2210 Bridle Path Wisconsin Rapids, WI 54494

Estimated Value: $332,000 - $666,908

--

Bed

--

Bath

--

Sq Ft

0.81

Acres

About This Home

This home is located at 2210 Bridle Path, Wisconsin Rapids, WI 54494 and is currently estimated at $499,454. 2210 Bridle Path is a home located in Wood County with nearby schools including Grove Elementary School, Wisconsin Rapids Area Middle School, and East Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 11, 2013

Sold by

Duellman Todd J and Duellman Terra R

Bought by

Duellman Revocable Trust

Current Estimated Value

Purchase Details

Closed on

Jan 15, 2008

Sold by

South Wood County Ymca

Bought by

Duellman Todd J and Duellman Terra R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,000

Outstanding Balance

$58,058

Interest Rate

5.95%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$441,396

Purchase Details

Closed on

Oct 25, 2007

Sold by

Bama Barn Llc

Bought by

Alexander John E

Purchase Details

Closed on

Dec 31, 2004

Sold by

Paul Terrance D and Paul Judith A

Bought by

Bama Barn Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Duellman Revocable Trust | -- | None Available | |

| Duellman Todd J | $98,000 | Goetz Abstract & Title | |

| Duellman Todd J | $98,000 | -- | |

| Alexander John E | $118,200 | None Available | |

| Alexander South Wood County | $118,200 | -- | |

| Bama Barn Llc | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Duellman Todd J | $93,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $13,571 | $683,400 | $44,500 | $638,900 |

| 2023 | $14,311 | $508,400 | $56,500 | $451,900 |

| 2022 | $14,318 | $508,400 | $56,500 | $451,900 |

| 2021 | $13,948 | $508,400 | $56,500 | $451,900 |

| 2020 | $13,471 | $508,400 | $56,500 | $451,900 |

| 2019 | $13,371 | $508,400 | $56,500 | $451,900 |

| 2018 | $13,131 | $508,400 | $56,500 | $451,900 |

| 2017 | $10,344 | $391,000 | $53,700 | $337,300 |

| 2016 | $10,253 | $391,000 | $53,700 | $337,300 |

| 2015 | $10,200 | $391,000 | $53,700 | $337,300 |

Source: Public Records

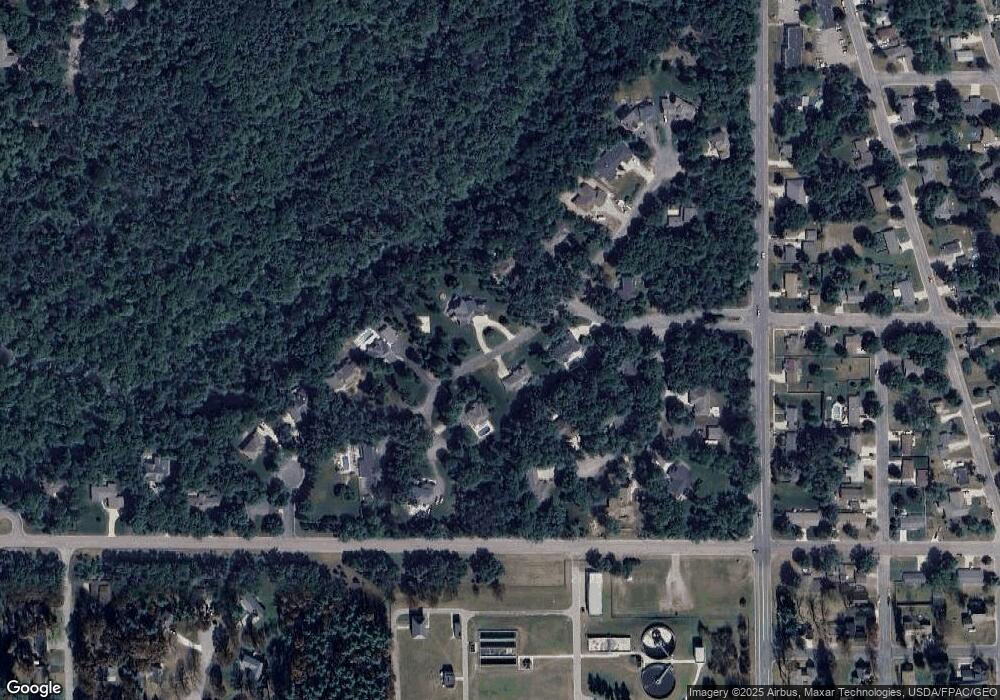

Map

Nearby Homes

- 2020 Bridle Path

- 99 River Ridge Rd

- 2420 2nd St S

- 2720 3rd St S

- 2821 3rd St S

- 240 Lyon St

- 2841 Lincoln St

- 350 Madison St

- 1426 21st Ave S Unit 1426

- 1416 21st Ave S

- 521 Elm St

- 1410 21st Ave S

- 811 Witter St

- 2331 10th St S

- 521 11th Ave S

- 2610 Gaynor Ave

- 435 Maple St

- 540 16th Ave S

- 2511 Boles St

- 3811 Cliff St

- 2220 Bridle Path

- 2130 Bridle Path

- 2221 Bridle Path

- 2230 Bridle Path

- 2211 Bridle Path

- 2120 Bridle Path

- 2311 Bridle Path

- 2310 Bridle Path

- 2110 Bridle Path

- 96 River Ridge Rd

- 97 River Ridge Rd

- 2220 Carriage Ct

- 2321 Bridle Path

- 2121 Bridle Path

- 2111 Bridle Path

- 2320 Bridle Path

- 2320 Carriage Ct

- 2311 River Birch Ln

- 2331 Bridle Path

- 2311 Carriage Ct