2205 San Vittorino Cir Unit 107 Kissimmee, FL 34741

Tapestry NeighborhoodEstimated Value: $247,000 - $268,000

4

Beds

3

Baths

1,470

Sq Ft

$174/Sq Ft

Est. Value

About This Home

This home is located at 2205 San Vittorino Cir Unit 107, Kissimmee, FL 34741 and is currently estimated at $256,427, approximately $174 per square foot. 2205 San Vittorino Cir Unit 107 is a home located in Osceola County with nearby schools including Kissimmee Elementary School, Kissimmee Middle School, and Osceola High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 22, 2023

Sold by

Hodge Robert J

Bought by

Rta Property Solutions Llc

Current Estimated Value

Purchase Details

Closed on

Feb 4, 2010

Sold by

Deutsche Bank National Trust Company

Bought by

Hodge Robert J

Purchase Details

Closed on

Nov 2, 2009

Sold by

Malakhov Vladimir and Romero Yulisa

Bought by

Deutsche Bank National Trust Company

Purchase Details

Closed on

Jul 25, 2006

Sold by

Parmer Ramesh Chandra and Parmer Ramila

Bought by

Malakhov Vladimir and Romero Yulisa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$177,600

Interest Rate

7.19%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rta Property Solutions Llc | $300,000 | None Listed On Document | |

| Hodge Robert J | $70,000 | Rels Title | |

| Deutsche Bank National Trust Company | -- | Attorney | |

| Malakhov Vladimir | $222,000 | Watson Title Services Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Malakhov Vladimir | $177,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,560 | $261,600 | -- | $261,600 |

| 2023 | $3,560 | $254,800 | $0 | $254,800 |

| 2022 | $3,112 | $208,600 | $0 | $208,600 |

| 2021 | $2,663 | $148,400 | $0 | $148,400 |

| 2020 | $2,559 | $142,400 | $0 | $142,400 |

| 2019 | $2,376 | $132,300 | $0 | $132,300 |

| 2018 | $2,173 | $118,800 | $0 | $118,800 |

| 2017 | $2,046 | $112,600 | $0 | $112,600 |

| 2016 | $1,897 | $105,200 | $0 | $105,200 |

| 2015 | $1,800 | $100,800 | $0 | $100,800 |

| 2014 | $1,657 | $93,000 | $0 | $93,000 |

Source: Public Records

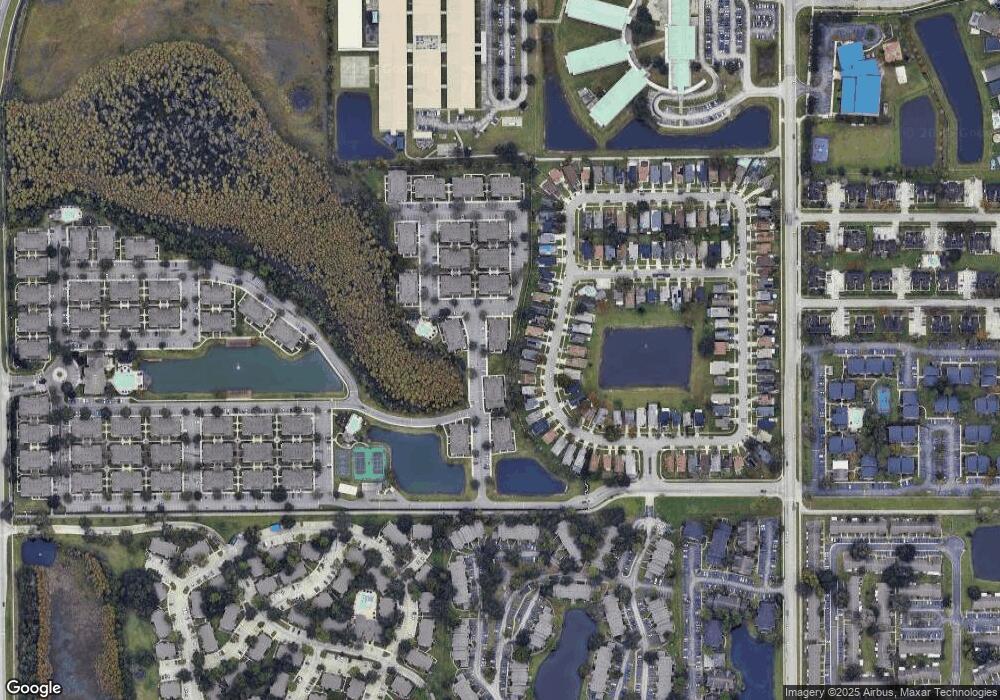

Map

Nearby Homes

- 2208 San Vittorino Cir Unit 107

- 2212 San Vittorino Cir Unit 107

- 2211 San Vittorino Cir Unit 101

- 2211 San Vittorino Cir Unit 103

- 2211 San Vittorino Cir Unit 102

- 2219 San Vittorino Cir Unit 106

- 2213 San Vittorino Cir Unit 106

- 2333 Pebble Brook Rd

- 2203 San Vittorino Cir Unit 108

- 2203 San Vittorino Cir Unit 103

- 2313 Pebble Brook Rd

- 2200 San Vittorino Cir Unit 104

- 4014 Santa Maria Dr Unit 101

- 4012 Santa Maria Dr Unit 102

- 2200 San Zanobi Dr Unit 108

- 2200 San Zanobi Dr Unit 105

- 4010 Santa Maria Dr Unit 106

- 4010 Santa Maria Dr Unit 103

- 4008 San Sabastian Dr Unit 107

- 4008 San Sebastian Dr Unit 105

- 2205 San Vittorino Cir Unit 105

- 2205 San Vittorino Cir Unit 102

- 2205 San Vittorino Cir Unit 101

- 2205 San Vittorino Cir Unit 108

- 2205 San Vittorino Cir Unit 104

- 2205 San Vittorino Cir Unit 103

- 2205 San Vittorino Cir Unit 106

- 2206 San Vittorino Cir Unit 102

- 2206 San Vittorino Cir Unit 106

- 2206 San Vittorino Cir Unit 108

- 2206 San Vittorino Cir Unit 103

- 2206 San Vittorino Cir Unit 107

- 2206 San Vittorino Cir Unit 104

- 2206 San Vittorino Cir Unit 105

- 2206 San Vittorino Cir Unit 101

- 2340 Pebble Brook Rd

- 2344 Pebble Brook Rd

- 2336 Pebble Brook Rd

- 2348 Pebble Brook Rd

- 2332 Pebble Brook Rd