2245 E Decorah Rd West Bend, WI 53095

Estimated payment $12,175/month

Highlights

- Horses Allowed On Property

- 155.82 Acre Lot

- Garage

- Decorah Elementary School Rated A-

About This Lot

A rare opportunity close to West Bend. 155 acre farm on City of West Bend east side ready for residential mixed use development. Property fronts on Decorah, River, and Sand Dr. Two beautiful ponds located on parcel and abuts farm land and parcel owned by school district. Peaceful and Tranquil Property for a large scale Developer to plan next project. The Buyer will have to work with City for annexation, and negotiate the cost/special assessment to connect into the sanitary. The sanitary serving this area is serviced by the West Bend Inceptor that was built many years ago. Don't let this opportunity pass you by. Call today!

Listing Agent

Emmer Real Estate Group Brokerage Email: frontdesk@emmerrealestate.com License #37034-90 Listed on: 12/19/2024

Property Details

Property Type

- Land

Est. Annual Taxes

- $2,795

Parking

- Garage

Schools

- Decorah Elementary School

- Badger Middle School

Additional Features

- 155.82 Acre Lot

- Horses Allowed On Property

Listing and Financial Details

- Exclusions: farm crop rights

- Assessor Parcel Number T11 053100B

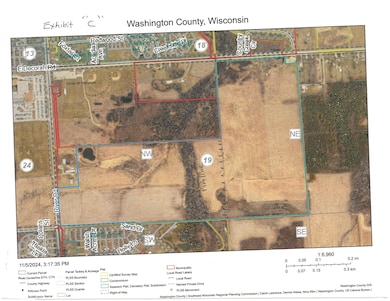

Map

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,963 | $317,500 | $155,400 | $162,100 |

| 2023 | $2,511 | $242,000 | $126,700 | $115,300 |

| 2022 | $2,761 | $243,300 | $128,000 | $115,300 |

| 2021 | $2,808 | $241,500 | $126,200 | $115,300 |

| 2020 | $2,890 | $207,600 | $114,700 | $92,900 |

| 2019 | $2,620 | $204,400 | $111,500 | $92,900 |

| 2018 | $2,649 | $204,400 | $111,500 | $92,900 |

| 2017 | $2,616 | $204,400 | $111,500 | $92,900 |

| 2016 | $2,756 | $205,000 | $113,500 | $91,500 |

| 2015 | $2,562 | $205,000 | $113,500 | $91,500 |

| 2014 | $2,555 | $205,000 | $113,500 | $91,500 |

| 2013 | $2,741 | $229,800 | $126,500 | $103,300 |

Property History

| Date | Event | Price | List to Sale | Price per Sq Ft |

|---|---|---|---|---|

| 01/02/2025 01/02/25 | For Sale | $2,325,000 | 0.0% | -- |

| 12/20/2024 12/20/24 | Off Market | $2,325,000 | -- | -- |

| 12/19/2024 12/19/24 | For Sale | $2,325,000 | -- | -- |

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Warranty Deed | -- | -- | |

| Interfamily Deed Transfer | -- | None Available |

Source: Metro MLS

MLS Number: 1902215

APN: T11-053100B

- 720 Wood River Ct Unit 4

- Lt0 County Highway I

- 518 Woodside Ct

- 478 Woodside Ct

- 511 Woodside Ct

- Lt187 Arbor Vista Place

- 1795 Arbor Vista Place

- 1860 Arbor Vista Place

- 1426 Goldenrod Cir

- 1990 Paradise Dr

- 2040 Paradise Hills Ct

- 625 Madison Ave

- 1275 Shadowood Cir Unit 110

- 1130 S River Rd

- 1519 E Washington St

- 1125 Anchor Ave

- 1117 Anchor Ave

- 1063 Anchor Ave

- 1071 Anchor Ave

- 1980 Paradise Dr

- 619 Wellington Dr

- 211 E Paradise Dr Unit 211

- 239 Water St

- 250 S Forest Ave

- 420 Vine St

- 1934 Sylvan Way

- 151 Wisconsin St

- 2022 Sylvan Way

- 2022 Sylvan Way

- 2021 Sylvan Way

- 384 Minz Park Cir Unit 5

- 2037 S Main St

- 433 N Main St

- 555 Veterans Ave

- 611 Veterans Ave

- 202 Gadow Ln

- 1600 Vogt Dr

- 2105-2113 Barton Ave

- 2117-2123 Barton Ave

- 1207 Mint Dr

Ask me questions while you tour the home.