222 Plum St Danville, OH 43014

Estimated Value: $186,000

3

Beds

4

Baths

1,588

Sq Ft

$117/Sq Ft

Est. Value

About This Home

This home is located at 222 Plum St, Danville, OH 43014 and is currently estimated at $186,000, approximately $117 per square foot. 222 Plum St is a home located in Knox County with nearby schools including Danville Elementary School, Danville Middle School, and Danville High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 24, 2019

Sold by

Oliver David F

Bought by

Oliver David F

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

3.81%

Purchase Details

Closed on

Jan 4, 2019

Sold by

Oliver Linda

Bought by

Oliver Norman C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

4.51%

Purchase Details

Closed on

Jan 7, 2016

Sold by

Frazee Edith M

Bought by

Oliver Linda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

3.97%

Purchase Details

Closed on

May 16, 2002

Sold by

Truex Donald L and Truex Helen M

Bought by

Frazee Edith M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Oliver David F | $40,000 | -- | |

| Oliver Norman C | -- | -- | |

| Oliver Linda | -- | -- | |

| Frazee Edith M | $85,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Oliver Linda | -- | |

| Previous Owner | Oliver Linda | -- | |

| Previous Owner | Oliver Linda | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $213 | $5,760 | $4,680 | $1,080 |

| 2023 | $213 | $4,680 | $4,680 | $0 |

| 2022 | $160 | $3,710 | $3,710 | $0 |

| 2021 | $160 | $3,710 | $3,710 | $0 |

| 2020 | $151 | $3,710 | $3,710 | $0 |

| 2019 | $1,086 | $25,090 | $5,010 | $20,080 |

| 2018 | $1,092 | $25,090 | $5,010 | $20,080 |

| 2017 | $1,063 | $25,090 | $5,010 | $20,080 |

| 2016 | $982 | $23,230 | $4,640 | $18,590 |

| 2015 | $1,141 | $23,230 | $4,640 | $18,590 |

| 2014 | $986 | $23,230 | $4,640 | $18,590 |

| 2013 | $1,088 | $24,610 | $4,360 | $20,250 |

Source: Public Records

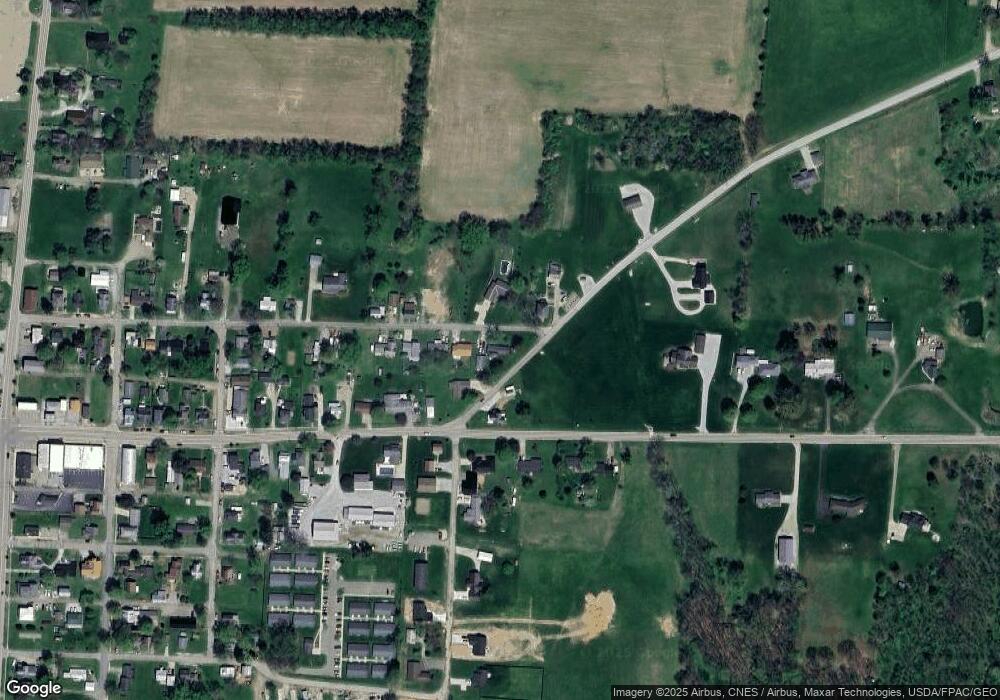

Map

Nearby Homes

- 202 Plum St

- 9 E South St

- 228 E Walnut St

- 102 Cedar St

- 106 W Rambo St

- 14799 Millersburg Rd

- 26367 Danville Amity Rd

- 13617 Millersburg Rd

- 13904 Carey Ln

- 15757 Hunter Rd

- 29575 Hoover Rd

- 13356 Mowery Rd

- 15977 Mohaven Rd

- 0 King Rd Unit 20260021

- 0 King Rd Unit 225019584

- 12275 Humbert Rd

- 0 Grand Valley Dr Unit 20260011

- 0 Westmoreland Dr Unit 225036591

- 0 Westmoreland Dr Unit 20250682

- 817 Highland Hills Dr

Your Personal Tour Guide

Ask me questions while you tour the home.