222 Westleton Dr Unit 18-C West Hyde Park Myrtle Beach, SC 29572

Arcadian Shores NeighborhoodEstimated Value: $261,000 - $283,000

1

Bed

1

Bath

700

Sq Ft

$388/Sq Ft

Est. Value

About This Home

This home is located at 222 Westleton Dr Unit 18-C West Hyde Park, Myrtle Beach, SC 29572 and is currently estimated at $271,779, approximately $388 per square foot. 222 Westleton Dr Unit 18-C West Hyde Park is a home located in Horry County with nearby schools including Myrtle Beach Child Development Center, Myrtle Beach Elementary School, and Myrtle Beach Primary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 25, 2025

Sold by

306 Westbury Ct Mb Llc

Bought by

Green David C and Green Elsie M

Current Estimated Value

Purchase Details

Closed on

Aug 15, 2023

Sold by

Morgan David

Bought by

306 Westbury Ct Mb Llc

Purchase Details

Closed on

May 17, 2023

Sold by

Britt Teri Jo

Bought by

Morgan David and Morgan Dawn Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,875

Interest Rate

6.39%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 29, 2021

Sold by

Lewis Bryan D

Bought by

Juniper Dennis R and Juniper Susan A

Purchase Details

Closed on

Jun 3, 2021

Sold by

Singh Rana

Bought by

Lewis Bryan D and Lewis Kelly C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$146,700

Interest Rate

2.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 29, 2012

Sold by

Maeser Thomas C

Bought by

Singh Rana

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Green David C | $285,000 | -- | |

| 306 Westbury Ct Mb Llc | -- | -- | |

| Morgan David | $254,500 | -- | |

| Juniper Dennis R | $191,000 | -- | |

| Lewis Bryan D | $165,000 | -- | |

| Singh Rana | $145,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Morgan David | $190,875 | |

| Previous Owner | Lewis Bryan D | $146,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,351 | $15,000 | $0 | $15,000 |

| 2023 | $2,351 | $16,275 | $0 | $16,275 |

| 2021 | $2,259 | $16,275 | $0 | $16,275 |

| 2020 | $1,942 | $16,275 | $0 | $16,275 |

| 2019 | $1,942 | $16,275 | $0 | $16,275 |

| 2018 | $0 | $14,070 | $0 | $14,070 |

| 2017 | $1,740 | $8,040 | $0 | $8,040 |

| 2016 | -- | $8,040 | $0 | $8,040 |

| 2015 | $1,740 | $14,070 | $0 | $14,070 |

| 2014 | $1,682 | $8,040 | $0 | $8,040 |

Source: Public Records

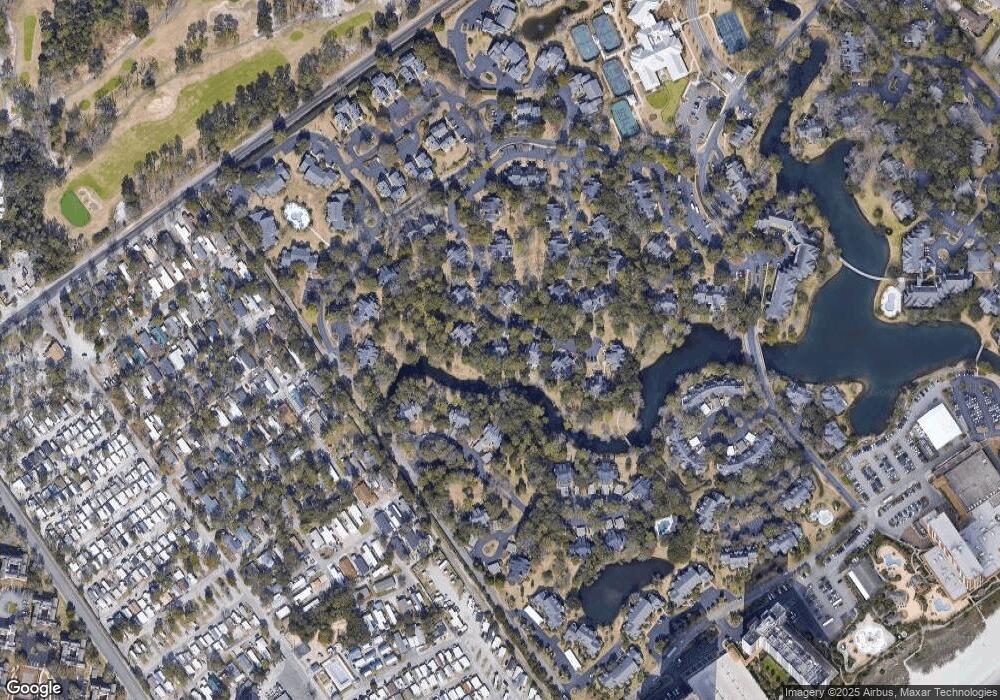

Map

Nearby Homes

- 213 Westleton Dr Unit 16-C

- 213 Westleton Dr Unit 16-D

- 213 Westleton Dr Unit 16B

- 218 Westleton Dr Unit 17-D

- 210 Westleton Dr Unit 13-D

- 234 Westleton Dr Unit 21-C

- 101 Westhill Cir Unit 5-C

- 311 Cumberland Terrace Dr Unit 7-E

- 800 Castleford Cir Unit 1-C

- 800 Castleford Cir Unit 1-E

- 428 Appledore Cir Unit 1-C

- 175 Saint Clears Way Unit 23A

- 416 Willow Garth Cir Unit 6-C

- 180 Rothbury Cir Unit 303

- 180 Rothbury Cir Unit 203

- 180 Rothbury Cir Unit 302

- 180 Rothbury Cir Unit 305

- 180 Rothbury Cir Unit 116

- 246 Comanche Dr Unit Apache Camp Ground

- 215 Baslow Ct Unit 1D

- 222 Westleton Dr Unit 18-A West Hyde Park

- 222 Westleton Dr

- 222 Westleton Dr Unit West Hyde Park 18-D

- 222 18-B Westleton Dr Unit 18B

- 222 Westleton Dr Unit 18-B

- 222 Westleton Dr Unit 18-A

- 218 Westleton Dr Unit 17-A

- 218 Westleton Dr Unit 17-E West Hyde Park

- 218 Westleton Dr Unit 17-D West Hyde Park

- 218 Westleton Dr Unit 17-C West Hyde Park

- 218 Westleton Dr Unit 17-C

- 218 Westleton Dr Unit 17-E

- 226 Westleton Dr

- 226 Westleton Dr Unit 19-D West Hyde

- 226 Westleton Dr Unit 19-A West Hyde Park

- 226 Westleton Dr Unit 19-D West Hyde Park

- 226 Westleton Dr Unit 19-E West Hyde Park

- 226 Westleton Dr Unit 19-B West Hyde Park

- 226 Westleton Dr Unit 19A

- 226 Westleton Dr Unit 19B