2206 Grant Ct Unit 2206 Norristown, PA 19403

West Norriton Township NeighborhoodEstimated Value: $437,000 - $452,000

4

Beds

3

Baths

2,272

Sq Ft

$196/Sq Ft

Est. Value

About This Home

This home is located at 2206 Grant Ct Unit 2206, Norristown, PA 19403 and is currently estimated at $445,396, approximately $196 per square foot. 2206 Grant Ct Unit 2206 is a home located in Montgomery County with nearby schools including Charles Blockson Middle School, Paul V Fly Elementary School, and East Norriton Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 27, 2012

Sold by

Macalintal Ronaldo B and Macalintal Mercedita G

Bought by

Macalintal Ronaldo B and Macalintal Maria Mercedita G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

3.66%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Oct 17, 2001

Sold by

Martinko James M and Martinko Megan N

Bought by

Macalintal Ronaldo B and Macalintal Mercedita G

Purchase Details

Closed on

Jan 28, 1999

Sold by

Martinko James M and Martinko Megan Ann

Bought by

Martinko James M and Martinko Megan N

Purchase Details

Closed on

Mar 25, 1996

Sold by

Gambone Bros Development Co and Murdoch William B

Bought by

Martinko James M and Noonan Megan Ann

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Macalintal Ronaldo B | -- | None Available | |

| Macalintal Ronaldo B | $177,000 | -- | |

| Martinko James M | -- | -- | |

| Martinko James M | $150,341 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Macalintal Ronaldo B | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,273 | $148,860 | $24,890 | $123,970 |

| 2024 | $7,273 | $148,860 | $24,890 | $123,970 |

| 2023 | $7,191 | $148,860 | $24,890 | $123,970 |

| 2022 | $7,144 | $148,860 | $24,890 | $123,970 |

| 2021 | $7,101 | $148,860 | $24,890 | $123,970 |

| 2020 | $6,889 | $148,860 | $24,890 | $123,970 |

| 2019 | $6,735 | $148,860 | $24,890 | $123,970 |

| 2018 | $5,249 | $148,860 | $24,890 | $123,970 |

| 2017 | $6,358 | $148,860 | $24,890 | $123,970 |

| 2016 | $6,300 | $148,860 | $24,890 | $123,970 |

| 2015 | $5,837 | $148,860 | $24,890 | $123,970 |

| 2014 | $5,837 | $148,860 | $24,890 | $123,970 |

Source: Public Records

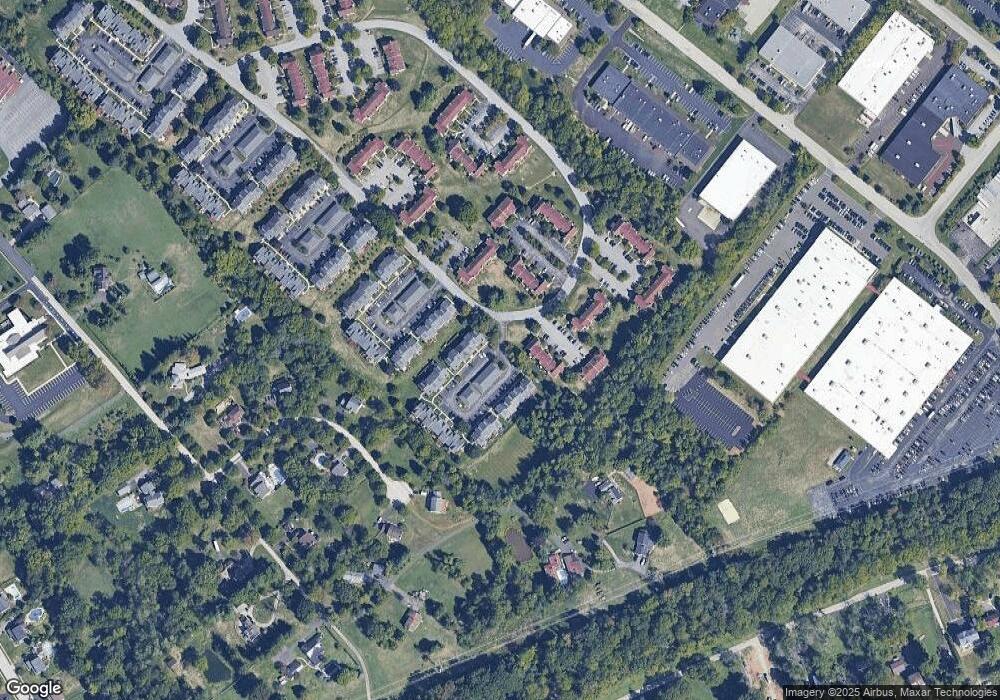

Map

Nearby Homes

- 2504 Grant Ct

- 1503 Reagan Ct

- 365 Norris Hall Ln

- 0 Roosevelt Blvd

- 2447 Hillside Dr

- 2017 Yorktown S

- 2012 Yorktown S

- 526 Bassett Ln

- 548 Susan Dr

- 1914 Yorktown S

- 213 River Trail Cir

- 735 Champlain Dr

- 254 River Trail Cir

- Shannon Plan at River Trail at Valley Forge

- Harper Grand Plan at River Trail at Valley Forge

- Finely II Plan at River Trail at Valley Forge

- 1905 Yorktown N

- 115 River Trail Cir

- 117 River Trail Cir

- 110 Lizabetta Ln Unit 82

- 2205 Grant Ct Unit 22

- 2301 Grant Ct

- 2204 Grant Ct Unit 2204

- 2203 Grant Ct

- 2303 Grant Ct

- 2202 Grant Ct

- 2101 Harrison Ct

- 2102 Harrison Ct Unit 2102

- 2004 Harrison Ct

- 2304 Grant Ct Unit 2304

- 2103 Harrison Ct Unit 2103

- 2201 Grant Ct

- 2003 Harrison Ct Unit 2003

- 2104 Harrison Ct Unit 2104

- 2002 Harrison Ct

- 2105 Harrison Ct

- 2001 Harrison Ct

- 2106 Harrison Ct Unit 2106

- 2401 Grant Ct Unit 2401

- 2402 Grant Ct Unit 2402