221 Yoder St Calhan, CO 80808

Estimated Value: $432,000 - $486,000

3

Beds

2

Baths

1,674

Sq Ft

$274/Sq Ft

Est. Value

About This Home

This home is located at 221 Yoder St, Calhan, CO 80808 and is currently estimated at $457,989, approximately $273 per square foot. 221 Yoder St is a home located in El Paso County with nearby schools including Calhan Elementary School, Calhan Middle School, and Calhan Secondary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 21, 2014

Sold by

Kelly Leon A and Kelly Susan J

Bought by

Egp Properties Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Interest Rate

5%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jun 10, 2005

Sold by

Richard D Young Marital Trust

Bought by

Kelly Leon A and Kelly Susan J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,000

Interest Rate

5.79%

Mortgage Type

Unknown

Purchase Details

Closed on

Jul 27, 1999

Sold by

Gordon Betty L

Bought by

Young Richard D and Young Marjorie R

Purchase Details

Closed on

Jun 3, 1996

Sold by

Gordon Betty L

Bought by

Toney Thomas R and Toney Emma Yolande Jane

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,500

Interest Rate

10%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Egp Properties Llc | $225,000 | Land Title Guarantee Company | |

| Kelly Leon A | $220,000 | -- | |

| Young Richard D | $185,000 | Land Title | |

| Toney Thomas R | $165,000 | Land Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Egp Properties Llc | $125,000 | |

| Previous Owner | Kelly Leon A | $235,000 | |

| Previous Owner | Toney Thomas R | $148,500 | |

| Closed | Toney Thomas R | $6,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,872 | $30,100 | -- | -- |

| 2024 | $1,766 | $28,310 | $7,460 | $20,850 |

| 2022 | $1,454 | $19,020 | $6,450 | $12,570 |

| 2021 | $1,334 | $19,570 | $6,640 | $12,930 |

| 2020 | $1,137 | $16,400 | $5,310 | $11,090 |

| 2019 | $1,021 | $16,400 | $5,310 | $11,090 |

| 2018 | $957 | $15,050 | $5,350 | $9,700 |

| 2017 | $948 | $15,050 | $5,350 | $9,700 |

| 2016 | $960 | $15,250 | $5,620 | $9,630 |

| 2015 | $960 | $15,250 | $5,620 | $9,630 |

| 2014 | $907 | $14,250 | $5,620 | $8,630 |

Source: Public Records

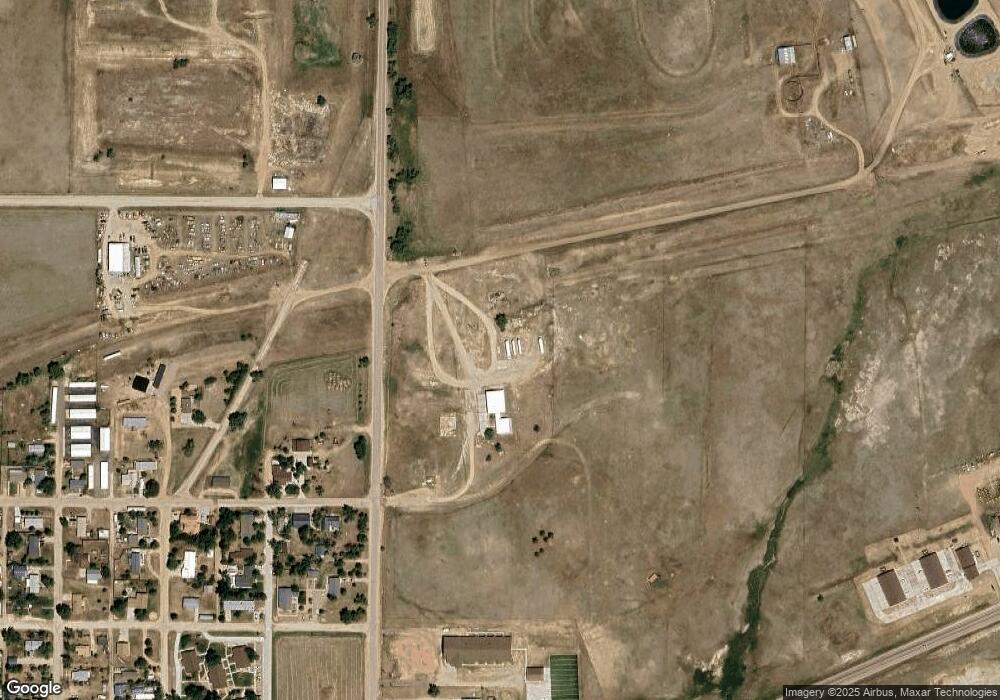

Map

Nearby Homes

- 401 Cheyenne St

- 344 3rd St

- Floresta Plan at Mayberry Village

- Woodlyn Plan at Mayberry Village

- Roseland Plan at Mayberry Village

- Aster Plan at Mayberry Village

- Havenwood Plan at Mayberry Village

- Beacon Plan at Mayberry Village

- Terramar Plan at Mayberry Village

- Bristol Plan at Mayberry Village

- 495 Golden St

- 0000 Judge Orr Rd

- 1049 Denver St

- 1075 8th St

- 11040 N Calhan Hwy

- 1120 Monument St

- 15530 Kanuch Rd

- 12275 N Calhan Hwy

- 29440 Gardetto View

- Parcel 3 Barney Rd