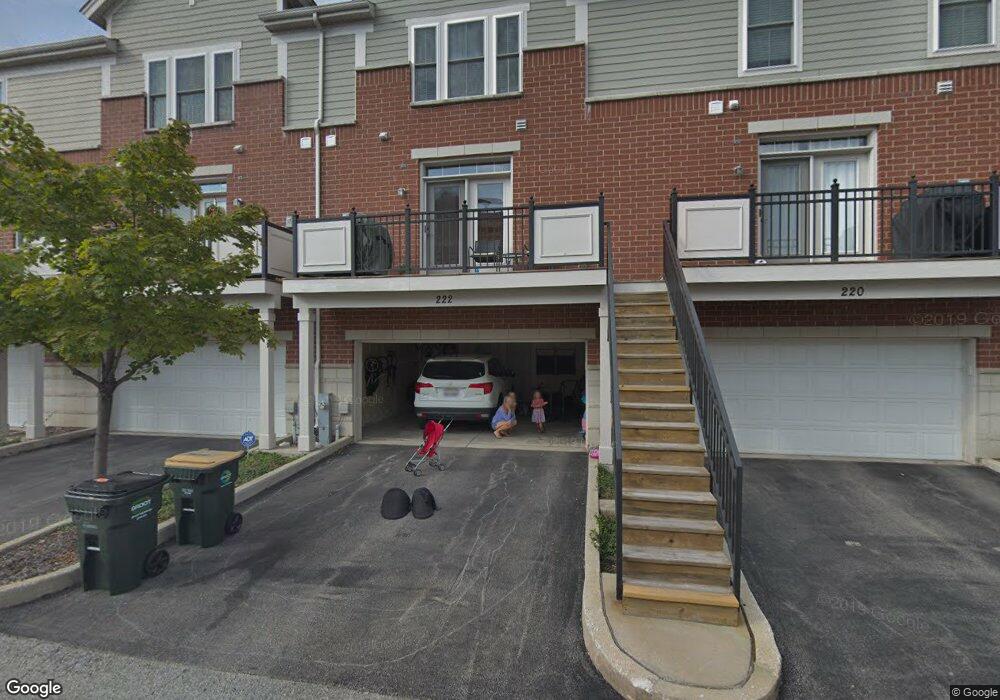

222 W Hyde St Unit 8-2 Arlington Heights, IL 60005

Estimated Value: $412,104 - $480,000

2

Beds

4

Baths

2,025

Sq Ft

$215/Sq Ft

Est. Value

About This Home

This home is located at 222 W Hyde St Unit 8-2, Arlington Heights, IL 60005 and is currently estimated at $434,776, approximately $214 per square foot. 222 W Hyde St Unit 8-2 is a home located in Cook County with nearby schools including Holmes Jr High School, Juliette Low Elementary School, and Rolling Meadows High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 19, 2021

Sold by

Chanthaboury Nikhob and Hedrick Lindsey

Bought by

Chanthaboury Nikhop and Hedrick Lindsey

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$267,000

Outstanding Balance

$240,500

Interest Rate

3.25%

Mortgage Type

New Conventional

Estimated Equity

$194,276

Purchase Details

Closed on

Mar 27, 2019

Sold by

Kuchar Kevin and Knurr Gina

Bought by

Chanthaboury Nikhob and Hedrick Lindsey

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$269,175

Interest Rate

4.87%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 25, 2010

Sold by

Lennar Communities Of Chicago Llc

Bought by

Knurr Gina and Kuchar Kevin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$299,450

Interest Rate

4.5%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chanthaboury Nikhop | -- | Novas Title Company Llc | |

| Chanthaboury Nikhob | $277,500 | Fidelity National Title Ins | |

| Knurr Gina | $305,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chanthaboury Nikhop | $267,000 | |

| Closed | Chanthaboury Nikhob | $269,175 | |

| Previous Owner | Knurr Gina | $299,450 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,372 | $28,501 | $4,127 | $24,374 |

| 2023 | $7,034 | $28,501 | $4,127 | $24,374 |

| 2022 | $7,034 | $28,501 | $4,127 | $24,374 |

| 2021 | $7,379 | $26,111 | $2,708 | $23,403 |

| 2020 | $7,168 | $26,111 | $2,708 | $23,403 |

| 2019 | $2,613 | $13,937 | $2,708 | $11,229 |

| 2018 | $6,180 | $25,531 | $2,321 | $23,210 |

| 2017 | $6,107 | $25,531 | $2,321 | $23,210 |

| 2016 | $6,130 | $26,263 | $2,321 | $23,942 |

| 2015 | $6,786 | $27,090 | $2,063 | $25,027 |

| 2014 | $6,714 | $27,090 | $2,063 | $25,027 |

| 2013 | $6,535 | $27,090 | $2,063 | $25,027 |

Source: Public Records

Map

Nearby Homes

- 2234 S Crambourne Way

- 1708 S Fernandez Ave

- 2206 S Goebbert Rd Unit 409

- 1607 S Kaspar Ave

- 2315 S Goebbert Rd Unit D209

- 2342 S Shag Bark Trail

- 700 S Noah Terrace

- 1535 S Douglas Ave

- 1355 S Dunton Ave

- 1020 Arbor Ct

- 1016 Arbor Ct

- 1008 Arbor Ct

- 1306 S Walnut Ave

- 2669 S Embers Ln Unit 142669

- 601 S Saint Cecilia Dr

- 2121 W Haven St

- 808 S Deborah Ln

- 2736 S Embers Ln Unit 2736

- 1107 W White Oak St

- 1822 W Pheasant Trail

- 222 W Hyde St

- 220 W Hyde St

- 220 W Hyde St Unit 8-1

- 226 W Hyde St

- 208 W Hyde St Unit 9-4

- 224 W Hyde St Unit 8-3

- 2230 S Crambourne Way

- 2230 S Crambourne Way Unit 1-1

- 217 W Hyde St Unit 7-2

- 217 W Hyde St

- 211 W Hyde St

- 211 W Hyde St Unit 7

- 211 W Hyde St Unit 7-4

- 206 W Hyde St

- 219 W Hyde St Unit 1-JUL

- 219 W Hyde St Unit 219

- 219 W Hyde St

- 219 W Hyde St Unit 7-1

- 207 W Hyde St

- 215 W Hyde St