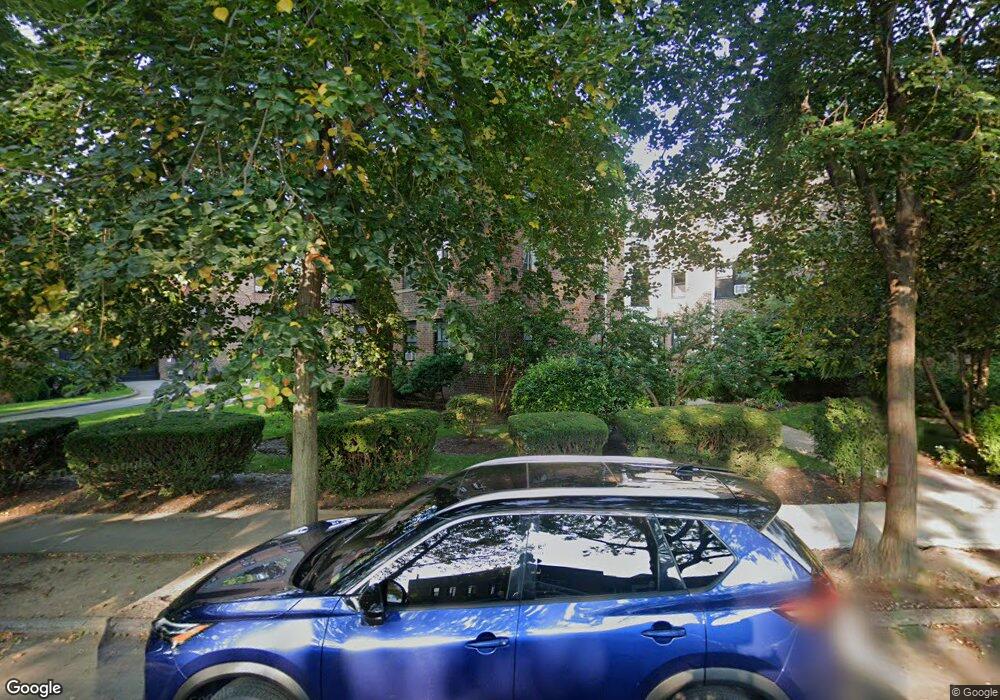

2230 79th St Unit 3A East Elmhurst, NY 11370

Ditmars Steinway NeighborhoodEstimated Value: $403,000 - $493,000

--

Bed

--

Bath

747

Sq Ft

$610/Sq Ft

Est. Value

About This Home

This home is located at 2230 79th St Unit 3A, East Elmhurst, NY 11370 and is currently estimated at $455,696, approximately $610 per square foot. 2230 79th St Unit 3A is a home located in Queens County with nearby schools including P.S. 2 Alfred Zimberg, Is 141 The Steinway, and William Cullen Bryant High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 23, 2009

Sold by

Manolakos Peter and Matthusen Amy

Bought by

Vallianatos Nikolaos and Yallelis Theodora

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$298,800

Outstanding Balance

$194,119

Interest Rate

5.06%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$261,577

Purchase Details

Closed on

Jan 31, 2005

Sold by

Mayo Jamie O and Mayo Patricia

Bought by

Manolakos Peter and Matthusen Amy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$236,000

Interest Rate

5.83%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 8, 1995

Sold by

Autz Arthur L and Autz Margarita

Bought by

Mayo Jaime O and Mayo Patricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,750

Interest Rate

8.8%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vallianatos Nikolaos | $332,000 | -- | |

| Vallianatos Nikolaos | $332,000 | -- | |

| Manolakos Peter | $295,000 | -- | |

| Manolakos Peter | $295,000 | -- | |

| Mayo Jaime O | $91,000 | Chicago Title Insurance Co | |

| Mayo Jaime O | $91,000 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vallianatos Nikolaos | $298,800 | |

| Closed | Vallianatos Nikolaos | $298,800 | |

| Previous Owner | Manolakos Peter | $236,000 | |

| Previous Owner | Mayo Jaime O | $63,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,021 | $40,816 | $7,202 | $33,614 |

| 2024 | $3,610 | $40,164 | $7,202 | $32,962 |

| 2023 | $4,927 | $39,410 | $7,202 | $32,208 |

| 2022 | $3,367 | $39,160 | $7,202 | $31,958 |

| 2021 | $3,188 | $36,235 | $7,202 | $29,033 |

| 2020 | $3,117 | $41,150 | $7,202 | $33,948 |

| 2019 | $2,922 | $39,004 | $7,202 | $31,802 |

| 2018 | $3,733 | $29,350 | $7,202 | $22,148 |

| 2017 | $3,379 | $26,566 | $7,202 | $19,364 |

| 2016 | $3,249 | $26,566 | $7,202 | $19,364 |

| 2015 | $1,668 | $23,298 | $7,202 | $16,096 |

| 2014 | $1,668 | $21,367 | $7,202 | $14,165 |

Source: Public Records

Map

Nearby Homes

- 22-39 78 St

- 2220 78th St Unit A3

- 22-31 77th St Unit C2

- 2255 78th St Unit 2E

- 22-28 77th St Unit C1

- 22-40 80th St Unit 2B

- 22-60 79th St Unit 1A

- 76-12 Ditmars Blvd Unit B3

- 2209 76th St Unit C2

- 22-27 76 St Unit B2

- 21-40 78th St Unit 2

- 2205 80th St

- 2208 76th St Unit A3

- 21-43 80th St

- 2230 75th St

- 21-14 80th St

- 21-16 77 Street 2nd Floor

- 22-39 74th St

- 22-26 74th St

- 19-65 79th St Unit 2C

- 2230 79th St Unit 3-D

- 2230 79th St Unit 2E

- 2230 79th St Unit 1A

- 2230 79th St Unit 1C

- 2230 79th St Unit 3E

- 2230 79th St Unit 3D

- 2230 79th St Unit 3C

- 2230 79th St Unit 3B

- 2230 79th St Unit 2F

- 2230 79th St Unit 2E

- 2230 79th St Unit 2D

- 2230 79th St Unit 2C

- 2230 79th St Unit 2B

- 2230 79th St Unit 2A

- 2230 79th St Unit 1F

- 2230 79th St Unit 1E

- 2230 79th St Unit 1D

- 2230 79th St Unit 1B

- 2230 79th St Unit 1A

- 2230 79th St Unit 3F