2232 E 1050 N Ossian, IN 46777

Estimated Value: $353,000

3

Beds

2

Baths

--

Sq Ft

30.5

Acres

About This Home

This home is located at 2232 E 1050 N, Ossian, IN 46777 and is currently estimated at $353,000. 2232 E 1050 N is a home located in Wells County with nearby schools including Norwell High School and St. Aloysius School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 27, 2011

Sold by

Well John R

Bought by

Staynoff John C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,000

Outstanding Balance

$27,122

Interest Rate

4.88%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$325,878

Purchase Details

Closed on

Aug 15, 2007

Sold by

Wells John R

Bought by

Wells John R and Wells Johnny R

Purchase Details

Closed on

Jun 1, 2007

Sold by

Smith Michelle R

Bought by

Wells John R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,000

Interest Rate

8.25%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Staynoff John C | $140,000 | Pioneer Title | |

| Stayanoff John C | -- | None Available | |

| Wells John R | -- | None Available | |

| Wells John R | $175,000 | Poineer Title | |

| Wells John R | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stayanoff John C | $70,000 | |

| Previous Owner | Wells John R | $175,000 | |

| Closed | Wells John R | $0 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,197 | $94,000 | $51,900 | $42,100 |

| 2023 | $1,150 | $87,500 | $43,200 | $44,300 |

| 2022 | $1,018 | $79,400 | $34,100 | $45,300 |

| 2021 | $570 | $44,200 | $29,400 | $14,800 |

| 2020 | $623 | $43,900 | $29,100 | $14,800 |

| 2019 | $699 | $50,300 | $35,500 | $14,800 |

| 2018 | $718 | $51,400 | $36,600 | $14,800 |

| 2017 | $737 | $57,400 | $42,100 | $15,300 |

| 2016 | $775 | $59,800 | $44,600 | $15,200 |

| 2014 | $881 | $72,100 | $63,100 | $9,000 |

| 2013 | $793 | $65,400 | $55,800 | $9,600 |

Source: Public Records

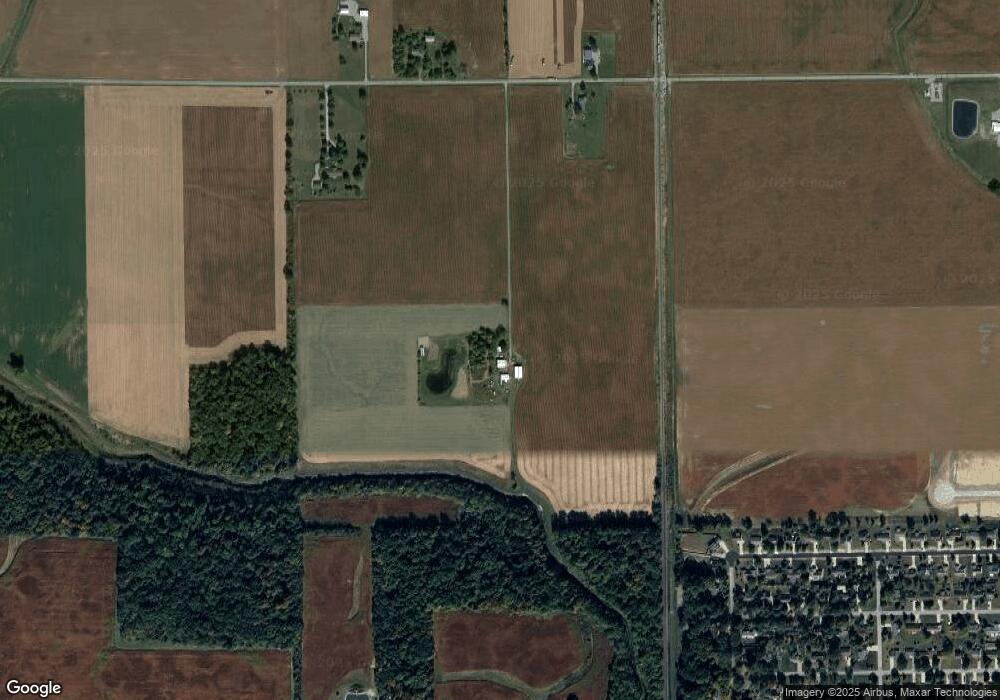

Map

Nearby Homes

- 504 Meadow Ln

- 618 Ingle Dr

- 701 Egber St

- 205 E Craig St

- 711 Sandalwood Dr

- 10221 Indiana 1

- 3703 E 1000 N

- 305 Piper Ct

- 313 Piper Ct

- TBD 850 N

- Harmony Plan at Crosswind Lakes

- Chatham Plan at Crosswind Lakes

- Aldridge Plan at Crosswind Lakes

- 408 Ridge Ct

- TBD N State Road 1

- 6936 N State Road 1

- 5144 E 1200 N-90 Unit 90

- 1800 W 950 N-90

- 11136 N 200 W

- 16902 Prine Rd