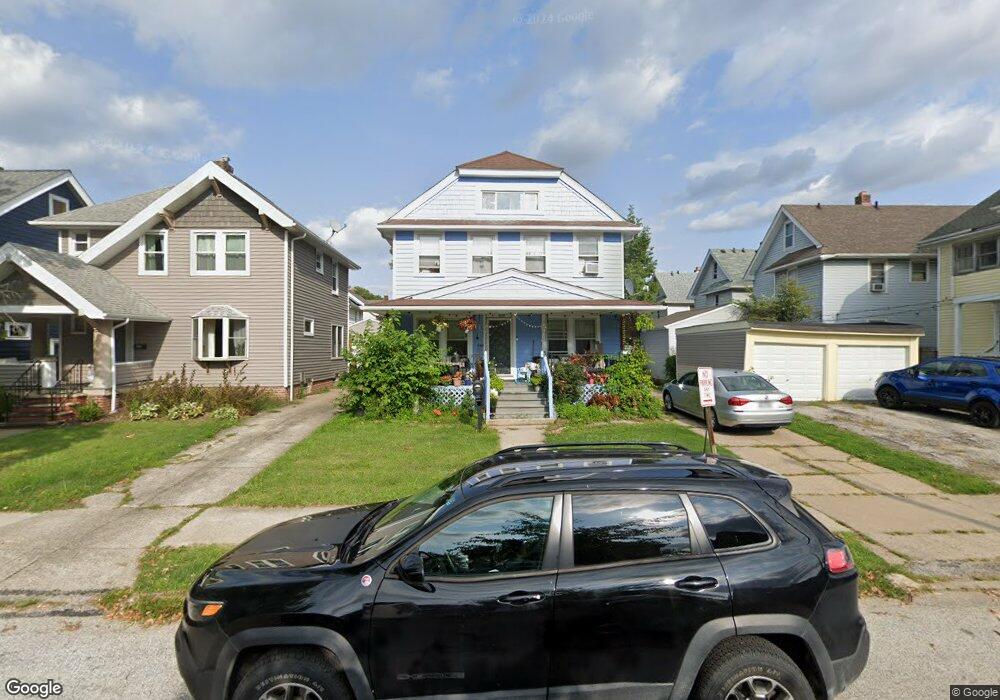

2205 Mars Ave Lakewood, OH 44107

Estimated Value: $280,000 - $333,000

4

Beds

1

Bath

1,283

Sq Ft

$236/Sq Ft

Est. Value

About This Home

This home is located at 2205 Mars Ave, Lakewood, OH 44107 and is currently estimated at $303,390, approximately $236 per square foot. 2205 Mars Ave is a home located in Cuyahoga County with nearby schools including Hayes Elementary School, Harding Middle School, and Lakewood High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 5, 2011

Sold by

Springleaf Financial Services Of Ohio In

Bought by

Suleiman Jaafar S and Suleiman Kefan M

Current Estimated Value

Purchase Details

Closed on

Jan 13, 2011

Sold by

Holliman Christopher D and Holliman Barbara E

Bought by

American General Financial Services Inc

Purchase Details

Closed on

Jun 28, 1996

Sold by

Schill Bessie J

Bought by

Holliman Christopher D and Holliman Barbara E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,800

Interest Rate

8.13%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 30, 1992

Sold by

Mitchell Kathleen T

Bought by

Leonard Kathleen T

Purchase Details

Closed on

Jul 31, 1990

Sold by

Pastorkovich Robert J

Bought by

Mitchell Kathleen T

Purchase Details

Closed on

Sep 19, 1989

Sold by

Mclaughlin James B

Bought by

Pastorvich Joseph M

Purchase Details

Closed on

Mar 17, 1977

Sold by

Middleton George L and L M

Bought by

Mclaughlin James B

Purchase Details

Closed on

Jan 1, 1975

Bought by

Middleton George L and L M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Suleiman Jaafar S | $55,000 | Patriot Land Title | |

| American General Financial Services Inc | $30,000 | Public | |

| Holliman Christopher D | $89,900 | -- | |

| Leonard Kathleen T | -- | -- | |

| Schill Bessie June | $95,700 | -- | |

| Mitchell Kathleen T | $89,000 | -- | |

| Pastorvich Joseph M | $84,500 | -- | |

| Mclaughlin James B | $35,000 | -- | |

| Middleton George L | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Holliman Christopher D | $80,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,247 | $80,115 | $17,360 | $62,755 |

| 2023 | $5,074 | $66,930 | $14,460 | $52,470 |

| 2022 | $5,056 | $66,920 | $14,455 | $52,465 |

| 2021 | $5,004 | $66,920 | $14,460 | $52,470 |

| 2020 | $4,436 | $51,870 | $11,200 | $40,670 |

| 2019 | $4,349 | $148,200 | $32,000 | $116,200 |

| 2018 | $4,132 | $51,870 | $11,200 | $40,670 |

| 2017 | $3,948 | $42,850 | $8,510 | $34,340 |

| 2016 | $3,921 | $42,850 | $8,510 | $34,340 |

| 2015 | $4,637 | $42,850 | $8,510 | $34,340 |

| 2014 | $4,637 | $41,200 | $8,190 | $33,010 |

Source: Public Records

Map

Nearby Homes

- 14924 Delaware Ave

- 2230 Alger Rd

- 2165 Arthur Ave

- 14926 Esther Ave

- 2209 Alger Rd

- 14909 Arden Ave

- 14924 Arden Ave

- 15615 Fernway Ave

- 2263 Warren Rd

- 2234 Olive Ave

- 14428 Delaware Ave

- 3158 W 159th St

- 2239 Woodward Ave

- 2209 Woodward Ave

- 14404 Bayes Ave

- 2099 Olive Ave

- 2223 Eldred Ave

- 15555 Hilliard Rd Unit 401A

- 14426 Alger Rd

- 2078 Baxterly Ave

- 2201 Mars Ave

- 14968 Delaware Ave

- 14972 Delaware Ave

- 2197 Mars Ave

- 14964 Delaware Ave

- 15305 Lanning Ave

- 14960 Delaware Ave

- 15301 Lanning Ave

- 14958 Delaware Ave

- 2206 Mars Ave

- 2189 Mars Ave

- 2208 Mars Ave

- 15297 Lanning Ave

- 14952 Delaware Ave

- 2196 Mars Ave

- 2192 Mars Ave

- 2185 Mars Ave

- 15123 Lanning Ave

- 14948 Delaware Ave

- 15304 Lanning Ave