220 N Fanning Ave Unit 39 Idaho Falls, ID 83401

Estimated Value: $167,000 - $208,000

2

Beds

3

Baths

1,008

Sq Ft

$190/Sq Ft

Est. Value

About This Home

This home is located at 220 N Fanning Ave Unit 39, Idaho Falls, ID 83401 and is currently estimated at $191,035, approximately $189 per square foot. 220 N Fanning Ave Unit 39 is a home located in Bonneville County with nearby schools including Dora Erickson Elementary School, Taylorview Middle School, and Idaho Falls Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 16, 2018

Sold by

Pamer Ryan and Palmer Amanda D

Bought by

Petersen Paul and Peterson Ann Marie

Current Estimated Value

Purchase Details

Closed on

Jul 19, 2012

Sold by

Palmer Ryan and Palmer Amanda D

Bought by

Palmer Amanda D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$66,500

Interest Rate

3.62%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 21, 2007

Sold by

Lecheminant Tommie and Lecheminant Debbie

Bought by

Lecheminant Llc

Purchase Details

Closed on

Nov 21, 2006

Sold by

Lecheminant Debbie

Bought by

Lecheminant Tommie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,500

Interest Rate

6.36%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 19, 2005

Sold by

Mortensen Sterling J and Mortensen Maureen

Bought by

Rhoades Corinne L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,255

Interest Rate

5.84%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Petersen Paul | -- | Amerititle | |

| Palmer Amanda D | -- | First American Title | |

| Palmer Amanda D | -- | First American Title | |

| Lecheminant Llc | -- | None Available | |

| Lecheminant Tommie | -- | -- | |

| Lecheminant Tommie | -- | -- | |

| Rhoades Corinne L | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Palmer Amanda D | $66,500 | |

| Previous Owner | Lecheminant Tommie | $40,500 | |

| Previous Owner | Rhoades Corinne L | $40,255 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,516 | $172,074 | $23,340 | $148,734 |

| 2024 | $1,516 | $166,920 | $16,098 | $150,822 |

| 2023 | $1,558 | $158,112 | $17,242 | $140,870 |

| 2022 | $1,779 | $143,065 | $14,239 | $128,826 |

| 2021 | $1,372 | $100,225 | $14,239 | $85,986 |

| 2019 | $1,378 | $87,891 | $12,057 | $75,834 |

| 2018 | $673 | $76,089 | $10,732 | $65,357 |

| 2017 | $624 | $68,384 | $9,434 | $58,950 |

| 2016 | $611 | $63,749 | $8,651 | $55,098 |

| 2015 | $592 | $60,069 | $8,651 | $51,418 |

| 2014 | $18,122 | $60,069 | $8,651 | $51,418 |

| 2013 | $697 | $66,080 | $8,592 | $57,488 |

Source: Public Records

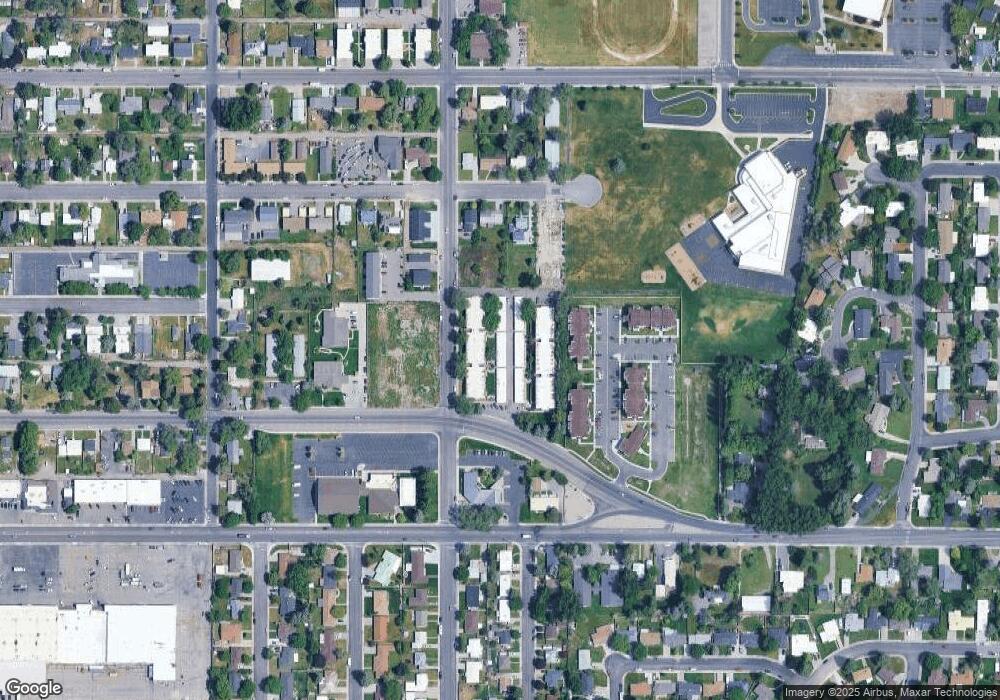

Map

Nearby Homes

- 220 N Fanning Ave Unit 9

- 220 N Fanning Ave Unit 15

- TBD Cleveland St

- 772 Cleveland St

- 110 Chatham Dr

- 798 Garfield St

- 287 Balsam Cir

- 367 N Fanning Ave

- 242 Pinon Dr

- 984 Syringa Dr

- 375 N Freeman Ave

- 270 Linden Dr

- 1108 Halsey St

- 330 Tendoy Dr Unit 2

- TBA Royal Ave

- 145 Tabor Ave

- 1210 Garfield St

- 160 Tabor Ave

- 461 Gladstone St

- 921 E Elva St

- 220 N Fanning Ave Unit 48

- 220 N Fanning Ave Unit 47

- 220 N Fanning Ave Unit 46

- 220 N Fanning Ave Unit 45

- 220 N Fanning Ave Unit 44

- 220 N Fanning Ave Unit 43

- 220 N Fanning Ave Unit 42

- 220 N Fanning Ave Unit 41

- 220 N Fanning Ave Unit 40

- 220 N Fanning Ave Unit 38

- 220 N Fanning Ave Unit 37

- 220 N Fanning Ave Unit 36

- 220 N Fanning Ave Unit 35

- 220 N Fanning Ave Unit 34

- 220 N Fanning Ave Unit 33

- 220 N Fanning Ave Unit 32

- 220 N Fanning Ave Unit 31

- 220 N Fanning Ave Unit 30

- 220 N Fanning Ave Unit 29

- 220 N Fanning Ave Unit 28