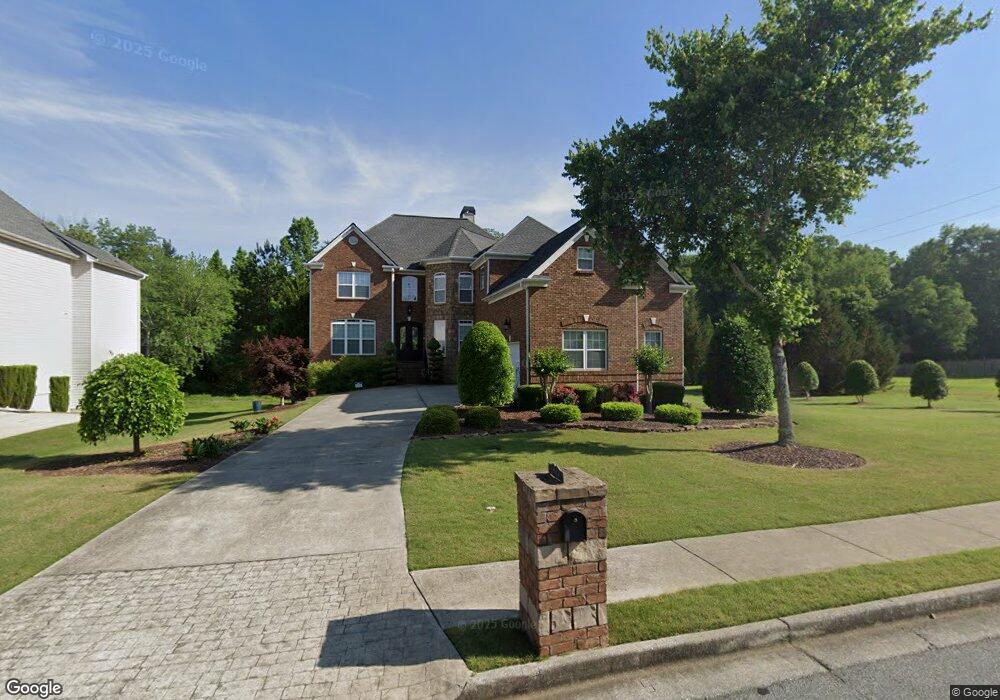

2246 Noelle Place Powder Springs, GA 30127

Estimated Value: $572,297 - $640,000

5

Beds

5

Baths

3,703

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 2246 Noelle Place, Powder Springs, GA 30127 and is currently estimated at $615,074, approximately $166 per square foot. 2246 Noelle Place is a home located in Cobb County with nearby schools including Tapp Middle School, McEachern High School, and Grace Baptist Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 10, 2013

Sold by

Boykin Kaye

Bought by

Boykin Kaye and Boykin Jesse E

Current Estimated Value

Purchase Details

Closed on

Feb 27, 2006

Sold by

Hampton Thelma F

Bought by

Hampton Thelma F and Hampton Marion

Purchase Details

Closed on

Jul 22, 2005

Sold by

Wilsons Classic Hms Inc

Bought by

Boykin Kaye

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$333,000

Interest Rate

7.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 29, 2004

Sold by

Pws Inc

Bought by

Wilsons Classic Homes Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$231,425

Interest Rate

5.49%

Mortgage Type

Stand Alone Second

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Boykin Kaye | $405,929 | -- | |

| Hampton Thelma F | -- | -- | |

| Boykin Kaye | $406,000 | -- | |

| Wilsons Classic Homes Inc | $346,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Boykin Kaye | $333,000 | |

| Previous Owner | Wilsons Classic Homes Inc | $231,425 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,374 | $250,960 | $36,000 | $214,960 |

| 2024 | $6,379 | $250,960 | $36,000 | $214,960 |

| 2023 | $4,700 | $198,544 | $36,000 | $162,544 |

| 2022 | $4,236 | $150,852 | $28,000 | $122,852 |

| 2021 | $4,236 | $150,852 | $28,000 | $122,852 |

| 2020 | $3,682 | $130,336 | $28,000 | $102,336 |

| 2019 | $3,682 | $130,336 | $28,000 | $102,336 |

| 2018 | $3,682 | $130,336 | $28,000 | $102,336 |

| 2017 | $3,491 | $130,336 | $28,000 | $102,336 |

| 2016 | $2,626 | $100,232 | $17,200 | $83,032 |

| 2015 | $2,693 | $100,232 | $17,200 | $83,032 |

| 2014 | $2,715 | $100,232 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 2239 Noelle Place

- 2223 Noelle Place

- 4821 Overland Dr

- Payton III Plan at Springside Reserve - Farmhouse Series

- Monroe Plan at Springside Reserve - Farmhouse Series

- Huntington Plan at Springside Reserve - Farmhouse Series

- Benjamin II Plan at Springside Reserve - Farmhouse Series

- Richard II Plan at Springside Reserve - Farmhouse Series

- Somerset III Plan at Springside Reserve - Farmhouse Series

- Reynold Plan at Springside Reserve - Farmhouse Series

- Alexander Plan at Springside Reserve - Farmhouse Series

- 4350 Gaydon Rd

- 2532 Greenes Ln

- 4696 Cooling Water Cir

- 2337 Old Lost Mountain Rd

- 4625 Gaydon Rd

- 5199 Olive Branch Cir

- 5110 MacLand Rd

- 2607 Restoration Dr

- 2695 Moon Cabin Dr

- 2250 Noelle Place

- Lot 21 Noelle

- LOT 20 Noelle

- LOT 15 Noelle

- LOT 58 Noelle

- LOT 9 Noelle

- 2254 Noelle Place

- 2247 Noelle Place Unit 1

- 2238 Noelle Place Unit 64

- 2238 Noelle Place

- 2255 Noelle Place Unit 1

- 2258 Noelle Place

- 2239 Noelle Place Unit 64

- 2232 Noelle Place

- 2412 Noelle Ln

- 2114 Noelle Ln

- 4858 Cathedral Ct

- 4858 Cathedral Ct Unit 67

- 2262 Noelle Place

- 2235 Noelle Ln Unit 63