22227 Midbury San Antonio, TX 78259

Encino Ranch NeighborhoodEstimated Value: $555,000 - $602,620

4

Beds

4

Baths

3,416

Sq Ft

$170/Sq Ft

Est. Value

About This Home

This home is located at 22227 Midbury, San Antonio, TX 78259 and is currently estimated at $579,655, approximately $169 per square foot. 22227 Midbury is a home located in Bexar County with nearby schools including Roan Forest Elementary School, Tejeda Middle School, and Johnson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 14, 2013

Sold by

Schaefer James Robert and Schaefer Marion I

Bought by

Newton Rebecca L and Newton James T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,900

Outstanding Balance

$36,794

Interest Rate

3.38%

Mortgage Type

New Conventional

Estimated Equity

$542,861

Purchase Details

Closed on

Dec 17, 2004

Sold by

Wilshire/Hearthstone Venture I Lp

Bought by

Schaefer James Robert and Schaefer Marion I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$258,600

Interest Rate

5.78%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Newton Rebecca L | -- | None Available | |

| Schaefer James Robert | -- | Mission Title Lp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Newton Rebecca L | $164,900 | |

| Previous Owner | Schaefer James Robert | $258,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,327 | $550,000 | $94,730 | $455,270 |

| 2024 | $10,327 | $550,000 | $94,730 | $455,270 |

| 2023 | $10,327 | $534,977 | $94,730 | $484,850 |

| 2022 | $12,001 | $486,343 | $82,400 | $434,480 |

| 2021 | $11,295 | $442,130 | $74,970 | $367,160 |

| 2020 | $10,772 | $415,380 | $74,970 | $340,410 |

| 2019 | $10,764 | $404,160 | $62,820 | $341,340 |

| 2018 | $9,847 | $368,810 | $62,820 | $305,990 |

| 2017 | $10,186 | $377,980 | $62,820 | $315,160 |

| 2016 | $9,626 | $357,220 | $62,820 | $294,400 |

| 2015 | $8,923 | $342,140 | $53,690 | $288,450 |

| 2014 | $8,923 | $330,740 | $0 | $0 |

Source: Public Records

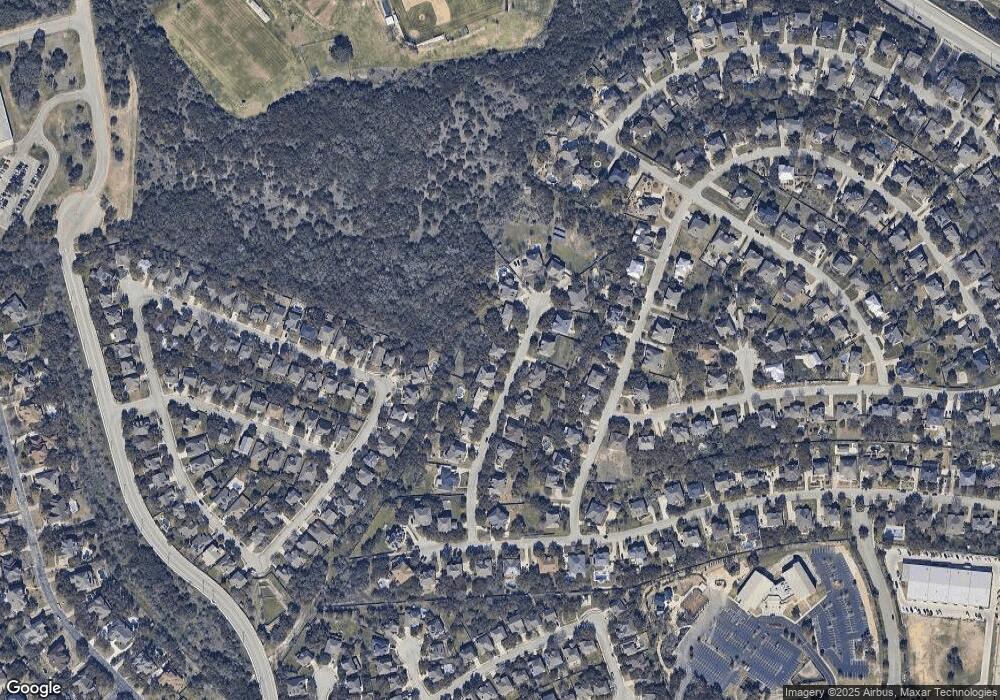

Map

Nearby Homes

- 24 Sable Forest

- 134 Gazelle Ct

- 131 Impala Cir

- 8 Sable Forest

- 139 Impala Cir

- 22422 Sierra Blanca

- 3515 Edge View

- 22418 Roan Forest

- 22415 Roan Forest

- 23223 Treemont Park

- 3330 Edge View

- 3526 Blackstone Run

- 2927 Winter Gorge

- 3415 Crest Noche Dr

- 3426 Hilldale Point

- 21726 Luisa

- 23414 Treemont Park

- 3007 Sable Creek

- 21715 Cliff View Dr

- 2922 Kentucky Oaks