Estimated Value: $349,000 - $796,237

4

Beds

3

Baths

3,402

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 223 Lake Joy Rd Unit A, Perry, GA 31069 and is currently estimated at $620,059, approximately $182 per square foot. 223 Lake Joy Rd Unit A is a home located in Houston County with nearby schools including Langston Road Elementary School, Perry Middle School, and Perry High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2020

Sold by

Matthews Debra and Matthews Debra L

Bought by

Blanton Robert Cameron and Blanton Ashley Jawel

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$423,000

Outstanding Balance

$375,334

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$244,725

Purchase Details

Closed on

Feb 1, 2001

Sold by

Matthews Ronald B and Matthews Debra*

Bought by

Matthews Debra

Purchase Details

Closed on

Mar 4, 1998

Sold by

Matthews Ronald B

Bought by

Matthews Ronald B and Matthews Debra*

Purchase Details

Closed on

May 2, 1997

Sold by

Homes By Summit Inc

Bought by

Matthews Ronald B

Purchase Details

Closed on

Jun 28, 1996

Sold by

Rucker Lucian M and Rucker Betty B

Bought by

Homes By Summit Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Blanton Robert Cameron | $470,000 | None Available | |

| Matthews Debra | -- | -- | |

| Matthews Ronald B | -- | -- | |

| Matthews Ronald B | $270,000 | -- | |

| Homes By Summit Inc | $60,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Blanton Robert Cameron | $423,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,839 | $257,800 | $105,320 | $152,480 |

| 2023 | $3,271 | $220,840 | $92,800 | $128,040 |

| 2022 | $3,105 | $214,120 | $92,800 | $121,320 |

| 2021 | $4,199 | $196,920 | $87,760 | $109,160 |

| 2020 | $3,924 | $162,760 | $55,040 | $107,720 |

| 2019 | $3,746 | $153,480 | $55,040 | $98,440 |

| 2018 | $3,746 | $153,480 | $55,040 | $98,440 |

| 2017 | $3,750 | $153,480 | $55,040 | $98,440 |

| 2016 | $3,756 | $153,480 | $55,040 | $98,440 |

| 2015 | $3,763 | $153,480 | $55,040 | $98,440 |

| 2014 | -- | $153,480 | $55,040 | $98,440 |

| 2013 | -- | $153,480 | $55,040 | $98,440 |

Source: Public Records

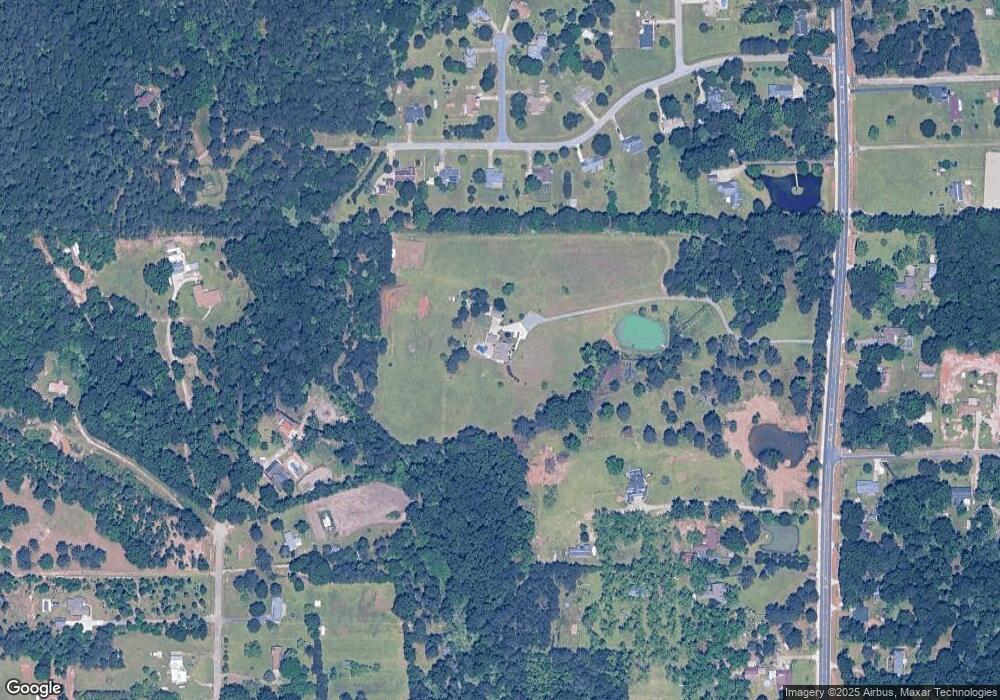

Map

Nearby Homes

- 238 Lake Joy Rd

- 127 Glen Oaks Rd

- 203 Washington Place Dr

- 320 Langston Rd

- 116 Nash Ct

- 113 Nash Ct

- 115 Nash Ct

- 106 Nash Ct

- 111 Nash Ct

- 102 Seven Pines Ct

- 3053 Cellar Ln

- 3051 Cellar Ln

- 3049 Cellar Ln

- 3055 Cellar Ln

- 121 Saraland Trail

- 3048 Cellar Ln

- 3054 Cellar Ln

- 102 N Haven Ln

- 206 Sutton Dr

- 204 Sutton Dr