2220 Crestview Tahlequah, OK 74464

Estimated Value: $271,000 - $361,000

4

Beds

2

Baths

1,690

Sq Ft

$195/Sq Ft

Est. Value

About This Home

This home is located at 2220 Crestview, Tahlequah, OK 74464 and is currently estimated at $329,042, approximately $194 per square foot. 2220 Crestview is a home located in Cherokee County with nearby schools including Briggs Public School, Agape Christian Academy, and Boudinot Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 12, 2024

Sold by

Sanchez Thomas B and Sanchez Mesha

Bought by

Fletcher Andrew and Fletcher Rachel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$332,405

Outstanding Balance

$328,171

Interest Rate

7.03%

Mortgage Type

New Conventional

Estimated Equity

$871

Purchase Details

Closed on

Jul 28, 2016

Sold by

Moore Linda Josephine and Leggett Linda Josephine

Bought by

Sanchez Mesha Lin

Purchase Details

Closed on

Sep 27, 2006

Sold by

Rogers Johnnik W and Rogers Valerie J

Bought by

Sanchez Thomas B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,190

Interest Rate

6.51%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fletcher Andrew | $350,000 | Infinity Title | |

| Sanchez Mesha Lin | -- | None Available | |

| Sanchez Thomas B | $146,000 | Cherokee Capitol Abstract & |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Fletcher Andrew | $332,405 | |

| Previous Owner | Sanchez Thomas B | $148,190 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,449 | $38,500 | $4,400 | $34,100 |

| 2024 | $1,449 | $17,560 | $1,400 | $16,160 |

| 2023 | $1,449 | $16,724 | $2,462 | $14,262 |

| 2022 | $1,429 | $16,724 | $2,462 | $14,262 |

| 2021 | $1,320 | $16,724 | $2,462 | $14,262 |

| 2020 | $1,326 | $16,724 | $2,462 | $14,262 |

| 2019 | $1,279 | $16,010 | $2,462 | $13,548 |

| 2018 | $1,226 | $15,122 | $2,462 | $12,660 |

| 2017 | $1,235 | $15,122 | $2,462 | $12,660 |

| 2016 | $1,241 | $15,094 | $1,621 | $13,473 |

| 2015 | $1,116 | $14,375 | $1,400 | $12,975 |

| 2014 | $1,116 | $16,060 | $1,400 | $14,660 |

Source: Public Records

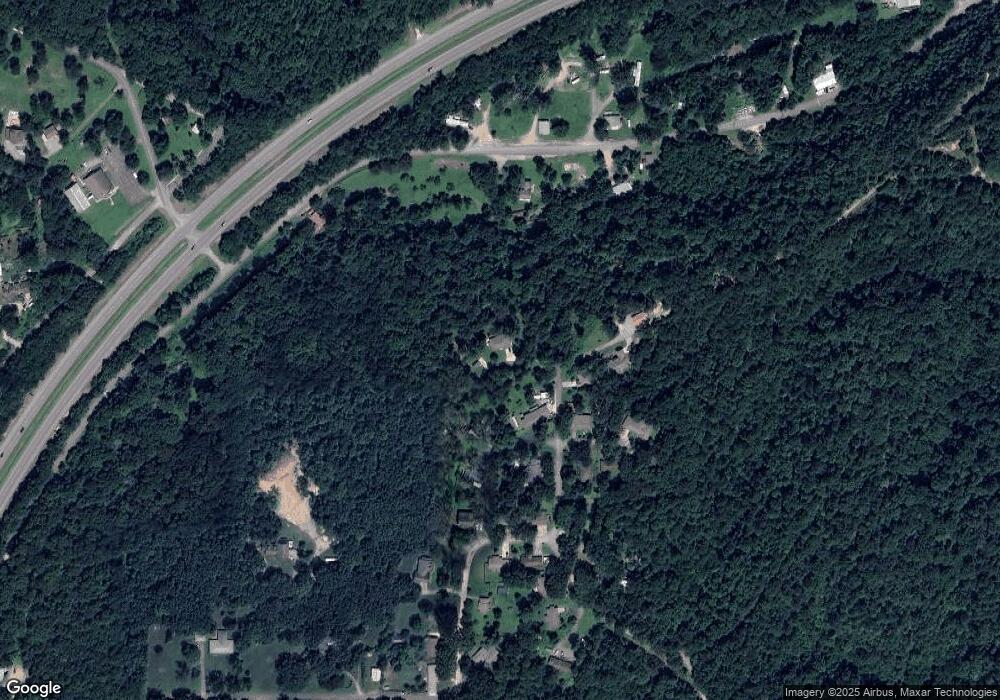

Map

Nearby Homes

- 2205 Oakridge Dr

- 20413 E Allen Rd

- 17730 S Old Highway 62

- 2000 Tarkington St

- 20596 E Whipperwill Rd

- 0 Hwy 10 N Unit 2514793

- 1518 E Hogner St

- 1505 E Summerfield St

- 1390 N Legion Dr

- 407 N Bliss Ave

- 1450 E Allen Rd

- 920 Francis Ave

- 1025 E Downing St

- 204 Woodhaven Ave

- 802 E Seneca St

- 18679 S 525 Rd

- 710 Victor St

- 18714 S 525 Rd

- 707 Victor St

- 0 S Hwy 82 A Hwy Unit 2532332

- 2220 Crestview

- 2201 Woodland Ln

- 2203 Woodland Ln

- 880 Crestwood Ave

- 0 Crestview Ln Unit 1529346

- 0 Crestview Ln Unit 1636824

- 0 Crestview Ln Unit 1615161

- 0 Crestview Ln Unit 1547723

- 2289 Crestview

- 2205 Woodland Ln

- 745 Crestwood Ave

- 2203 Oakridge Dr

- 2200 Woodland Ln

- 750 Crestwood Ave

- 2207 Woodland Ln

- 2209 Woodland Ln

- 2204 Woodland Ln

- 17440 S Old Highway 62

- 2201 Oakridge Dr

- 2208 Woodland Ln