2220 Meadowlark Ln W Unit 2220 Reynoldsburg, OH 43068

Estimated Value: $263,000 - $291,000

3

Beds

3

Baths

1,648

Sq Ft

$170/Sq Ft

Est. Value

About This Home

This home is located at 2220 Meadowlark Ln W Unit 2220, Reynoldsburg, OH 43068 and is currently estimated at $280,660, approximately $170 per square foot. 2220 Meadowlark Ln W Unit 2220 is a home located in Franklin County with nearby schools including Slate Ridge Elementary School, Hannah J Ashton Middle School, and Baldwin Road Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 25, 2014

Sold by

Gray Phillip R

Bought by

Hauger Jan M and Hauger Carolyn J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Outstanding Balance

$76,571

Interest Rate

3.91%

Mortgage Type

New Conventional

Estimated Equity

$204,089

Purchase Details

Closed on

Dec 22, 2011

Sold by

Morris Donald E and Lee Joyce Ann L

Bought by

Gray Phillip R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$65,000

Interest Rate

3.95%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 28, 2004

Sold by

Olympus Homes Inc

Bought by

Morris James E and Morris Dorothy A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hauger Jan M | $125,000 | Valmer Land Title Agency Box | |

| Gray Phillip R | $97,500 | Attorney | |

| Morris James E | $150,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hauger Jan M | $100,000 | |

| Previous Owner | Gray Phillip R | $65,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,588 | $79,870 | $15,050 | $64,820 |

| 2023 | $3,455 | $79,870 | $15,050 | $64,820 |

| 2022 | $3,129 | $57,200 | $6,830 | $50,370 |

| 2021 | $3,142 | $57,200 | $6,830 | $50,370 |

| 2020 | $3,205 | $57,200 | $6,830 | $50,370 |

| 2019 | $2,573 | $44,000 | $5,250 | $38,750 |

| 2018 | $2,501 | $44,000 | $5,250 | $38,750 |

| 2017 | $2,540 | $44,000 | $5,250 | $38,750 |

| 2016 | $3,222 | $39,480 | $5,600 | $33,880 |

| 2015 | $2,430 | $39,480 | $5,600 | $33,880 |

| 2014 | $2,441 | $39,480 | $5,600 | $33,880 |

| 2013 | $1,526 | $39,480 | $5,600 | $33,880 |

Source: Public Records

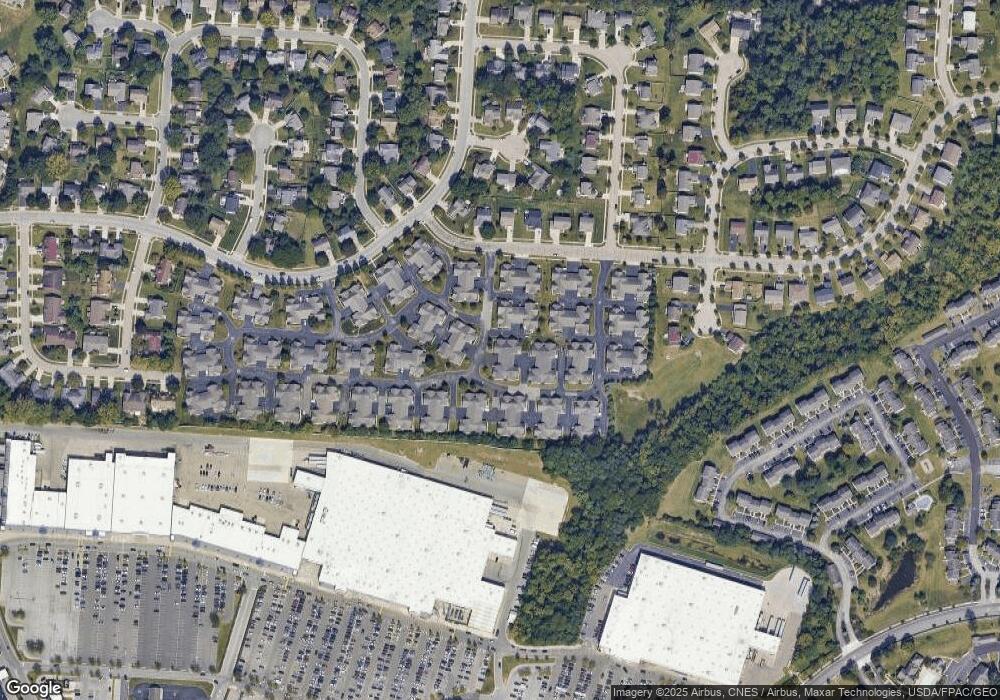

Map

Nearby Homes

- 7933 Meadowlark Ln S Unit 7933

- 7780 Featherleaf Ct

- 1960 Haverton Dr

- 2098 Stone Valley Place

- 1890 Lockmere Ct

- 1849 Drugan Ct SW

- 1788 Leighton Dr

- 7607 Palmer Rd SW

- 7832 Country Brook Ln

- 1744 Graham Rd

- 10039 Taylor Rd SW

- 1569 Marabar Dr

- 0 Oak Valley Rd Unit 5148458

- 0 Oak Valley Rd Unit Lot 4, 1.088 ac.

- 13115 Morrison Place

- 1545 Alar Ave

- 13137 E Crosset Hill Dr

- 13068 Rustic Dr

- 214 Estates Ln

- 7682 E Main St

- 7904 Meadowlark Ln S Unit 7904

- 2222 Meadowlark Ln W Unit 2222

- 7902 Meadowlark Ln S Unit 7902

- 2204 Meadowlark Ln W Unit 2204

- 2204 Meadowlark Ln W Unit Bld 27 - 2204

- 2204 Meadowlark Ln W Unit Bldg. 27

- 7848 Meadowlark Ln S

- 7914 Meadowlark Ln S Unit 7914

- 2215 Meadowlark Ln W Unit 2215

- 2215 Meadowlark Ln W Unit 17-2

- 2206 Meadowlark Ln W Unit 2206

- 2200 Meadowlark Ln W Unit 2200

- 7912 Meadowlark Ln S Unit 7912

- 2217 Meadowlark Ln W

- 2217 Meadowlark Ln W Unit Building 17

- 2202 Meadowlark Ln W Unit 2202

- 2192 Meadowlark Ln S

- 7918 Meadowlark Ln S Unit 7918

- 7877 Meadowlark Ln N Unit 7877

- 7877 Meadowlark Ln N Unit 17-3