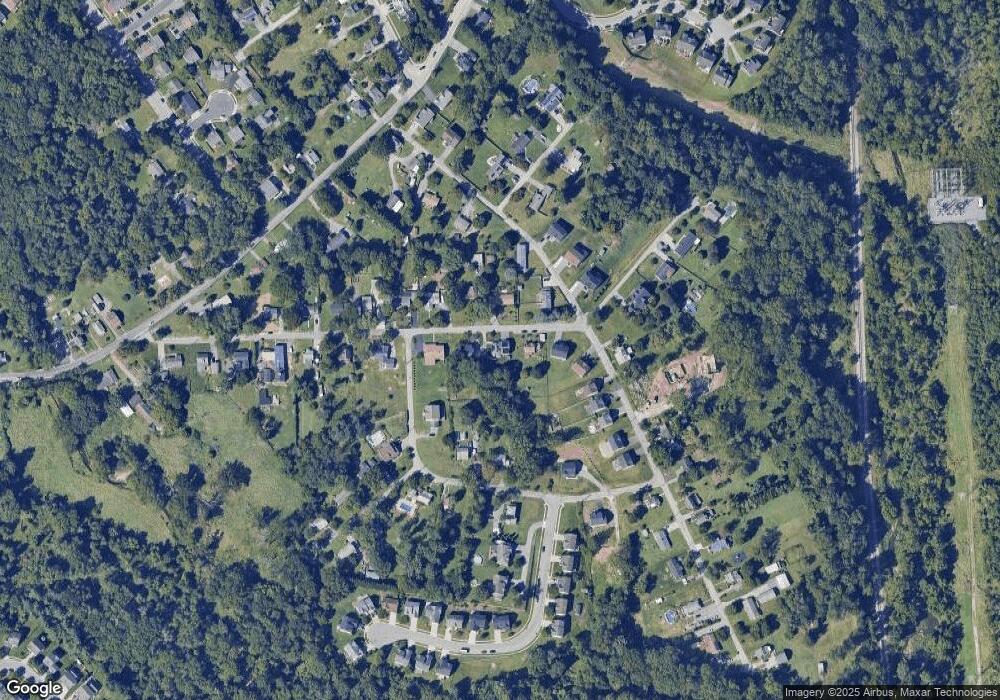

Map

Nearby Homes

- 921 Academy Ave

- 923 Academy Ave

- 21 Samantha Ct

- 25 Samantha Ct

- 970 Joshua Tree Ct

- 37 Blue Sky Dr

- 805 Joshua Tree Ct

- 923A Academy Ave

- 19 Pleasant Hill Rd

- 32 Pleasant Hill Rd

- 610 Academy Ave

- 604 Academy Ave

- 202 Embleton Rd

- 305 Wyndham Cir Unit 305K

- 39 Legacy Dr

- 301 Kearney Dr

- 452 Doe Meadow Dr

- 331 Bryanstone Rd

- 318 Bryanstone Rd

- 156 S Ritters Ln